Will 7 Change to 10? Watch out

In reviewing the July 28 FOMC statement and comments from the core of the Fed, it's clear that top officials feel like they don't need to be rushed into pre-committing to a taper. Through their collective comments, the consensus has settled around a Nov/Dec taper announcement, likely in $20B increments.

Powell said at Jackson Hole, cryptically that at the July meeting he thought it could be appropriate to start taper this year. Since then, he said, there has been more progress on employment but also the further spread of the delta variant.

The wording of his comments were somewhat ambiguous and he may see benefits in maintaining that, especially since fresh China growth worries have replaced delta fears, adding a new risk.

The alternative is that Powell and the FOMC would want to strongly pre-commit to a Nov/Dec timeline so as to give the market the ample warning that he's often touted. Given where expectations are, I'm not sure an explicit commitment is necessary, especially because some unforeseen turmoil could force them into a credibility-sapping climbdown.

In practical terms, there's no need to change the language of the FOMC statement. A tweak to this sentence in the second-to-last paragraph is probably sufficient: “Since then, the economy has made progress toward these goals, and the Committee will continue to assess progress in coming meetings.”

That kind of tweak should be largely market neutral but there may be some USD selling as those expecting an explicit taper signal clear out. In his press conference, he could channel Williams who said that assuming the economy continues to improve as anticipated, it could be appropriate to start reducing the pace of asset purchases this year

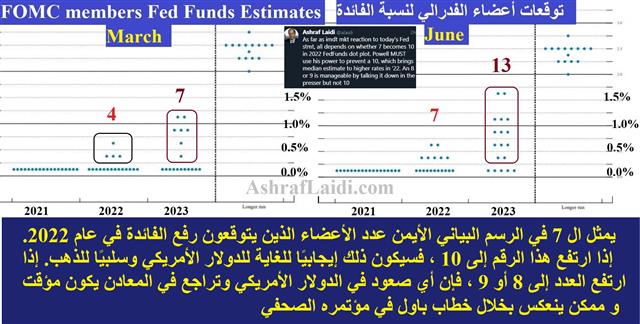

Like in June, the dot plot may dominate the market reaction. Recall that 7 of 18 members forecast a 2022 rate hike. If just three more shift, that would put the median into 2022. This will also feature the first publication of 2024 dots and they'll offer the first solid hint at how aggressive Fed members plan to be once the hiking begins.Latest IMTs

-

Gold 4850 No Change

by Ashraf Laidi | Jan 20, 2026 9:48

-

Silver's Road to 102

by Ashraf Laidi | Jan 19, 2026 13:25

-

Avoid Yen Intervention Trap

by Ashraf Laidi | Jan 17, 2026 11:20

-

Winners & Losers

by Ashraf Laidi | Jan 15, 2026 16:22

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jan 15, 2026 13:55