Hot-Charts

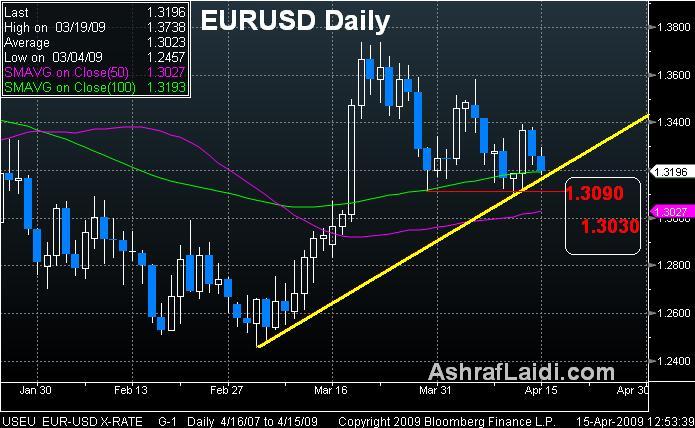

Euro Nears the Support

by

Apr 15, 2009 13:28

| 6 Comments

Euro's retreat will likely intensify now that the ECB has officially announced it will unveil a package of non-conventional monetary policy measures in May, i.e. credit easing as the refi rate reaches 1.00% and the deposit reaches 0.0%. The trend line support (yellow) at $1.3170 is at risk of being breached, which would pave the way for the 50% retracement from the March 4th rebound, at $1.31. Subsequent losses seen stabilizing at $1.3030. Upside capped at $1.34.

More Hot-Charts

-

Gold Range or Shoulders?

Oct 31, 2025 11:59 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send a detailed note on latest technical parameters to our WhatsApp Bdcst Group... -

Currency School

Oct 29, 2025 12:11 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات . Will send a detailed note on latest technical parameters to our WhatsApp Bdcst Group .. -

EURGBP Revisited

Oct 29, 2025 11:02 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send a detailed note on latest technical parameters to our WhatsApp Bdcst Group...

Ashraf

Rob, Today's $1.3148 low may not be enough to call it a breach of the trend line ( we need to see $1.31). If you're short, then consider stops at $1.3240. Considering ECB's latest talk on easing, i see upsdie limited at 1.33.

TAHA, pls see aove reply to Rob.

Ashraf

could you tell me simply , what is your recommendations for euro /usd in the next two weeks ? . and could you mention the key levels , please ? .

Thanks

Taha

With equities in the green (right now) and US Ind Prod at -1.5 (I saw your comment on Twitter), are you sticking with EUR losses? I'm sure you'll say yes, but I guess I'm referring to very short-term. Also, if we get good numbers from the banks reporting this week and next, equities should rise and EUR after it, yes. Seems like equities is keeping EUR propped up. Bottom line, I can never tell which is more important, data or equities, what would you say? Seems like equities always runs the show when it comes to EUR. Thanks a bunch, and note that it's great of you to recognize/mention calls you've made that haven't gone perfect (eg: CAD)- it only validates your expertise, honesty, and integrity further. Thanks

So looks like Operates should Meets undersells high or Meets buys up lowly,You think from this month, until to the ECB next meeting. Stock market's positive phase relatedness how?

Thanks

Francis