Intraday Market Thoughts

A Change in the Game but Not a Game-Changer

by

Aug 28, 2020 15:00

The choppy, indecisive move in most markets Thursday after the Fed shift to average inflation targeting speaks to the muddled market focus. The Australian dollar and the Japanese yen are the strongest, with the latter boosted by the resignation of PM Abe on the expectation that theBoJ may turn less dovish.

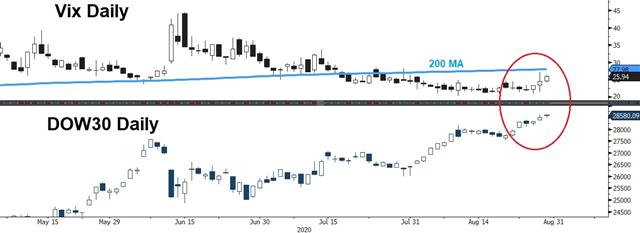

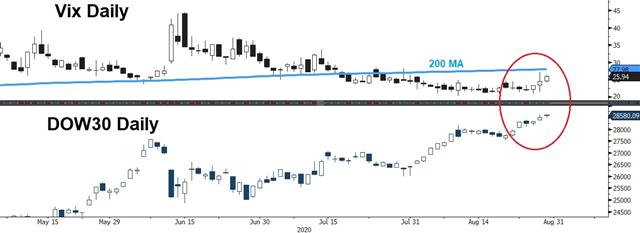

Click To Enlarge

It's likely that the simple explanation of the FOMC paradigm shift on Thursday is the correct one: It means that rates will stay lower for longer. Yields rose, equities where higher and AUD/JPY was the best performer in a classic risk trade. Yen turned later on Abe's resignation. That points to a return of the pre-pandemic risk trade and additional news on virus treatments and testing is a tailwind.

In the longer-term, it raises a series of risks and more questions about the wisdom of owning sub-1% bonds with a Fed target now above 2%. That could spark a negative feedback loop but it's too early to declare the 6 bps rise in 10-year yields as a genuine breakout. It's a spot to watch in September.

In FX, the series of doji stars in EUR/USD, GBP/USD and other crosses speak to the indecision in the overall market. Ultimately, economic strength will matter and with that we will continue to watch the data. On Thursday, US initial jobless claims were once again above 1m. On Friday, the US July PCE report is expected to show a 1.5% rise in personal consumption. Watch inflationary numbers too for a sign of surprise. Anything on the upside could spark a bigger move in yields and USD/JPY.Latest IMTs

-

Gold Bear or Correction

by Ashraf Laidi | Oct 23, 2025 9:51

-

Gold Wave 3 تحديث موجات الذهب

by Ashraf Laidi | Sep 18, 2025 16:19

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33