BoC Rate Cut on Recession Watch

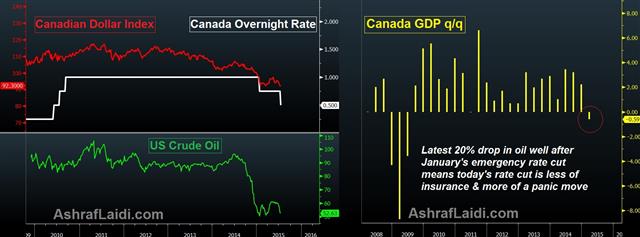

The Bank of Canada cut its overnight rate by 25-bps to 0.50%--the lowest in five years. The rate cut was all about fears of a full blown recession as the BoC expects a contraction in H1 2015 with -0.5% GDP growth in Q2 (revised from +1.8%) following -0.6% in Q1. +1.5% seen in Q3 (revised from +2.8%). Overall 2015 GDP revised to +1.1% from +1.9%. The BoC expressed risks to the downside in inflation and growing financial vulnerabilities stemming from rising household debt. Judged rate cut was needed to return the economy to full capacity, aimed for 1H 2017 from H2 2016.

Since BoC described January's rate cut as an “emergency”, what would it call today's cut? Despite the loonie's 8% depreciation of the past 9 weeks, the central bank is on a mission to avert a deepening recession. Previous reluctance from the BoC to cut was attributed to risking further swelling in household debt, but the priority of avoiding a deepening growth slump led the central bank to take action. The 18% drop in oil five months after January's emergency rate cut implies further shakedown Canada's economic foundation to the extent that the central bank sees no pickup from its Southern neighbour.

Our Premium Insights subscribers received the initial warning of a BoC rate cut on July 6th (well before those disappointing CAD jobs figures). Our decision to stick with CADJPY shorts and EURCAD is now paying off.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| BoC Interest Rate Decision | |||

| 0.50% | 0.75% | 0.75% | Jul 15 14:00 |

Latest IMTs

-

Gold Bear or Correction

by Ashraf Laidi | Oct 23, 2025 9:51

-

Gold Wave 3 تحديث موجات الذهب

by Ashraf Laidi | Sep 18, 2025 16:19

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33