Risk Rebounds, PCE Next

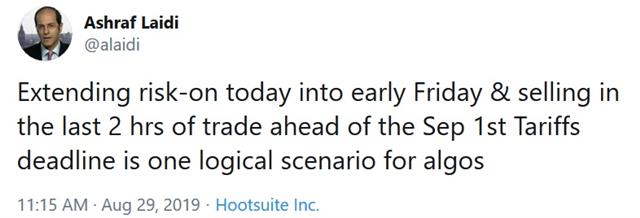

The US dollar was boosted by recovering risk trades on Thursday on an ebb in trade tensions. The Canadian dollar was the top performer while the Swiss franc lagged. Week-to-date, silver and CAD are the only gainers versus the greenback. The week wraps up today with Canadian GDP and the US PCE report. US traders in need of a rest, looking forward to a Labour Day weekend, which coincides with the Sep 1st Chinese tariffs on US imports. A new Premium trade in FX was published before the close of Thursday trade. The chart below highlights August's volatility, showing the S&P500 had three days of 2.5% declines or more --the highest since the ugly December 2018--while also containing seven days of 1.0% gains or more -- the highest since the fateful February 2018. Such 2-way volatility bears reason for concern.

The equity market continues to bite on headlines that suggest calls and meetings between the US and China. On Thursday that resulted in a 36 point jump in the S&P 500 as all the main global markets made strong gains.

Meanwhile, the bond market remains unimpressed. Treasury yields moved up briefly on a 2 basis point tail at a 7-year auction but the moved didn't last as yields finished the day up 1-2 bps across the curve.

In FX, risk trades were also tepid. AUD and NZD failed to make any headway against the field. It all suggests that flows and month-end rebalancing are bigger factors than any genuine change in sentiment.

A long weekend in North America now looms with drama in UK parliament likely to greet the return on Tuesday. The pound has held up admirably in the turmoil this week and positions remain deeply short. Some headlines suggest that Corbyn could have support from at least one Conservative in a caretaker government and Spearker Berkow is reportedly scheming with Conservative remainers. The pound could jump on legislation ruling out a no-deal Brexit.

Economic data springs to the forefront today. The July US PCE report is another critical look at the US consumer. It's expected to show personal spending up 0.3% with inflation running up 0.2% m/m. Any disappointment would harden calls for Fed cuts.

The Bank of Canada is a tougher central bank to handicap, in large part because there has been zero communication from the BOC since July 10. The market is pricing in a 15% chance of a cut on Sept 4 but that could shift depending on Q2 GDP data due Friday. The consensus is for a health 3.0% annualized pace.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (m/m) | |||

| 0.1% | 0.2% | Aug 30 12:30 | |

Latest IMTs

-

Grow an Account 5x

by Ashraf Laidi | Feb 26, 2026 14:36

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27