The Pre-ECB Pause

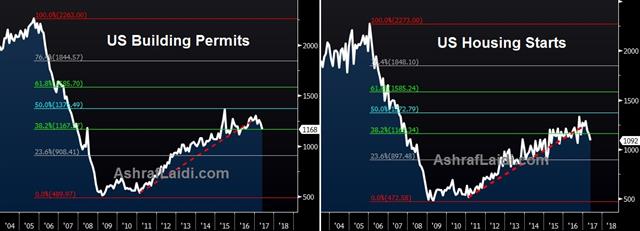

A quiet FX session in Asia and Europe ahead of ECB Thursday following another round of USD damage on Tuesday. Draghi may shed more light on the likelihood of signalling QE reduction, but he is also due to speak on the topic at next month's Jackson Hole symposium. US June housing starts and building permits are due next (see charts below). We revisit yesterday's UK CPI figures below. There are 8 Premium trades in progress: 4 in FX, 2 in metals and 2 in indices.

On Monday, we wrote about how the small USD bounce was a tell i.e a sign that it remained weak. Tuesday proved that to be true as the dollar fell hard across the board in Asian and European trade. It hit multi-month lows against EUR, AUD, CAD in a sign that the breakdown is continuing.

The same appeared to be underway in cable but the trade reversed when UK June CPI was flat compared to a 0.2% rise expected. Core measures also missed. In the aftermath, cable fell to 1.3005 from 1.3100. Despite the broad shift to more hawkish policies, no one is facing a genuine inflation problem. Even in the UK, where it's running above 2%, it can almost entirely be explained by FX rather than wages.

Equally fascinating was that Carney brushed off the soft data in an interview with Sky News. He said it didn't change the big picture on prices. The confusing bit is that he's been on both sides of the big picture. He's said inflation will only be temporarily above target but he's also been hawkish. That sets up a resolution when we hear from the BOE again. They will get a look at consumers first with the retail sales report due Thursday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| 0.4% | -1.2% | Jul 20 8:30 | |

Latest IMTs

-

How I Grew the Account 5x

by Ashraf Laidi | Mar 2, 2026 11:54

-

Breakout to 2 Month Highs

by Ashraf Laidi | Feb 27, 2026 12:12

-

Grow an Account 5x

by Ashraf Laidi | Feb 26, 2026 14:36

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21