Aussie View

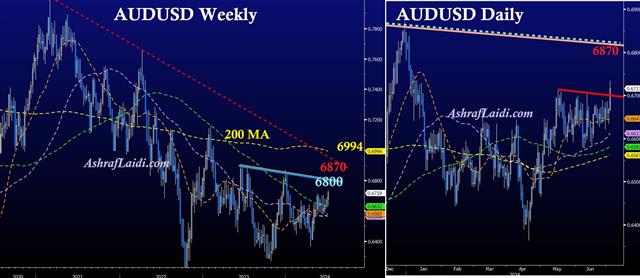

The Australian dollar is the 3rd highest performing currency in the G10 so far this yearm behind USD and GBP. Following stronger than expected Aussie retail sales overnight and today's unexpected drop in US Services ISM back to contraction territory, AUDUSD is having a field day. The DAILY chart (on the right) shows a sharpp break of the trendline resistance starting from the May 16 high. As long as AUDUSD closes the day above 6710, the path remains clear for the next target resistance at 6870. Tomorrow is a holiday in the US, but Friday will release the latest NFP/Unemployment Rate report for June, which can be highly instrumental in triggering a break of 6800 in AUDUSD and a print of 2390 in XAUUSD. This would especially be the case if US 10 yr yields drop below 4.24/25%.

More Hot-Charts

-

Weekly & Monthly

Feb 27, 2026 13:54 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold 5000?

Feb 24, 2026 14:19 | by Ashraf LaidiCan gold drop back to $5000 per ounce. Here are 2 possible technical scenarios. China's return to the market could also bring back selling pressure during Asian session.. -

Before and After the New Tariffs

Feb 23, 2026 12:49 | by Ashraf LaidiThe chart on the left is Nasdaq100 CFD (US100) which opened on Sunday night at 11 pm London Time after Trump announcement of 15% tariffs, and the other chart is the Nasdaq cash, ending on Friday...