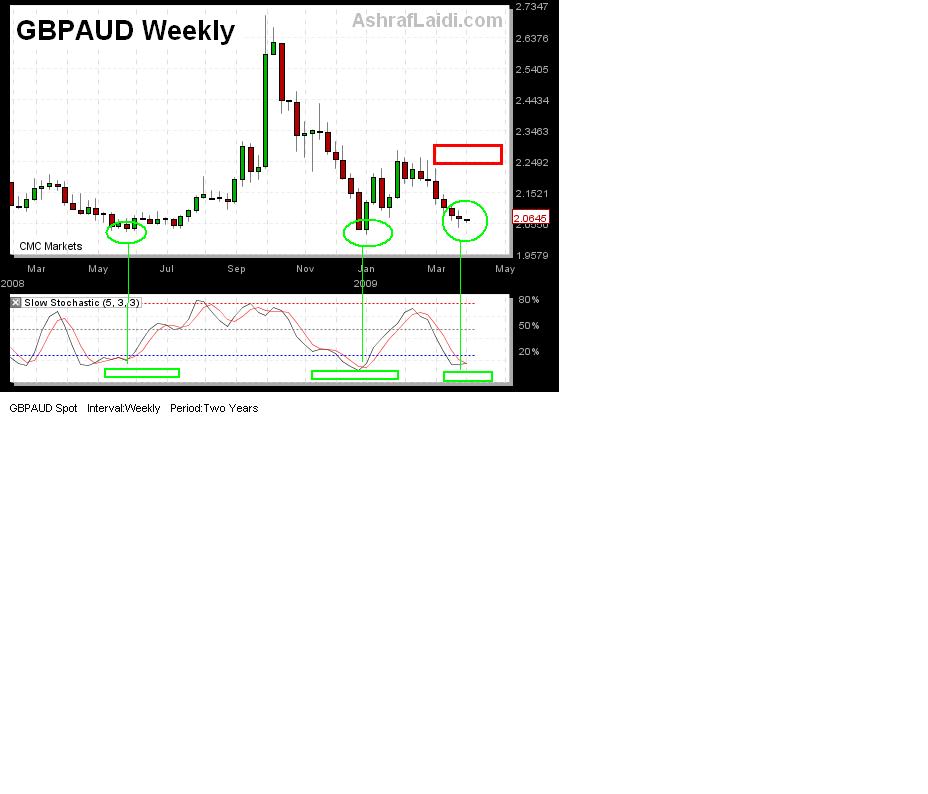

GBPAUD Testing the Bottom

Aussie has long been a favourite on this website and its performance speaks for itself. But rather than pitting Aussie against the weak currencies, lets assess its potential against the sterling, whose robust ways suggest more upside for the Aussie against the British currency. The weekly chart shows the oscillators call for a bullish divergence. Sterling has been firming largely due to improved risk appetite but Aussies more fundamental superiority enabled it to quickly recover from negative retail sales. The latest AUDJDPYHotChart took 2 days to be in the money. GBPAUD is more of a longer term play for the 2.097 and 2.11 target to emerge. For more bang out of your buck, consider AUDGBP instead of GBPAUD. This is not only cheaper but offers more pips per capital used.

More Hot-Charts

-

Gold Next Move

Dec 26, 2025 15:32 | by Ashraf LaidiWill send detailed note on latest parameters to our WhatsApp Bdcst Group - سأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - .. -

EURGBP & Bank of England

Dec 17, 2025 19:24 | by Ashraf LaidiToday's weaker than expected UK CPI sharply boosted EURGBP and dragged down GBPUSD on improved expectations the BoE will cut rates tomorrow (Thursday). -

Indices & Gold Update

Dec 16, 2025 12:16 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group...