Housing Higher, Dollar Bets Shrink

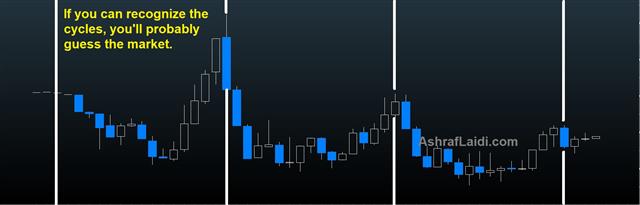

Here we go again; central bank meetings and more earnings from the US. US housing starts jumped 16% on Friday in a positive sign for the US consumer and a sign that low interest rates might be working too well. Trading was light on Monday largely because of the MLK holiday in the US. Gold leads all currencies, holding partly to gains after US inde futures bounce from Asia lows. The CFTC positioning data showed US dollar longs cutting back again. As speculation mounts ahead of this week's BoE and ECB monetary policy decisions, Ashraf posted the chart below, which he says is foretelling a major move in 2020.

The jump in US housing starts to 1608K from 1380K was the biggest one-month gain since October 2016. One caveat to the rise was unseasonably warm weather, which may have artificially increased activity but in the bigger picture, starts have been strong since August.

From a global perspective, US housing is still relatively cheap in part due to the overhang from the crisis, but the scars are beginning to fade and low rates remain steroids for home buying. In addition, home builders have been scaling down to lower-priced homes to capture high demand in that segment. That trend could help to boost activity in 2020 while higher housing prices could spark a wealth effect.

The jump is a reminder that US risks are more two-sided than they were in 2020. If manufacturing and trade-related sectors get a bump from the phase-one trade deal or if business investment picks up, the Fed could be facing questions about inflation.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -48K vs -61K prior GBP +31K vs +17K prior JPY -31K vs -12K prior CHF flat vs -4K prior CAD +33K vs +26K prior AUD -20K vs -27K prior NZD flat vs -1K prior

The overall the US remains firmly in a net-long position but it's at the weakest since June 2018.

Latest IMTs

-

4890 Hit, Now What?

by Ashraf Laidi | Jan 21, 2026 11:34

-

Gold 4850 No Change

by Ashraf Laidi | Jan 20, 2026 9:48

-

Silver's Road to 102

by Ashraf Laidi | Jan 19, 2026 13:25

-

Avoid Yen Intervention Trap

by Ashraf Laidi | Jan 17, 2026 11:20

-

Winners & Losers

by Ashraf Laidi | Jan 15, 2026 16:22