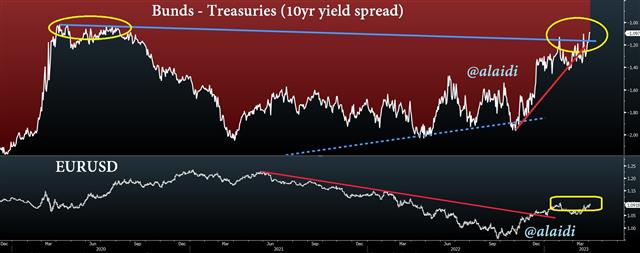

Bunds Treasuries Spread Breakout

When Yield Spreads Failed in FX

See how EURUSD remained steady in spring-winter 2020 despite the Bunds-Treasuries spread falling. The reason was related to the fact that USD was sunk by trillions of fresh central bank liquidity, even as US yields were starting to stabilize relative their German counterpart. Other examples of the yield spread's ineffectiveness was during 2002-2004 –when a rising EURUSD rode on the back of an implicit USD-depreciation policy from the Treasury as well as the start of the commodity boom.

When Yield Spreads Worked in FX

As for the classic examples when Bunds-Treasuries yield spread proved effective in predicting EURUSD, these were in 2000-2002 and 2011-2017.

Looking ahead, the Bund-Treasuries 10-yr yield spread appears to be breaking above the trendline resistance (upper right corner of chart). Yet, the spread needs to ascend further towards the -0.50 territory (when bund yields are -0.5% below treasuries) in order for $1.10 to hold and build up for $1.15. The warning becomes the following: Once/if the break into positive territory (spread goes above zero%), the FX implications, could be significant (in propsects and in speed) for EURUSD due to algos deploying new buy orders, on such massive Global Macro developments. As for the fundamental triggers, they could include: i) New evidence of weakness in US labour markets; ii) signals of Fed pivot (definite pause in hikes); or even iii) Japan nearing the end of YCC. Think deeply about the last one, as it's not straightforward.

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40