USD Deleveraging & Tech Applications

USDX broke above that key neckline resistance of the inverted H&S formation, coinciding with the 55-DMA. The big question facing the FX market remains whether this is a dollar dead-cat bounce or the start of a longer retracement cycle. The price action on Tuesday highlighted the scope for further gains as it broke some technical levels and neared others. The bid in the dollar was strong and steady even as the news and market sentiment varied.

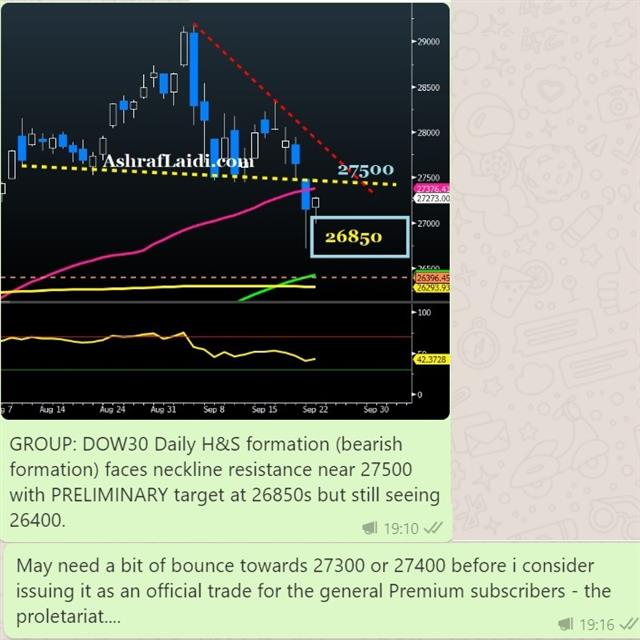

Below, is Ashraf's chart & trade idea on the DOW30 before the close of Tuesday's cash session, highlighting the 27500 neckline support turned resistance.

The steady bid in USD/JPY is certainly a curious element of the playing field as it climbs from levels that are undoubtedly a headache for Japanese officials. That extra bid could be providing some of the marginal strength in the dollar.

Another part of the equation is undoubtedly the resurgence of the virus in Europe. The UK placed a new curfew on bars and encouraged companies to allow work from home. Eurozone consumer confidence was better than anticipated on Tuesday but cases throughout the continent are moving in the wrong direction just as cold-and-flu season begins.

In the battle of easy money vs uncertainty the certain of low rates appears to be priced in while the uncertainty around the virus and US election is encouraging some deleveraging. That shift to the sidelines is helping to unwind crowded positions like long stocks and short USD.

Latest IMTs

-

Gold Bear or Correction

by Ashraf Laidi | Oct 23, 2025 9:51

-

Gold Wave 3 تحديث موجات الذهب

by Ashraf Laidi | Sep 18, 2025 16:19

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33