The Best UK Election Scenario for Gilts

As we assess the impact of the UK general election on UK government bonds (gilts), it is important to tackle the prospects for inflation/deflation, earnings growth, austerity as well as the implications of holding a referendum on UK membership.

We have seen in previous election/markets pieces that downside risks for sterling and the FTSE associated with a Labour-SNP coalition (fiscal tightening for businesses and the wealthy and likelihood of undershooting budget targets), as well as those from Conservatives (pushing for referendum on UK's EU status) have been widely discussed among traders to the extent that they may no longer cast such a negative spell on the market and the pound.

While the probability of a majority government led by a Labour or Conservatives-led coalition is above 50%, a preferred scenario for the pound and gilts would be a Conservative-led minority government, formed by Conservatives, Liberal Democrats and Democratic Unionists Party accumulating about 305-315 seats. This would be insufficient to attain the 326-seat majority, but would bring the Tories ahead of Labour by five-to-eight seat margin. This would combine the benefits of an incumbent and market-friendly party victory, while eliminating the risk of EU referendum due to LibDem opposition to any referendum bill.

Minority government not as bad as you think

Fearing the possibility of a UK minority government stems largely from the experience of the 1974-79 government when the economy was hit by soaring inflation and high unemployment, resulting from the global oil shock. In 1976, the UK approached the International Monetary Fund for loan assistance and GBP/USD collapsed by nearly 25%. Those challenges were too great for any government – let alone the minority government at the time – to overcome.

Today, not only is the economy faring at its best footing since before the 2008-9 crisis, but both Parliament and the electorate are better prepared to handle the generational novelty of minority government after five years of coalition and an already very close race. The highlights of the last five years are characterised by a 50% reduction in the budget since the 2010 election, the fastest growing GDP growth among G7 nations, and the highest rate of employment (73%) since record began 40 years ago.

Neither is the economy

The negatives of a minority led-government associated with political gridlock could be balanced by eliminating the negatives of major parties seeking the extreme end of their agendas. These extremes are: Conservatives forcing a referendum on the UK membership in the EU (negative for most sterling assets, especially gilts as it raises the premium risk of UK exit); and Labour leaning towards tax-and-spend policies, which could impact growth and delay the path of balancing the budgets. Both extremes are a clear negative for gilts as they weigh on prices and boost yields higher at a time when inflation remains near zero.

Don't forget growth & the BoE

The aforementioned attributes may be a threat for gilts if inflation were overheating. But the lowest rate of inflation since records began 55 years ago suggests further long-term gains in gilts are ahead. The combination of low inflation, steady growth and restrained budget deficit will likely support the three-decade long bull market in gilts, especially with the help of an accommodating central bank. Aside from the fact that the 10-year gilt remains in a 25-year bull market, the Bank of England has proven to remain too careful in not upsetting the growth apple cart via any premature monetary tightening.

Most importantly, government bonds in the developed world have proven to be mainly driven by the low-inflation benefits of subpar growth, rather than the dangers of fiscal irresponsibility. We all recall the 2010 warnings from legendary bond fund manager Bill Gross describing the gilt market to be resting on a “bed of nitro-glycerine” due to deteriorating public finances at a time of deepening recession.

The combination of two-year-long austerity with prolonged gilt purchases by the central bank helped address the problem. UK government debt stood at a record 89% of GDP in 2014, from 76% in 2010 and 41% in 2005. But the budget deficit – the difference between tax revenue and government spending — stood at 5.4% of GDP in 2014, half the level of 2010. Gilts traders – and markets in general – are also pleased with the decline in UK household debt to 143% of disposable income in Q4 2014 from 152% in the 2010 election and 170% peak in Q1 2008.

Committing to deficit-reduction

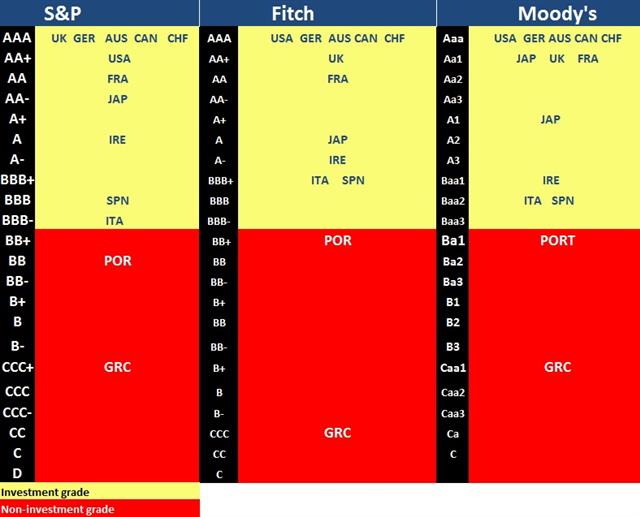

After notable progress on the budget front, major UK parties have little choice but to preserve the path to fiscal rectitude and avoid any downgrade in the UK's sovereign credit rating. All the big parties at Westminster are committed to shrinking the deficit, with the Conservatives targeting a surplus by 2020 and Labour and Lib Dems promising to balance the books net of investment spending.

Notably, Liberal Democrat leader Nick Clegg, seen as potentially pivotal in establishing a working coalition with Labour and Conservatives, announced he would demand a “stability budget” within 50 days of polling day as a condition of entering into coalition with either of the two major parties. Clegg's plan in aiming to eliminate the deficit will likely oppose the Conservatives' recent promise to eliminate all tax hikes in the next parliament. But its centrist agenda will likely be seen as positive for gilts.

The above charts suggest that an accommodating Bank of England, a prolonged supply of labour, and ongoing technological progress and disinflationary currents from China will maintain the declining trend in gilt yields (rise in gilt prices) via robust earnings growth, acquiescent inflation rate and a robust currency. And as long as UK's EU membership is not subjected to speculation and the Bank of England refrains from premature tightening, bonds will avoid Europe's negative yield spiral while regaining their AAA rating.