Demand Destruction or Delay?

At the confluence of consumer-demand, covid-shutdowns and the supply bottlenecks is the automotive industry. Hardly a Fed speech passes without a reference to the 45% y/y jump in used auto prices but it's developed into an even thornier issue to deconstruct.

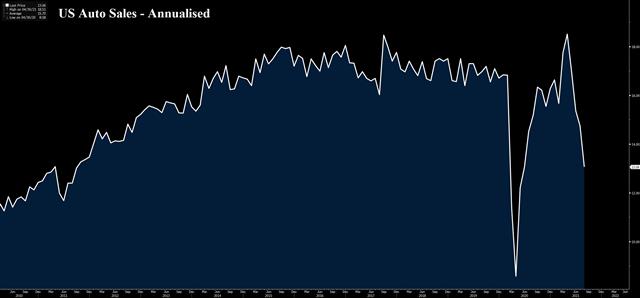

New auto sales also spiked during the pandemic and were on track for their best year in a decade before the chip shortage began to derail new car construction. As inventories were depleted, consumers slowly lost the ability to negotiate prices and companies dropped incentives.

If you arrive at a car lot today in the US, you'll almost certainly pay full price. If not, the next customer through the door will. Naturally, this continues to put pressure on auto prices but, instructively, it's also causing a rapid drop in sales overall. That drop – and similar declines in other durable goods – will be a large drag on GDP growth for the remainder of the year.

The question beyond that is whether the demand for those cars has been destroyed or simply delayed until inventories can be replenished. Moreover, at what prices will those transactions take place.

Naturally, that's a sliding scale but for the Fed, the answer is clear: Consumers believe prices will go down. That makes perfect sense because if they believed prices were going to stay flat or continue rising, there would be no reason to delay purchases.

So we're seeing a real life example of how inflation expectations are anchored.

It will be crucial to watch the industry and how pricing evolves. In an extremely competitive industry like autos, with spare manufacturing capacity (once the chip shortage is alleviated), it's reasonable to expect prices to come back down and incentives to return. Yet, the longer the shortages last, the more that's jeopardized.

More broadly, not every industry is as competitive as autos. In other industries where there are shortages, companies may try to boost margins and that could also lead to sustained inflation, particularly once consumers normalize the higher prices and seek higher wages in response.

In short, inflation is perhaps the most-difficult economic force to predict, understand and control. There are plenty of good reasons to expect a higher inflation regime and even more to trust the collective judgement of global central banks. The answer will be in the data and the automotive industry is the single best spot to monitor.Latest IMTs

-

Silver's Road to 102

by Ashraf Laidi | Jan 19, 2026 13:25

-

Avoid Yen Intervention Trap

by Ashraf Laidi | Jan 17, 2026 11:20

-

Winners & Losers

by Ashraf Laidi | Jan 15, 2026 16:22

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jan 15, 2026 13:55

-

Update on Gold & Silver after USSC

by Ashraf Laidi | Jan 14, 2026 19:54