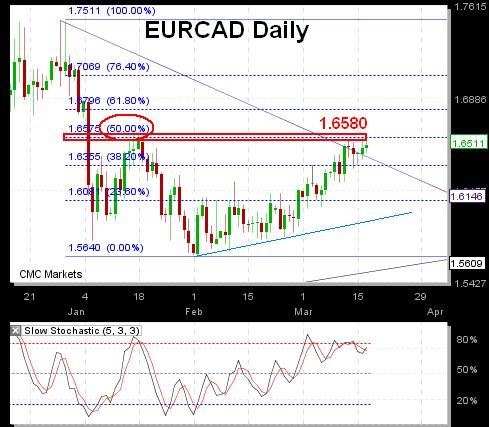

EURCAD

EURCAD at 2-month highs testing the 50% retracement of the decline from the 1.7511 high to the 1.5640 low, risking to peak out. Unexpected strength in US Feb housing starts and building permits in contrast with prolonged deterioration in Canadian Jan factory sales supports the outlook for the single currency (due to continued risk appetite from US data) at expense of CAD. EURCAD tests EURCAD requires the breach of the 1.6580 point in order to pave the way for 1.6800. A EURUSD close above $1.30 and prolonged support in EURGBP above 0.9150 helps signal persistent EUR bullishness. Support stands at 1.6330.

More Hot-Charts

-

Mystery Charts

Feb 5, 2026 20:48 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

2hr Gold Chart

Feb 3, 2026 13:09 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold Net Longs

Feb 2, 2026 17:16 | by Ashraf LaidiI really dislike after-the-fact analysis, but looking at this chart of Gold speculative net longs at the Comex, it shows speculators began lightening their longs on Jan 23.