2020 Oil: Intrigue & Non-Direction

The latest decrease in OPEC+ quotas, combined with an extra cut from Saudi Arabia sent oil prices 7% higher last week. Despite the move, the market has grown far too complacent about the risks in the sector and the murky outlook for 2020. CFTC positioning data showed a shift into antipodeans and out of the low-yielders. Cable regains 1.3150s, making the GBP the year's highest performing currency. Earlier today, Ashraf closed the Premium long GBPUSD trade at 1.3170 for 250-pip gain, before the next move ahead of Thursday's elections.

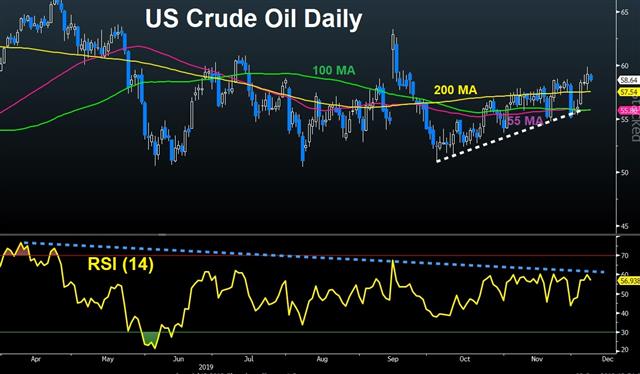

Aside from a brief bout of volatility around the Saudi rocket attacks, the oil market has been unusually sleepy this year. If we exclude the first 9 days of the year, the $15 range this year is the narrowest since 2003. The market has become a proxy for global growth sentiment more recently, but far more is emerging under the surface.

OPEC showed up in a big way this week, pledging deeper cuts than anticipated along with Saudi Arabia adding an extra 400k bpd in voluntary cuts. After the surprise move, crude rose to the highest since the aftermath of the missile attack.

The intriguing spot to watch in 2020 is US shale. The pain in the shale sector is hardly drawing any attention, but it's real and -- could get much worse, especially as yields correct.

The two key forces to watch:

1) Shale wells aren't producing as well as promised and production isn't growing as fast as anticipated. Estimates for 2020 US production growth are down to 600k bpd and they're falling almost daily. There's underinvestment elsewhere so a shortfall is coming so long as global growth holds up.2) The debt market for small and medium oil companies is shut. There's a fiscal cliff – or a fracking cliff – in oil coming. All the cheap money raised in the 2010-2014 era and is coming due from 2020-2024. It's increasingly clear that they will not be able to roll over the debt. That's leading to a rush to deleverage and many producers are going on a starvation diet. At some point large producers will come in and pick off the small ones but there's no telling if they'll wait for bankruptcies or just lower stock prices.

The nightmare scenario remains that of a protracted bust, spreading through debt markets. It's tough to see that unfolding in a US election year but even a sharp shift towards cash flow and away from production growth threatens to tip the oil market into undersupply. That will reverberate through FX, central banking and virtually every other part of markets.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -69K vs -61K prior GBP -30K vs -37K prior JPY -48K vs -40K prior CHF -22K vs -21K prior CAD +21K vs +20K prior AUD -36K vs -45K prior NZD -27K vs -36K prior

The crowded AUD and NZD-short trades are clearing out quickly. That's a classic shift as the rate-cutting cycle comes to an end – at least a temporary one. Friday's US jobs report added to the optimism about global growth in 2020 and helped to boost the pair. On the flipside, note how better sentiment is not narrowing the EUR position; it's another sign that its status as a funder is secure.

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40