Hot-Charts

EURUSD

by

Feb 10, 2009 12:01

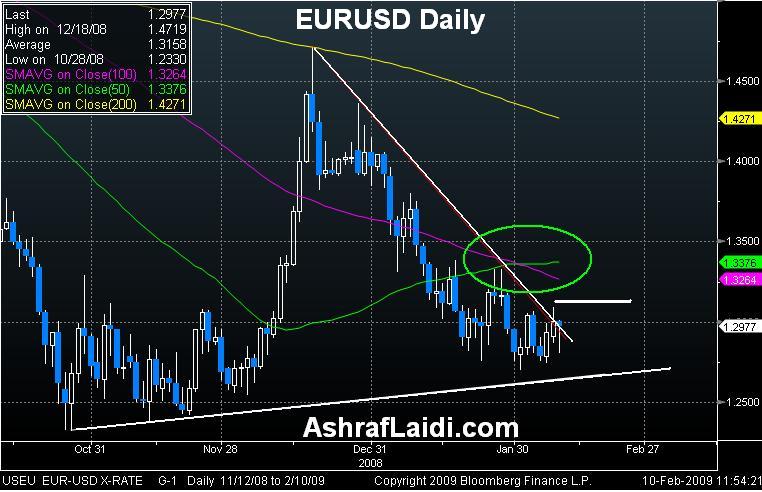

EURUSD consolidation is set to break out in medium term as ECB seeks to avoid telegraphing rate cuts beyond March. A breach of $1.3030 resistance in medium term is looming. USD downside risks underlined by record Treasury borrowing, which is boosting yields at expense of USD. Positive moving average cross-over (50 above 100) for the first time since July also provides technical basis along with bullish weekly stochastics. Breach of $1.3030 leads to $1.3080, followed by $1.3130.

More Hot-Charts

-

Gold Next Move

Dec 26, 2025 15:32 | by Ashraf LaidiWill send detailed note on latest parameters to our WhatsApp Bdcst Group - سأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - .. -

EURGBP & Bank of England

Dec 17, 2025 19:24 | by Ashraf LaidiToday's weaker than expected UK CPI sharply boosted EURGBP and dragged down GBPUSD on improved expectations the BoE will cut rates tomorrow (Thursday). -

Indices & Gold Update

Dec 16, 2025 12:16 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group...