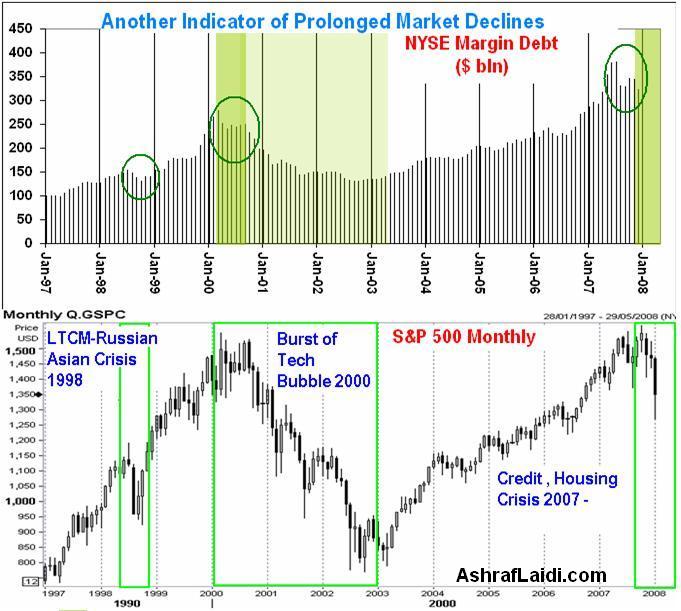

Margin Data Suggest Prolonged Bear Market

One essential indicator for the future performance of US equity indices is the aggregate margin debt used by member firms of the NYSE. After attaining a record high of $381 billion in July, member firms margin use continued to tumble for the following 4 months, reaching a low of $322 billion. Such declines in debt result from the execution of margin calls as client losses escalate to unsustainable levels, which is the case during mounting market volatility.

The chart below clearly shows that the rapid declines in margin debt from their record highs correctly predicted the prolonged bear market in equities in fall 1987, fall 1998 and spring 2000. The continued declines in margin debt in December to $322 billion from the July high of $381 billion suggests that continued losses are due in the market, which is consistent with our expectations for a prolonged bear market in equities. The 12-15% declines in stocks we predicted back in December are already underway. We expect another 15-25% of declines to come by end of H1 as the macroeconomic deterioration coupled with prolonged losses in US banks and profit warnings (no currency translation effect this time as the dollar stabilized in Q4-Q1) will overwhelm the easing measures of the Fed.

The importance of determining where the general equity indices are heading is highlighted by the 70-20-10 rule, which states that 70% of a stocks movements are influenced by the broad indices, 20% are driven by stocks sector and 10% by the fundamentals of the individual stock. As history has shown without fail, individual stocks have consistently followed the broad averages during prolonged bear markets regardless of their individual fundamentals.

Incorporating this outlook to currencies, continued risk reduction should maintain the yen as the key beneficiary of falling risk appetite and unwinding of carry trades. Further declines in USDJPY, GBPJPY and CADJPY are in store as we anticipate 103, 202 and 100 respectively before the end of the quarter.