US Dollar Rethink?

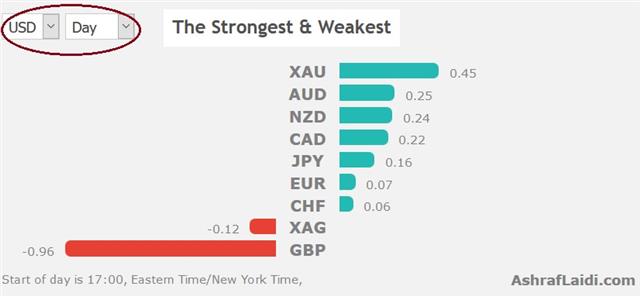

US Q1 GDP weakened to a better than exp 2.3% (exp 2.0%) from 2.9%, while personal consumption dropped as exp to 1.1% from 4.0%. USD momentum dissipated across the board folllowing the figures, while gold was the biggest winner of the day. In the UK, a soft UK GDP reading might have put a nail in the coffin of a May 10 Bank of England rate hike. The pound plunged on Friday as the two-week rout continued. US GDP beat estimates but that only fueled fears of excessive rate hikes. An additional Premium video "After the stops" has been posted following the US figures the latest thinking regarding the US dollar. بعد الخسائر (فيديو ايضافي للمشتركين)

On April 16, cable was trading at a post- Brexit high of 1.4376 and the OIS market was pricing in a 96% chance of a May 10 rate hike. Just hours after hitting the high, Carney appeared on the BBC to talk about the economy. He said “that although people should be prepared for a possible rate rise this year, there was still a lot of data to consider before they needed make the decision.”

That was hardly a signal about a retreat on hikes but it was a warning to markets that 96% was too high. His focus on data was followed by poor inflation and retail sales numbers among others. As those rolled out, cable began to roll over. On Friday, GDP was just +0.1% q/q compared to +0.3% expected. The ONS cited poor weather but the sense from the market is that Carney wanted to focus on data and the data didn't deliver. The odds of a hike have fallen to just 23% in what has been a complete rethink.

Cable has fallen every day except one since Carney's BBC appearance and is down to 1.3790 from 1.4376. It's now closing in on the February low of 1.3711, which will be in play along with the BOE decision.

The UK data calendar is light in the week ahead, so the market will stew over these figures for some time.

The other side of the cable equation will be in sharp focus with a heavy slate to come. Friday's US GDP report showed growth at 2.3% q/q annualized compared to 2.0%. That helped to stoke optimism initially but there is a growing fear the Fed could hike three more times this year and that's more likely to stoke risk aversion than smooth path for USD higher.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Advance GDP (q/q) [P] | |||

| 2.3% | 2.0% | 2.9% | Apr 27 12:30 |

| Prelim GDP (q/q) [P] | |||

| 0.1% | 0.3% | 0.4% | Apr 27 8:30 |

Latest IMTs

-

How I Grew the Account 5x

by Ashraf Laidi | Mar 2, 2026 11:54

-

Breakout to 2 Month Highs

by Ashraf Laidi | Feb 27, 2026 12:12

-

Grow an Account 5x

by Ashraf Laidi | Feb 26, 2026 14:36

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21