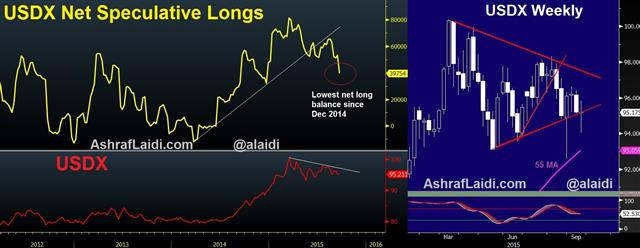

USDX net Longs Lowest for the Year

Net speculative longs in USD Index contracts traded at the New York Board of Trade reached their lowest level for the year in the week ending on Tuesday at 39,754 contracts. The information was provided before Thursday's FOMC-driven selloff of the greenback. But the late Friday pullback in EURUSD means that the weekly chart on USDX ended unchanged, right on the 4-month trend support.

Criticism of the USD index revolves around the non-representational nature of the index, which is 58% occupied by the euro, 14% by the yen, 12% by the pound and 9% by the Canadian dollar. The Swedish krona and Swiss franc make up the rest around 4% each.

Broader USD Index

A broader measure of the US dollar is the 25-currency Broad USD index, prepared by the St Louis Fed, which is currently near 11-year highs. The index includes several emerging market nations, hence the relative strength. Considering the Federal Reserve widely cites its broad index, as did Yellen at Thursday's press conference, this implies further cautiousness from the US central bank ahead. The Fed decision was a wake-up call to those who have rejected the idea of globally-sensitive policy making by the US central bank.Relevance of USDX

The relevance of the USD index is highlighted by its near inverse relation with EURUSD, a pair that occupies about 23% of the daily turnover in the spot FX market. Having EUR/USDX equivalents during trading helps pin-point inflection points in currencies, especially as the index is largely traded by hedge funds. Identifying coincident confluences in moving averages and trendlines is part of the puzzle.Now that the Fed is out of the way for at least 4 weeks, attention returns to ECB policymakers for actionable rhetoric before reverting to the usual US data watch. A retest of 91.20 is anticipated before a new direction is sought.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's Lockhart speech | |||

| Sep 21 17:00 | |||

Latest IMTs

-

Gold Silver Next الذهب و الفضة

by Ashraf Laidi | Dec 26, 2025 17:15

-

Everyone's Talking about this Risk

by Ashraf Laidi | Dec 24, 2025 14:08

-

2026 Difficult but not Impossible

by Ashraf Laidi | Dec 22, 2025 20:06

-

Bank of Japan Massacre or Yawn?

by Ashraf Laidi | Dec 18, 2025 20:50

-

EURGBP Eyes 8920

by Ashraf Laidi | Dec 17, 2025 19:31