The other omission from the Fed statement

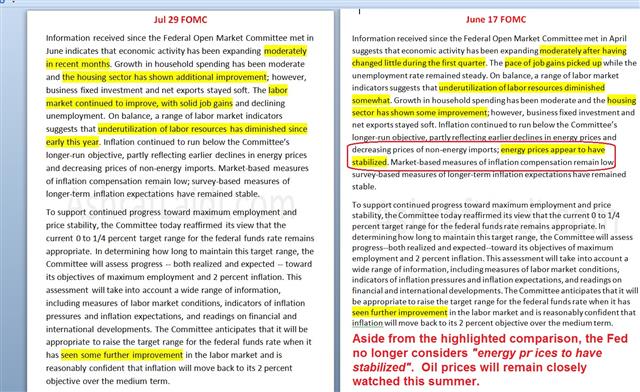

The FOMC statement was not as hawkish as many anticipated. Despite that, the US dollar remained resilient afterwards, we look at what that means. Up next we hear from the RBA leader and get Japanese industrial production data. Our Premium long in EURUSD from Jul 21 at 1.0890 hit its final 1.1120 target on Sunday. Today, we opened a new USD long, supported by 2 charts and 4 reasons. The snapshot below highlights the omission of the Fed's phrase from the June meeting that it regarded energy prices to have stabilized. Since the 20% decline in energy prices took place, the Fed has not only taken notice, but any further decline in prices may creep into the Fed's inflation viewpoint.

The Fed has a dual mandate of full employment and low, stable inflation. Yellen is increasingly comfortable on the first part. The statement also noted that “some further” progress on jobs was still needed before raising rates when previously it said only “further”. The addition of “some” is a signal that the economy is closer to meeting the first part of its mandate.

That means that even with two solid but not spectacular non-farm payrolls reports before the next FOMC in September, that jobs portion of the mandate could be satisfactory.

The problem is on the inflation side. Over the past two weeks, breakeven rates have been tumbling, signaling less confidence from the market that the Fed will bring inflation back to 2%.

That's come in tandem with worries about China and the drop in oil prices. Some traders may continue to focus on jobs but many Fed officials over the past month have said signaled some discomfort on inflation and that's the data we will watch most closely. At the same time, if upcoming jobs reports are very strong, that could still give the Fed enough confidence that the economy is accelerating and that wages will soon rise to hike rates.

Overall, the Fed has remained true to its words in saying it will be data dependent. We now have almost two months before any Fed decision. The market is showing about a 40% chance of a hike and the ebb and flow of data will be critical.

What's also critical is how markets have reacted. This was a slightly dovish result but after a dip, the US dollar gained. That's a sign of strong underlying demand. Dollar bulls have been nervous over the past week but so long as data remains solid, they will grow increasingly assertive.

On the agenda next is RBA Gov Stevens who is speaking on a panel discussion at 0100 GMT. He's never shy about his feelings on the economy.

At 2350 GMT, Japan releases industrial production in the top release of the day. It's expected to rebound a modest 0.3% after a 2.1% fall previously. Japan needs to start showing signs of turning a corner or the BOJ will begin to feel pressure to act.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (JUN) (m/m) [P] | |||

| 0.3% | -2.1% | Jul 29 23:50 | |

| Industrial Production (JUN) (y/y) [P] | |||

| -3.9% | Jul 29 23:50 | ||

Latest IMTs

-

Gold Bear or Correction

by Ashraf Laidi | Oct 23, 2025 9:51

-

Gold Wave 3 تحديث موجات الذهب

by Ashraf Laidi | Sep 18, 2025 16:19

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33