Intraday Market Thoughts

GBP & Silver Separated at Birth

by

Feb 10, 2022 17:35

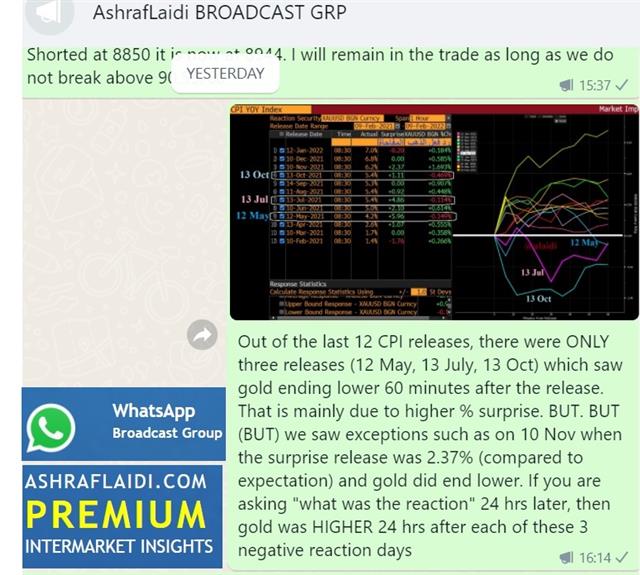

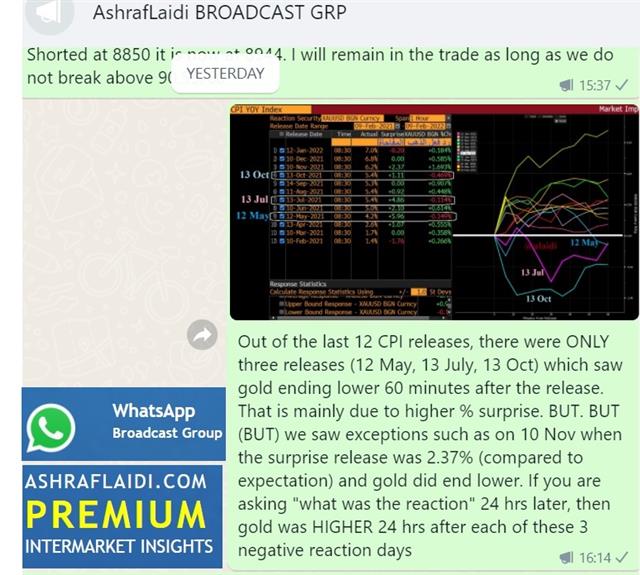

Another blowout US CPI report triggers another false reaction in metals. 5 months ago, gold would plummet $50 on the mere mention of Fed tapering. Today, gold rallies alongside silver despite a 70% chance of a 50-bp rate hike next month. Gold's ability to survive through the tightening landscape (especially flattening yield curves) reminds me of Bitcoin's ability to fight back in 2019 and 2020 despite stolen coins, shutdown exchanges and extraordinary volatility. We notified our WhatsApp Broadcast subscribers yesterday (see below the GBP chart).

Click To Enlarge

The other thing I want to highlight is the similarity between daily charts of GBPUSD and XAGUSD. I reiterated to our WGP since Jan 27 that I remained long GBPUSD, as long as the right shoulder support of 1.3350 held up. And it did just that before mounting a solid recovery ahead/after the BoE decision. Our bullishness in gold and silver was maintained as long as XAUXAG failed the 82 resistance. It is no longer a secret that I emphasized the importance of gold/silver ratio over the past 5 months, the most recent lesson was seen in 15:04 mins of this video

Click To Enlarge

Latest IMTs

-

Gold Bear or Correction

by Ashraf Laidi | Oct 23, 2025 9:51

-

Gold Wave 3 تحديث موجات الذهب

by Ashraf Laidi | Sep 18, 2025 16:19

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33