Durable Disappointment, Trump Changes Agenda

Monday was another day of confused trading as the dollar was hit by soft data and a slowdown on Trump's tax plan but rallied late anyway. The euro was the top performer while the yen lagged. Japanese industrial production data is due later. A new USD trades has been issued to the Premium Insights ahead of Trump's pre-speech interview on Fox News between 6-9 am EST (11:00-13:00 BST). The charts and notes of the trade shall be posted ahead of the Tokyo Tuesday session.

The headline didn't tell the story on US January durable goods orders. They rose 1.8% in the month compared to the 1.7% consensus but that masks a revision to December to -0.8% from -0.5%. Moreover, the key component on non-defense capital goods orders ex-air was down 0.4% compared to a 0.5% rise expected. US pending home sales data also missed estimates later.

The data put a negative bias into the US dollar but was lifted by Trump. Some disappointment set in as the administration shifted the focus of Tuesday's congressional address to Obamacare and military spending from taxes. Trump said a tax plan can't come until the cost of healthcare changes are clear.

The disappointment on taxes was balanced by Trump hinting about big spending on infrastructure. What's happening in the background is that various parts of the Republican administration are angling different priorities based on what's possible to accomplish. Trump had laid out something like taxes, Obamacare, infrastructure but that created some logistical challenges and Obamacare, infrastructure and taxes now seems like the plan.

There is room for disappointment there but until negative details emerge, the market wants to remain hopeful.

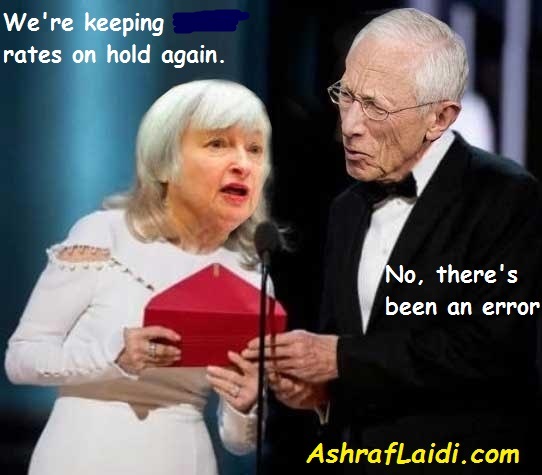

With Trump largely taking himself off this week's agenda, the focus may shift to the raft of Fed speakers on the agenda, culminating with Yellen and Fischer on Friday. Fed hike odds have crept up to 40% in what increasingly looks like it will be a tough meeting to handicap.

Looking ahead, Asia-Pacific traders will focus on Japanese industrial production at 2350 GMT. The consensus is for a 0.3% m/m rise after a 0.7% climb previously. Retail sales, construction orders and housing starts are also due later. For Australia, Q4 current account data is due at 0030 GMT. As it stands, the Australian dollar is the best performer in February.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Durable Goods Orders (m/m) | |||

| -0.2% | 0.5% | 0.9% | Feb 27 13:30 |

| Industrial Production (m/m) [P] | |||

| 0.4% | 0.7% | Feb 27 23:50 | |

| Pending Home Sales (m/m) | |||

| -2.8% | 1.1% | 0.8% | Feb 27 15:00 |

| Housing Starts (y/y) | |||

| 3.3% | 3.9% | Feb 28 5:00 | |

| Current Account | |||

| -3.8B | -11.4B | Feb 28 0:30 | |

Latest IMTs

-

Gold Bear or Correction

by Ashraf Laidi | Oct 23, 2025 9:51

-

Gold Wave 3 تحديث موجات الذهب

by Ashraf Laidi | Sep 18, 2025 16:19

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33