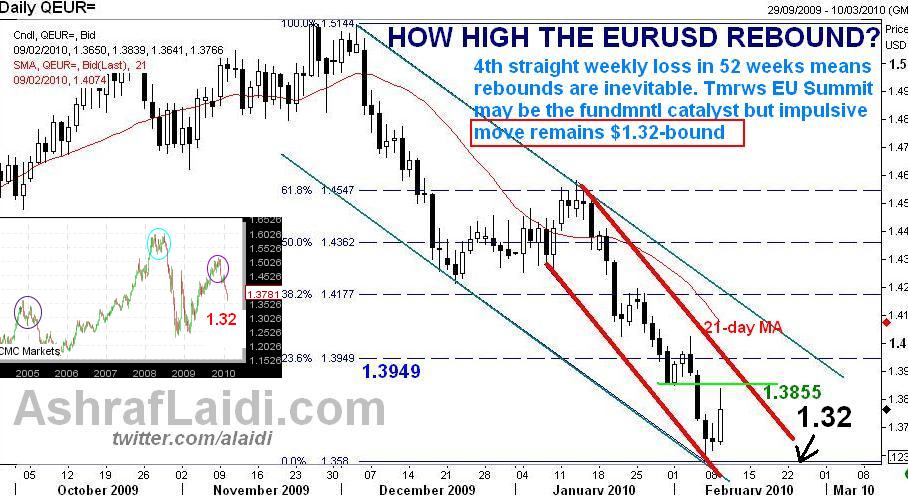

Capping Euro's Rebound

Finally, EURUSD shows signs of life (albeit short-lived) starting with a sell-off prompted by an overall market after Fitch said UK was the most vulnerable AAA sovereign, only for EUR to rally back upon reports by German govt sources about EU nations agreeing in principle in rescuing Greece. EUR then fell off its $1.3839 high when those remarks were dismissed as unfounded rumours. TRADERS MUST BE AWARE that EURUSD has fallen for 4 consecutive weeksLONGEST LOSING STREAK SINCE exactly a year ago and EURUSD remains well in midst of two major down channels (see chart). $1.3855 held up successfully against todays German-driven rumours but more upside MAY emerge when the EU Summit is due tomorrow. Any Greece rescue will prompt traders to ask What about Portugal, Spain ? Subsequent barrier stands at $1.3950. $1.32 target remains intact. EURUSD shorts stuck in any corrective bounce consider short-term longs in EURJPY as was the case today. Such a dynamic is backed by an intermediate (temporary) bottom in USDJPY.

More Hot-Charts

-

Mystery Charts

Feb 5, 2026 20:48 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

2hr Gold Chart

Feb 3, 2026 13:09 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold Net Longs

Feb 2, 2026 17:16 | by Ashraf LaidiI really dislike after-the-fact analysis, but looking at this chart of Gold speculative net longs at the Comex, it shows speculators began lightening their longs on Jan 23.