Deal Mirage, Earnings Unease & G7 Chatter

A fresh report on Wednesday saying the US-China have failed to make any progress since the G20 hurt sentiment. Moreover, there is a growing sense that the conditions aren't right for a deal. GBP is the strongest currency on a combination of stronger than expected UK retail sales and comments from EU chief Brexit negotiator reviving hopes of reaching a compromise on the Irish border issue.See the notes on Alcoa, CSX and Netflix below. Euro lost ground on a report stating that the ECB may revamp its approach to inflation. Both of this week's newly added Premium trades are in the green. There are currently 6 trades open. The Premium Video titled "The Short Backed by All 3 Metrics" is out.

A WSJ report said US-China talks are hung-up on executing the US pledge to allow Huawei to buy US technology. Once that's sorted out, China has pledged to buy US agricultural goods. The problem is the White House is struggling to decide what to allow the Chinese telecommunications company to buy so everything has grinded to a standstill.

The inability to make any concrete progress after several indications of an agreement is a sign of trouble. Equity markets stumbled Tuesday after initial comments from Trump expressing displeasure and they fell further Wednesday on the report.

The economic backdrop also makes it tough to envision a deal. The US reopened talks in December after a 20% drop in stock markets; now they're at record highs. There are also signs that China's economy is surviving a pivot towards consumers with retail sales strong in the latest quarter.

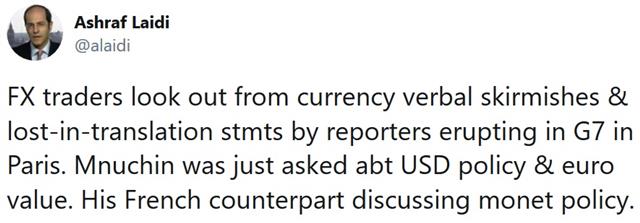

G7 FX Chatter

Here is a tweet from Ashraf on the G7 meeting in Paris:In other economic news, the Fed's Beige Book underscored a solid US economy with 'modest' growth. Commentary highlighted unease about trade but a 'generally positive' outlook and higher loan demand. Earnings continue to paint a slightly different picture. Railway operator CSX warned of softening demand Tuesday and aluminum giant Alcoa cut its global demand forecast Wednesday. Netflix tumbled 13% on news that it lost 130K US clients.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| 1.0% | -0.3% | -0.6% | Jul 18 8:30 |

Latest IMTs

-

Gold Correction or Breakdown

by Ashraf Laidi | Apr 25, 2025 14:56

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Feb 23, 2025 23:00

-

Charting gold storage in NY تحليل مخزونات الذهب في نيويورك

by Ashraf Laidi | Feb 21, 2025 19:45

-

آخر ضربة تعريفات ترامب على الأسواق

by Ashraf Laidi | Feb 7, 2025 19:52

-

تداول فوضة تعريفات ترامب

by Ashraf Laidi | Jan 31, 2025 21:19