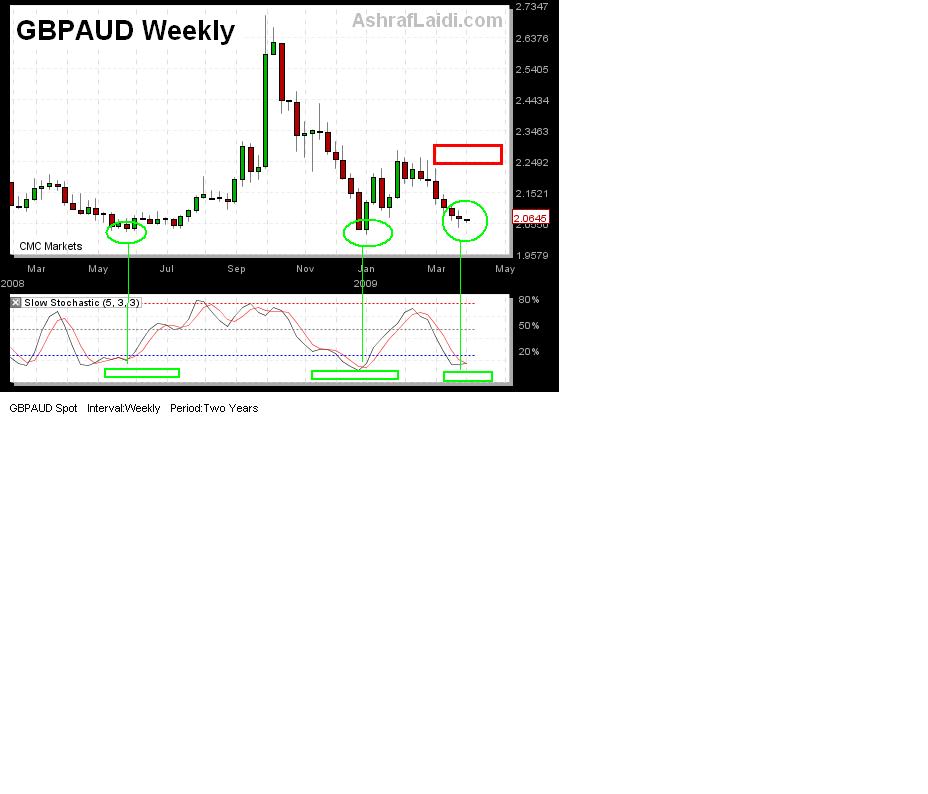

GBPAUD Testing the Bottom

Aussie has long been a favourite on this website and its performance speaks for itself. But rather than pitting Aussie against the weak currencies, lets assess its potential against the sterling, whose robust ways suggest more upside for the Aussie against the British currency. The weekly chart shows the oscillators call for a bullish divergence. Sterling has been firming largely due to improved risk appetite but Aussies more fundamental superiority enabled it to quickly recover from negative retail sales. The latest AUDJDPYHotChart took 2 days to be in the money. GBPAUD is more of a longer term play for the 2.097 and 2.11 target to emerge. For more bang out of your buck, consider AUDGBP instead of GBPAUD. This is not only cheaper but offers more pips per capital used.

More Hot-Charts

-

EURGBP Channel Test

Jan 22, 2026 13:20 | by Ashraf LaidiEURGBP is on the cusp of a channel breakout. One of the least well known secrets is how this pair correlates with major equity indices. -

Gold Channel ABC and D

Jan 8, 2026 16:27 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group - -... -

EURUSD Next

Jan 5, 2026 17:09 | by Ashraf LaidiIf EURUSD holds Monday above 1.17, it will show a hammer candle, supported above the 100-day moving average.