BoE cuts, buys & downgrades

3 of the 4 four big central banks have now made that much feared U-turn; The Bank of Japan did it, the European Central Bank did it and now the Bank of England has finally done it. Cutting rates and diving back into quantitative easing. The BoE cut its base rate by 25 bps to 0.25%, raised purchases of gilts (govt bonds) by £60 bn to £435 bn, while announcing the purchase of £10 bn in corporate bonds of select companies, bringing the total of purchases to £445 bn.

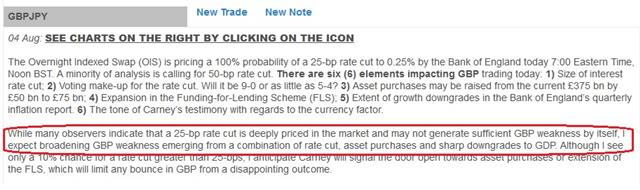

And if there were any doubts about the future of economic growth, the central bank reduced its growth forecasts across the board, slashing its 2017 GDP outlook to 0.8% from 2.3%, the biggest downgrade in over 2 decades. 40 minutes before the Bank of England announcement, gilts priced in a 100% chance of a 25-bp rate cut. Several pundits said 25-bps and QE of less than £50 bn would not be enough in weighing on GBP as it is widely priced in the market. Yet, we focused on the broader picture and issued 2 GBP Premium trades to clients. Above is part of the explanation. The rest was history. We stick with our two GBP trades until further notice.

Latest IMTs

-

Gold or Silver?

by Ashraf Laidi | Jan 23, 2026 17:42

-

40 on the Mint Ratio

by Ashraf Laidi | Jan 23, 2026 11:27

-

Trump's Golden Hit

by Ashraf Laidi | Jan 22, 2026 10:58

-

4890 Hit, Now What?

by Ashraf Laidi | Jan 21, 2026 11:34

-

Gold 4850 No Change

by Ashraf Laidi | Jan 20, 2026 9:48