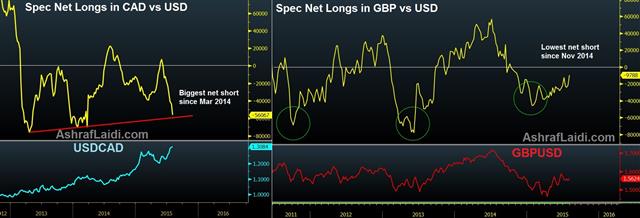

GBP & CAD Speculative Positioning

Net speculative interest in the British pound and Canadian dollar continues to move in opposite ways, as speculators reduce net short positions in the pound vs USD to 9,788 contracts—the lowest negative balance since November 2014, while loonie shorts contracts against USD swell to 56,067 contracts, the biggest net short balance since March 2014.

The once stable and non-volatile CAD has been damaged by two rate cuts in less than 6 months, while the pound is boosted by hawkish hints and a recovering economy.

Next week's quarterly inflation report from the Bank of England should lend fresh support to GBP bulls as it confirms the MPC's forecast that inflation will regain its 2.0% target within the next 2 years. In contrast, another disappointing GDP figure from Canada has maintained the selling of loonie bounce, especially as oil sustained a nasty end-of-week dead-cat bounce.

GBPCAD is already at 7-year highs. The more interesting play is to short CAD and long GBP against not-so obvious currency combinations. Our Premium trades currently have two CAD short and one GBP long.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (m/m) | |||

| -0.2% | 0.0% | -0.1% | Jul 31 12:30 |

Latest IMTs

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49