Retail Traders' Hastiness

In the early hours of last Wednesday, XAUUSD jumped $120 to $4888 before slumping $130 to $4755, causing many to "call" the start of gold correction. Less than 24 hrs later, gold jumped to $4960. Yesterday (Monday evening Europe) many rushed to call the top in gold & silver. Indeed, yesterday, silver had soared more than £13 or 11%, the highest percentage daily rise since 17th September 2008, the day of the Lehman Bros Collapse. On Monday, XAGUSD dropped to 101.92. Where is it now? 112.67

The greater fallout will surely come. Will it be after Wednesday's FOMC decision?

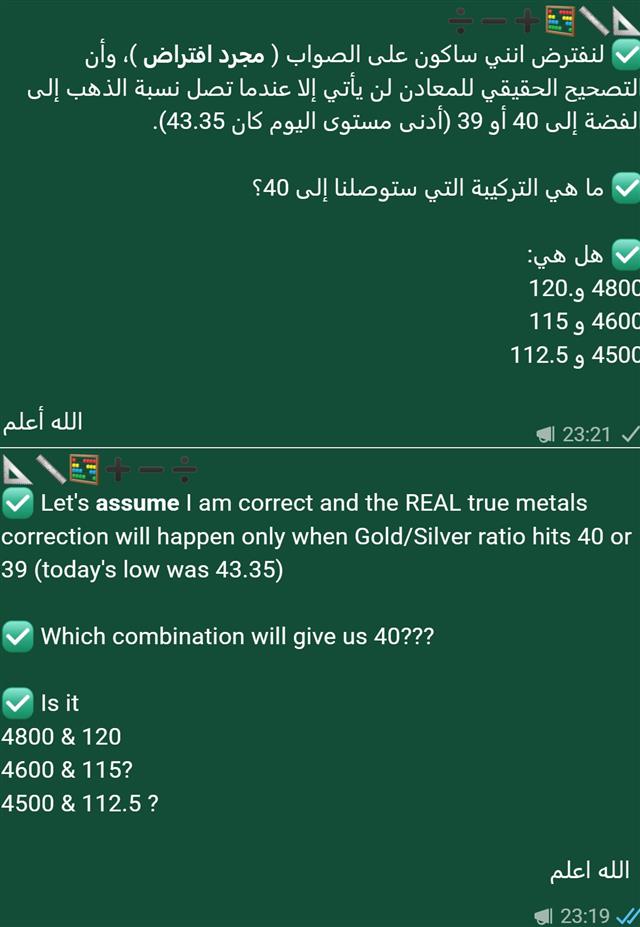

So what did I tell our WhatsApp Bdcst members? See below: as long as the Gold/Silver ratio did not extend to 40, silver will remain on the rise. Why 40? I explained it in 4 of the last 8 posts sent in this newsletters in the written and video form.

Latest IMTs

-

From Silver to Yen

by Ashraf Laidi | Jan 26, 2026 11:55

-

Gold or Silver?

by Ashraf Laidi | Jan 23, 2026 17:42

-

40 on the Mint Ratio

by Ashraf Laidi | Jan 23, 2026 11:27

-

Trump's Golden Hit

by Ashraf Laidi | Jan 22, 2026 10:58