Intraday Market Thoughts

Weak Dollar Awaits Jobs Rescue

by

Sep 2, 2021 20:48

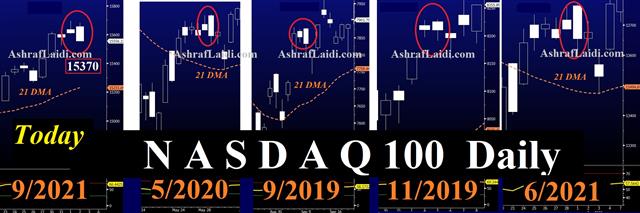

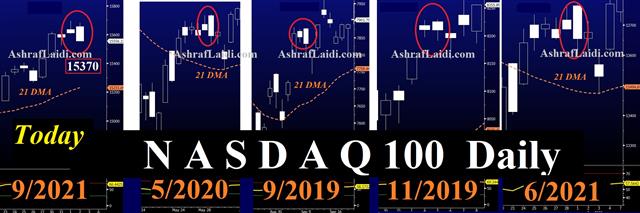

DXY is posting its 5th consecutive daily decline, the longest string of losses since April. Thursday's release of weekly jobless showed a slight decline as expected, but it was Wednesday's poor ADP employment report and hawkish ECB comments in response to upside surprise in Ezone CPI that helped accelerate USD selling. ADP does have a spotty record but the soft August reading adds to the mounting evidence that the US economy isn't as strong as believed. More on the gas sector below. The NASDAQ charts below suggest a short-term trading opportunity in NASDAQ100 based on 4 prior cases. We let the charts speak for themselves.

Click To Enlarge

The ADP employment report showed the US adding just 374K jobs in August compared to 640K expected. That was compounded by the employment component of the ISM manufacturing report falling below 50.

The pandemic-era history of the ADP report and the small size of manufacturing employment in the US make both metrics questionable but they underscored the market's focus on jobs at the moment. The dollar fell 30-40 pips across the board on the data in only a small preview of the decline should non-farm payrolls match the miss.

Another spot to watch is the weekly US natural gas storage report, which is expected to show a build of 20 bcf. Last week's surprise miss helped to send gas prices into high gear in the US and into overdrive in Europe and Asia. The base case for global central banks is that the flattening of energy prices flattens out inflation but natural gas – which is critical in home heating and energy generation – could add another front to watch on prices; and one that could present a big headache for politicians and central bankers. Moreover, this is not traditionally the peak of natural gas prices for the year with every recent seasonal spike coming in the cold months. So expect to hear much more about NG and LNG in the months ahead.Latest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55