Another Japanese Recession?

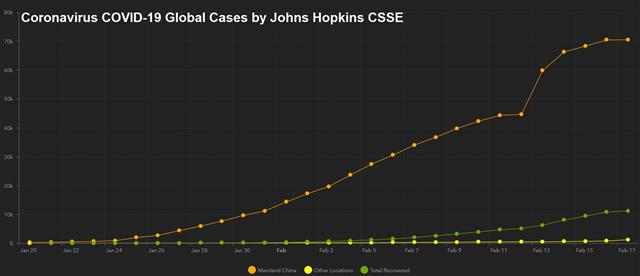

Global stocks pushed higher on the narrative of slowing growth in the number of coronavirus cases, which reached 71,810. The PBOC injected additional short term funds. US equities will close in observance of President Day Holiday but futures will remain open. CAD is the strongest performer, dragging USDCAD towards its 200-DMA. Japan is paying the price of another sales tax, seeing its biggest growth contraction in over five years. A new Premium trade was posted late Friday, bringing the number of open trades to seven. More below.

The world's third-largest economy erased all of the growth in 2018 and 2019 plus more in the final quarter of last year. Growth contracted by 1.6% in the quarter compared to 1.0% expected. That's an annualized pace of -6.3%. Even worse, growth in Q3 was revised down to +0.1% from +0.4% q/q.

The drop was the largest since 2014 in a quarter when the sales tax was also raised. This time, however, the economy faces a second hit from coronavirus and a local drought. The number of cases on the cruise ship quarantined in Japan have risen to 355 including 70 more on Sunday. The global total is now nearing 72,000 with 1,775 dead.

Nearby Thailand and Singapore both lowered GDP forecasts on the weekend. New Zealand's PM also warned of an H1 hit.

On Friday, US January retail sales numbers disappointed. The control group was flat compared to +0.3% expected and the prior was revised to +0.2% from +0.5%. Optimists pointed out that falling clothing prices caused a one-off blip while the pessimists note that average growth in the control group in the past six months is 0%.

The US is on holiday Monday so that may keep trading light.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -86K vs -75K prior GBP +21K vs +13K prior JPY -26K vs -21K prior CHF +4K vs +5 prior CAD +10K vs +19K prior AUD -33K vs -43K prior NZD -4K vs -2K prior

Specs were on the right side of the EUR/GBP last week and benefitted further from the late-week rally in the pound. The market is now fixated on the upcoming UK budget and the hope for fiscal spending. Watch for leaks.

Latest IMTs

-

Gold or Silver?

by Ashraf Laidi | Jan 23, 2026 17:42

-

40 on the Mint Ratio

by Ashraf Laidi | Jan 23, 2026 11:27

-

Trump's Golden Hit

by Ashraf Laidi | Jan 22, 2026 10:58

-

4890 Hit, Now What?

by Ashraf Laidi | Jan 21, 2026 11:34

-

Gold 4850 No Change

by Ashraf Laidi | Jan 20, 2026 9:48