USD Retreat Ignores Stocks Pullback

If we rewind back to December, there was plenty to worry about regarding sterling. Brexit was still a mess, the virus was raging and the BOE had floated negative rates. Skip ahead and the UK has gotten the upper hand on covid, memories (nightmares?) of Brexit are fading and negative rates are off the table.

Yet at the lows last Monday, cable was trading exactly where it was on December 30. Now much of that is due to a broader US dollar rally but with Treasury yields fading, there was room for a bounce and that began to materialize last week with a double bottom at 1.3670.

On Friday, there was another positive signal after a stumble lower in Asia was picked up aggressively and cable finished at a 10-day high. The bullish outside reversal is an opening for further gains.

The big drama on the weekend was in crypto as bitcoin fell nearly $10,000 to $51,300 in a broad crypto wipeout. Many coins fell more than 20% in a liquidation-like move. There was some recovery early on Monday but the volatility will keep the crypto market off balance all week.

There was plenty of talk and rumours about regulatory crackdowns but no real news. A power outage in parts of China may have hit miners but it's a stretch to pin the drop on any one factor.

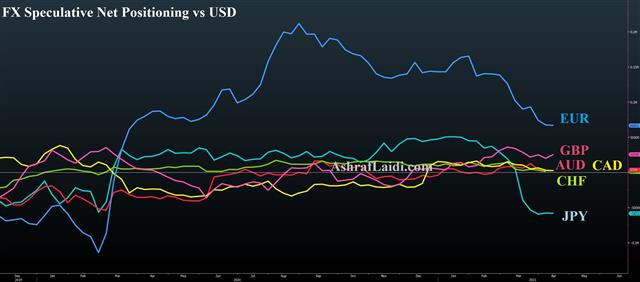

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +67K vs +68K prior

GBP +26K vs +20K prior

JPY -58K vs -58K prior

CHF +1K vs +3K prior

CAD +2K vs +3K prior

AUD +4K vs +4K prior

NZD +3K vs +3K prior

There isn't much to report this week aside from GBP longs edging higher.Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46