The Best of a Bad Bunch

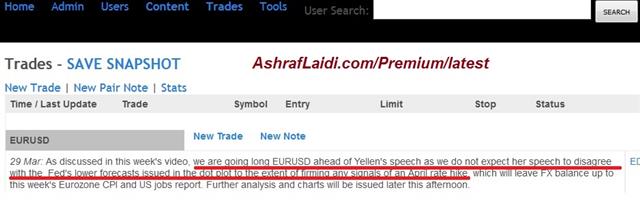

No one wants a strong currency. The dollar bulls tried to bid up the currency ahead of Yellen but she punished bets on the US dollar for the second time in three weeks. We break down the efforts central bankers and market forces are taking to undermine currencies. Japanese industrial production is due later. Ashraf's Premium Insights issued a long in EURUSD 1 hour before the Yellen speech. Various technical and fundamental reasons were cited but Ashraf kept it short and straightforward when he pulled the trigger below.

In the lead-up to Yellen's speech on Tuesday the main line of thinking was that she would walk back from dovish talk after regional Fed Presidents took a more constructive tone. We warned yesterday that was unlikely and that's what happened. She said caution on raising rates was 'especially warranted', was concerned by low inflation and once again expressed worry about the global economy.

The US dollar slumped in response. The immediate move was 40-70 pips across the board and that extended to upwards of 100 pips by the day's end.

We anticipated and understand the reasons for selling USD today but the problem going forward is that it's tough to buy anything else. USD/JPY slid back below 113.00 but the Japanese government is desperate to keep it above 111.00.

It's the same story in Europe where the ECB is pushing rates ever lower. Spanish 5-year yields hit a record low of 0.375% on Tuesday.

Sterling is at the mercy of Brexit talk as polls show a close contest or the camp that wants to leave in the EU in the lead.

The New Zealand dollar was up 2% on the day as it benefitted from a technical breakout and its high yield advantage. It was lifted further early in Wed trade by a 10.8% m/m jump in building permits. That runs in contrast to the RBNZ, which delivered a surprise rate cut this month along with a dose of jawboning.

The RBA's Stevens is so fond of jawboning he had is wrist slapped by the US but continues it anyway. On a growth and investment perspective, perhaps AUD and NZD remain best but the central bank and risk aversion trades always make it a dangerous game.

That leaves CAD, which has had a great month, but do you really want to bet on oil?

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (FEB) (m/m) [P] | |||

| -6.0% | 3.7% | Mar 29 23:50 | |

| Industrial Production (FEB) (y/y) [P] | |||

| -3.8% | Mar 29 23:50 | ||

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40