Dollar Breaking Out?

The USD dollar march continued on Thursday as it broke critical levels as economic data continues to improve. USD was the top performer while the pound sterling lagged yet again. Japanese labor cash earnings are due up later. Has it really broken? Or is this Dec 2015, Jan 2016 or Jul 2016? A new Premium tradd will be released shortly before the US jobs report.

The good news kept coming for the US dollar on Thursday as initial jobless claims fell to the lowest since April at 249K compared to 256K expected. The four-week moving average is now at the lowest since 1973 in what will look like a flashing red signal on wage inflation to the Fed hawks.

The buck climbed on all fronts with USD/JPY breaking above the 100-day moving average and touching 104.16 at the high. It was the eighth day of gains for the pair.

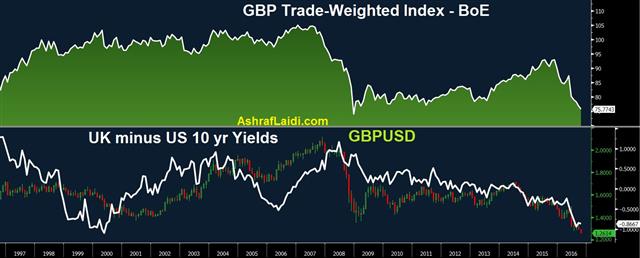

Similarly, cable continues to get beat up as it extended the break below the Brexit lows and down to 1.2601. The big figure is holding the line so far but it's basically unchartered territory for the pair as it plumbs the 31-year lows.

Technically, the US dollar is making some serious strides. It took out the 200-day moving average against the Swiss franc and Canadian dollar. The New Zealand dollar also fell below the 100-dma.

Gold fell below the 200-dma and is battling support in the 1250 zone which is the combination of the late-June low and the 38.2% retracement of the rally since December.

What's keeping the dollar bid? One is a growing sense that no matter who wins the election, a dose of fiscal stimulus is coming. The data is also solid and Friday's non-farm payrolls report may raise the probability of a hike.

Finally, the euro slid after the ECB's Constancio categorically denied this week's report about ECB tapering. The euro fell a half and is now near the Sept lows. Watch for comments from Draghi on the weekend.

On the upcoming calendar are releases from Australia and Japan. Up first at 2230 GMT, it's the Australian AiG performance of construction index. The prior reading was 46.6. It's unlikely to be a market mover but we keep a close eye on the sensitive construction industry for any surprises.

At 0000 GMT, the focus shifts to Japan and the August labor cash earnings report. The consensus is for a +0.4% y/y rise following the +1.4% y/y climb in July. The drop in the pace is another sign of the seemingly impossible challenges faced by the BOJ.

Looking to next week, note that China returns after Golden Week celebrations. Perhaps that will spark a bid in gold as it flirts with key support near $1250.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Labor Cash Earnings (y/y) | |||

| 0.5% | 1.2% | Oct 07 0:00 | |

| AIG Construction Index | |||

| 51.4 | 46.6 | Oct 06 22:30 | |

Latest IMTs

-

NFP & CPI Credibility

by Ashraf Laidi | Aug 11, 2025 16:35

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33

-

Recession Metric & Tariff Marsh

by Ashraf Laidi | May 26, 2025 13:47