How Soon Is ‘Fairly Soon’?

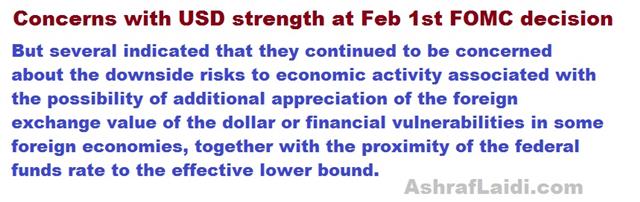

The March Fed meeting is shaping up to be a tough call but the FOMC Minutes offered some helpful hints. The yen was the top performer while the pound lagged. Australian capex numbers are due later. The paragrah below is among the reasons USD fell across the board after the release of Fed minutes.

The US dollar sold off after the FOMC Minutes, presumably because the market sees less of a chance of a hike. That might not be the right reaction.

The market is pricing in a 34% chance of rates rising at the March 15 meeting and that nearly doubles for the May 3 decision. The Minutes said many participants said it might be appropriate to hike 'fairly soon' if data on jobs and inflation is inline or better than Fed forecasts. Since then, the economic numbers have beaten expectations with the lone (and important) caveat that wage growth has been soft.

On top of that, Yellen clearly made an efforts to keep March in play and on Wednesday Powell said it was 'on the table'. Next Friday, Yellen and Fischer have both scheduled speeches for after non-farm payrolls in what will be a blockbuster day of trading.

In the past, the Fed has been accused of passing up solid opportunities to hike and with the stock market at record highs, the hawks will be putting on some pressure. Ultimately, any bump in the road could derail Yellen but if data is close to expectations for the next three weeks, a hike is a 50/50 proposition at worst.

The US dollar selloff in the aftermath of the minutes reiteartes that USD bulls are shy. A big part of that is politics but comments from Mnuchin in the WSJ are a hint that Trump is rethinking a currency war. The new Treasury Secretary said long-term USD strength is a good thing and that he expects more gains in the long term.

At the same time, we saw another wave of political risks are dominating trading Wednesday when a centrist Presidential candidate threw his support behind Macron. The headlines sent the euro 40 pips higher and tightened French spreads.

Turning to Australia, the key risk in the hours ahead is the 0030 GMT release of private capex data. The consensus is for a 0.5% decline in Q4. Any signs from the mining industry will be interesting. We can't remember a rally that's more disliked and disbelieved than the current run up in iron ore prices.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Kaplan Speaks | |||

| Feb 23 18:00 | |||

| RBA Gov Lowe Speaks | |||

| Feb 23 22:30 | |||

Latest IMTs

-

Gold or Silver?

by Ashraf Laidi | Jan 23, 2026 17:42

-

40 on the Mint Ratio

by Ashraf Laidi | Jan 23, 2026 11:27

-

Trump's Golden Hit

by Ashraf Laidi | Jan 22, 2026 10:58

-

4890 Hit, Now What?

by Ashraf Laidi | Jan 21, 2026 11:34

-

Gold 4850 No Change

by Ashraf Laidi | Jan 20, 2026 9:48