Commodity FX Keels, EMs Crack

The Canadian dollar touched a fresh 11-year low and the Brazilian real hit an all-time low on fresh signs of strain in emerging markets. The euro was the top performer on the day while the Australian dollar lagged. The latest Japanese manufacturing PMI is due later.

Emerging market and commodity worries continued to ramp up on Wednesday. The Canadian dollar initially rose on a bullish US oil inventory report but crude quickly reversed to fall 3.5% and pulled down the loonie with it. It was compounded by a flat reading on Canadian retail sales ex-autos, compared to a 0.5% rise expected. Late in the day, USD/CAD rose narrowly above the August high of 1.3353 in the fifth day of gains.

The Australian dollar and pound sterling are also working on four day losing streams but perhaps the worst streak of all is the Brazilian real. It's declined in 11 of the past 12 weeks and has been halved in the past year. Talk of impeaching President Rousseff continues and bonds of semi-state-oil company Petrobras are trading at severely distressed levels.

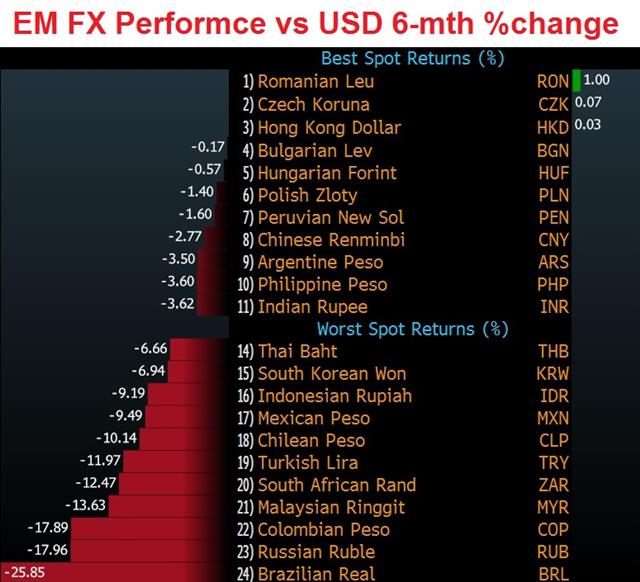

Brazil is often seen as a forerunner for emerging markets but they're far from the lone weak spot. South Africa's central bank slashed growth forecasts for 2015-2017 Wednesday and warned of FX weakness. Yesterday's China PMI raised fresh concerns about growth there and President Xi Jinping offered comments to reassure on growth during a trip to Washington.

One standout on the day was the euro as it rebounded after three days of losses. Soft global growth has sparked talk of more ECB QE but a speech from Draghi was very similar to his September ECB statement. He said the ECB could change the size, composition and duration of its balance sheet as needed but offered no more.

Looking ahead, a few Asia-Pacific events are on our radar. Up first, it's New Zealand trade balance at 2245 GMT. Exports are expected at $3.6B. Next is the Japan Nikkei prelim PMI for September. The BOJ hasn't yet opened the door to further easing but economic data is in sharp focus. The index is expected to slip to 51.2 from 51.7. Finally, at 0530 GMT, the RBA's Heath speaks in Perth.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Nomura/ JMMA PMI Manufacturing (SEP) [P] | |||

| 51.7 | Sep 24 1:35 | ||

| Markit US Manufacturing PMI (SEP) [P] | |||

| 53.0 | 52.8 | 53.0 | Sep 23 13:45 |

| PMI | |||

| 47.0 | 47.6 | 47.3 | Sep 23 1:45 |

| Eurozone Markit PMI Composite (SEP) [P] | |||

| 53.9 | 54.1 | 54.3 | Sep 23 8:00 |

| Eurozone Markit PMI Manufacturing (SEP) [P] | |||

| 52.0 | 52.0 | 52.3 | Sep 23 8:00 |

| Eurozone Markit Services PMI (SEP) [P] | |||

| 54.0 | 54.2 | 54.4 | Sep 23 8:00 |

| Retail Sales (AUG) (m/m) | |||

| 0.5% | 0.5% | 0.4% | Sep 23 12:30 |

| Retail Sales ex Autos (AUG) (m/m) | |||

| 0.0% | 0.4% | 0.5% | Sep 23 12:30 |

| Fed's Yellen Speech | |||

| Sep 24 21:00 | |||

| Trade Balance (AUG) (m/m) | |||

| $-850M | $-649M | Sep 23 22:45 | |

| Trade Balance (AUG) (y/y) | |||

| $-3.07B | $-2.69B | Sep 23 22:45 | |

| Exports (AUG) | |||

| $3.67B | $4.20B | Sep 23 22:45 | |

Latest IMTs

-

Silver's Signal to Gold Full Explanation

by Ashraf Laidi | Dec 30, 2025 20:04

-

Gold Silver Next الذهب و الفضة

by Ashraf Laidi | Dec 26, 2025 17:15

-

Everyone's Talking about this Risk

by Ashraf Laidi | Dec 24, 2025 14:08

-

2026 Difficult but not Impossible

by Ashraf Laidi | Dec 22, 2025 20:06

-

Bank of Japan Massacre or Yawn?

by Ashraf Laidi | Dec 18, 2025 20:50