Abe Wins, Yen Weakens

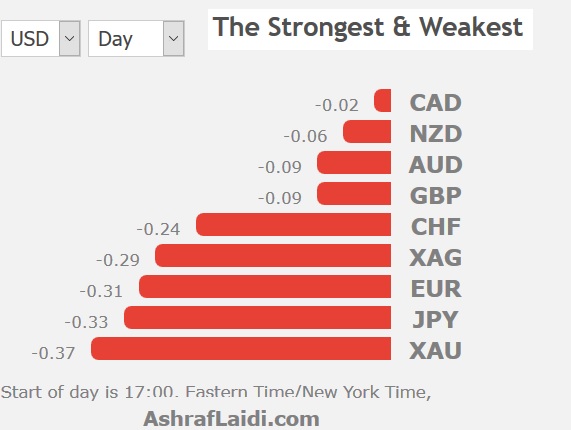

Shinzo Abe cemented himself as one of the great modern Japanese leaders with another election win on Sunday. USD/JPY climbed half a yen past the 114 level at the Asia open before retreating. CFTC positioning continues to show stretched EUR and CAD longs. A busy week ahead with the ECB decision on tapering, Catalunia meeting on Spanish direct rule, Senate vote in Madrid and US GDP figures. The JPY trade was stopped out, while 1 of the EUR trades deepened in the green.

Japanese politics is notoriously fickle but Abe has held power for nearly 5 years and won a new mandate in what looks to be a landslide Sunday. The results sent USD/JPY to the highest since July. Like Trump, one of his next missions will be appoint a new central bank leader. He could reappoint Kuroda or look to someone but either way, he will pursue a strategy to weaken the currency.

Another currency that's suffering is the Canadian dollar. On Friday, retail sales fell 0.3% compared to a +0.5% reading expected. It wasn't due to special factors; even stripping out autos, gasoline or other skews showed a poor number.

USD/CAD climbed 140 pips on Friday to break above the October double top. The market is divided on whether Poloz will hike again before year end, but the economic data is beginning to make a strong case for the sidelines.The Bank of Canada decides on rates on Wednesday. Technically, the August 30 high of 1.2663 will be a key level to watch in the day ahead.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - and long by +.EUR +90K vs +98K prior GBP +5K vs +15K prior JPY -101K vs -101K prior CHF –5K vs -4.3K prior CAD +75K vs +76K prior AUD +62K vs +69K prior NZD +7K vs +6K prior

The moves were minor for the second week. What's interesting is that some specs – particularly CAD and EUR longs – are beginning to look vulnerable. There are some heavy bets riding on the ECB and BOC.

Latest IMTs

-

Beware of US Supreme Court Ruling on Tariffs

by Ashraf Laidi | Jan 8, 2026 19:38

-

Falling to 11 Percent

by Ashraf Laidi | Jan 7, 2026 20:28

-

Dollar Cannot Wait for Q1 to End

by Ashraf Laidi | Jan 6, 2026 12:40

-

Silver's Signal to Gold Full Explanation

by Ashraf Laidi | Dec 30, 2025 20:04

-

Gold Silver Next الذهب و الفضة

by Ashraf Laidi | Dec 26, 2025 17:15