Fed's Dangerous Game of Chicken

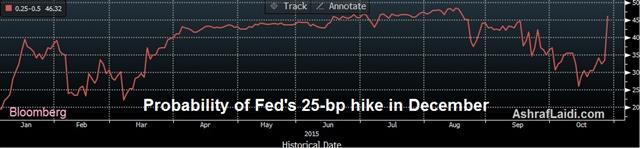

The Fed wanted to send a message to the market on Wednesday that a hike this year is a strong possibility. It's a dangerous game because the talk creates a de-facto tightening that will add to the current headwinds, forcing the central bank into another retreat. The US dollar surged on the FOMC statement in a volatile market day, which was followed by dovish talk from the RBNZ. Ashraf's Premium Insights modified the parameters of the existing EURUSD trade, while introducing the latest stress points in EURUSD and USDX charts. A new AUDUSD trade was added and both of the English and Arabic Premium videos posted here.

The Fed specifically highlighted the 'next' meeting as an opportunity to decide on rate hikes and removed a paragraph fretting about global headwinds. The result was a much more hawkish statement that the market was expecting.The dollar climbed 70 to 170 pips across the board. The dichotomy of the Fed hiking in and ECB easing in December dealt another blow to EUR/USD, tumbling to as low as $1.0897 from $1.1070.

In the hours leading up to the decision, the US dollar had slowly been losing ground. The late trades on the wrong side of the market likely added to the large moves and pushed them further than they might have gone, at least in the immediate term.

The Fed is more eager to hike rates than it needs to be, especially with headwinds coming from the US dollar and emerging markets. Yellen is showing that she's willing to sacrifice some growth to boost rates. That's a mistake in a low inflation environment.

But the Fed has threatened to hike before and then blinked. We will be looking for signs of how serious the Fed is this time.

Another story Wednesday was a nearly 7% rebound in oil prices. Crude had fallen in 6 of 7 days and fractionally tighter-than-expected inventories added to a violent squeeze. It spilled over into CAD trading and broad gains for the loonie.

The final piece of news on the day was the RBNZ decision. The main guidance – “some further reduction in the OCR seems likely” – was unchanged. Wheeler attempted to cap any NZD gains by saying a higher NZD would require a lower rate path but the market was looking for a more dovish slant and NZD/USD gained a half-cent after the announcement.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's Lockhart speech | |||

| Oct 29 13:10 | |||

Latest IMTs

-

Recession Metric & Tariff Marsh

by Ashraf Laidi | May 26, 2025 13:47

-

Bitcoin Maths رياضيات بيتكوين

by Ashraf Laidi | May 12, 2025 0:10

-

Gold Correction or Breakdown

by Ashraf Laidi | Apr 25, 2025 14:56

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Feb 23, 2025 23:00

-

Charting gold storage in NY تحليل مخزونات الذهب في نيويورك

by Ashraf Laidi | Feb 21, 2025 19:45