Gold, Iran & Oil

US Crude oil is up more than 6% on rising expectations of a US attack on Iran. Gold, however, is more muted, up 3%. Is there a reason? Yes, we know oil is more impacted by supply lines in Hormuz Strait. But gold is unable to show the same gains we saw last year on Iran tensions. Why? Will gold rally back to 5100? Can US crude hit $70?

Trade Already in Profit

If you missed yesterday's Live broadcast on Instagram explaining the "Perfect Trade", detailing the fundamental, technical and macometric arguments for entering it, then here is the link. The trade is already in the money after this morning's UK data. But more data are due tomorrow and Friday. The dynamics, covered in English and in Arabic are found nowherelse on the Internet. This is not only a journey of learning into unprecedented material, but also a money-making quest. Watch here. Start now.

I will go LIVE in 10 mins

I will discuss what could be the Perfect Trade on LIVE on my Instagram Channel. Ive already opened this trade 2 weeks ago and shall explain the fundamental and technical reasons for going long. The Live shall start at 10 pm GMT, 2 am Dubai Time. The fundamental triggers will start this week but the Live starts in 10 mins from this post. View the live on here.

3 Stocks Against Nasdaq

Here are 3 stocks I bought last year aimed at diversifying against corrections in technology sector. I shared these 3 companies with our members throughout last year. These companies are solid, involved in sectors regarded as high necessity. Watch here.

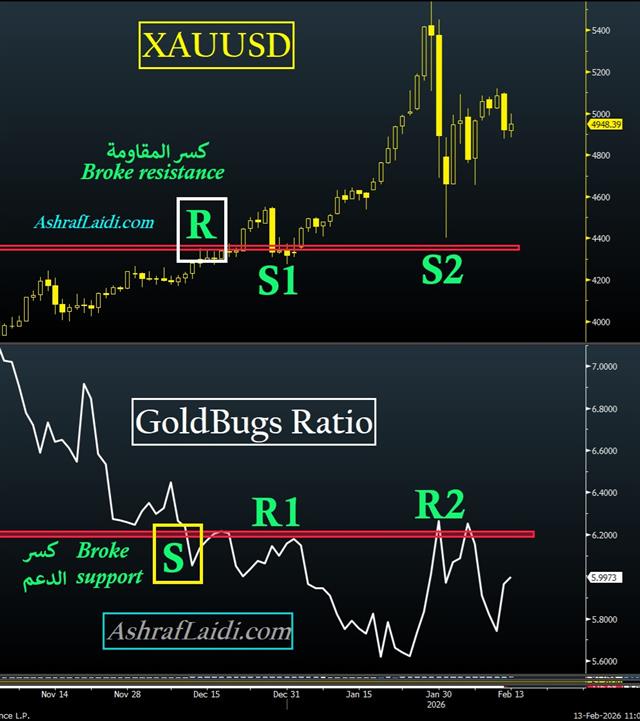

Revisiting Gold Bugs Ratio

As we go into today's much anticipated release of the US January CPI, here is a reminder of the inverse relationshiop between XAUUSD and the GoldBugs ratio (XAUUSD/HUI). The relationship, explained in many of my videos since March 2025 can be useful, when XAUUSD fails to give any clear signal, in which case you're likely to find tehcnical guideposts in the GoldBugs ratio. This clearly shown in the below chart gold broke multiple records between Jan 13 and Jan 28. During that time, XAUUSD had no reference resistance in sight, while GoldBugs ratio continued to break support. More significantly, see how Gold broke the 4400 in December (R), signalled by the breakdown of (S) in the ratio. And just when you were unsure whether XAUUSD would break below 4300 in late December (S1), the ratio held up its resistance (R1). If gold drops to 4700 or approaches 4600, then keep an eye on the all important resistance of 6.2 in the GoldBugs ratio.

If you prefer to receive these daily analysis into your mailbox and not miss an update, then feel free to register (for free) in "My Account" section in the upper rightcorner of the website. If you already have a username and forgot your password then email us to for a password reset, or use another username (email) and most importantly click to "Subscribe to Newsletter".

Archives