Intraday Market Thoughts Archives

Displaying results for week of Feb 01, 2015US jobs soar, yen hit hard

Both the US dollar and bond yields surged following a robust US jobs report bolstered the case for a Fed rate hike to occur as early as June, according to fed funds futures. So how does it look for USDJPY? Full charts & analysis

USD Slides, AUD in Focus Next

The yen was the worst performer while the euro and loonie led the way. The Asia-Pacific highlight is the RBA's quarterly statement on the economy and it could tip the nod about what Stevens will do next. 2 Premium Trades will be issued shortly ahead of the RBA statement due in 90 mins from now.

Markets are often volatile at turning points so the changeable sentiment towards the US dollar this week might be a warning sign. Then again, it could be apprehension ahead of non-farm payrolls or the start of a period of consolidation after a long, one-way move.

Economic data continues to send mixed signals. The US trade deficit in December was unexpectedly large at $46.6 billion compared to $38.0 billion expected. That led to Q4 GDP estimate revisions to as low as 2.0% from 2.6% in the first official release.

On the flipside, initial jobless claims were lower at 278K compared to the 290K consensus. A key factor in the jobs report – perhaps equal to jobs gains – will be wage growth. A preview came in the Q4 unit labor cost data with a 2.7% rise compared to 1.2% expected. It was entirely mitigated by a downward revision to Q3 data but the Fed may focus on the near-term trend rather than the older data.

The subtext in trading remains the Greek drama. The first meeting betweenScheauble and Varoufakis was wholly unsuccessful but that's not a surprise. Comments afterwards were diplomatic and that could mean the start of a better relationship.

Up next, the RBA releases the Statement on Monetary Policy at 030 GMT. Lower revisions to growth and inflation are a given but comments on the Australian dollar and rates will be critical for the market. Sevens was mum on what's next for rates at this week's decision but after yesterday's soft retail sales report, another cut in March is possible.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Nonfarm Payrolls (JAN) | |||

| 235K | 252K | Feb 06 13:30 | |

| RBA Monetary Policy Statement | |||

| Feb 06 1:30 | |||

| Retail Sales (m/m) | |||

| 0.2% | 0.3% | 0.1% | Feb 05 0:30 |

| Challenger Job Cuts (y/y) | |||

| 17.6% | 6.6% | Feb 05 12:30 | |

| Continuing Jobless Claims (FEB 24) | |||

| 2400K | 2388K | 2394K | Feb 05 13:30 |

| Initial Jobless Claims (FEB 31) | |||

| 278K | 290K | 267K | Feb 05 13:30 |

ECB Throws Greece to the Wolves

The ECB raised the stakes as Greece's new government prepares to meet with Germany on Thursday. They pulled the plug on emergency lending for Greek banks and sent the euro plunging; the US dollar rebounded strongly and was the top performer on the day. Australian retail sales are next. 2 EUR-related trades with 3 key charts have been issued in the aftermath of the ECB announcement and we're sent out to subscribers. See latest premium insights.

The euro gave back all its gains from a day earlier after the ECB announced it would end a waiver that allowed Greek banks to use Greek government debt as collateral for low-cost ECB funding. It won't cause an immediate bank crisis because it doesn't apply until Feb 11 but it's the kind of announcement that sparks a bank run.

The timing is no surprise with Tsipras in Germany on Thursday for tough negotiations. He made his political career on standing up to Germany so he won't be backing down on Day 1 and that probably means some euro-negative headlines will trickle out of the negotiating room.

The price action in the market was certainly a reminder that euros are unwanted as EUR/USD sank to 1.1313 from as high as 1.1539 a day earlier.

To be fair, it wasn't the only reversal as the entire market fell back in love with the dollars. It was doubly bad for the Canadian dollar as oil fell 8% and WTI hit $48.50. Ivey PMI data was also weak at 45.4 versus 53.9 expected and USD/CAD rose 1.5 cents.

Economic data in the US was close to expectations with ADP employment at 213K vs 225K exp but with a slight positive revision to the prior. ISM non-manufacturing was at 56.7 vs 56.3 expected but the employment component was soft.

Looking ahead, the Australian dollar is in focus once again with Dec and Q4 retail sales due at 0030 GMT. The consensus is for a 0.3% monthly rise and a 1.1% increase in the quarter. On a very soft number it would quickly spark talk of a rate cut in March.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (DEC) (m/m) | |||

| 0.4% | 0.1% | Feb 05 0:30 | |

| Eurozone Retail Sales (m/m) | |||

| 0.3% | -0.1% | 0.7% | Feb 04 10:00 |

| Final Services PMI [F] | |||

| 54.2 | 54.3 | 54.0 | Feb 04 14:45 |

| Ivey PMI | |||

| 45.4 | 53.8 | 55.4 | Feb 04 15:00 |

| Eurozone Spanish Services PMI | |||

| 56.7 | 54.5 | 54.3 | Feb 04 8:15 |

| Eurozone Final Services PMI [F] | |||

| 52.7 | 52.3 | 52.3 | Feb 04 9:00 |

| ADP Employment Change | |||

| 213K | 224K | 253K | Feb 04 13:15 |

| ISM Services (JAN) | |||

| 56.7 | 56.5 | 56.5 | Feb 04 15:00 |

US Dollar Dives, What’s Next?

The one-way trade in the US dollar came to an abrupt end on Tuesday in a painful squeeze. The loonie was the top performer as oil prices jumped for the fourth day. Early in Asia-Pacific trading, the New Zealand jobs data was strong. Today's Premium GBPAUD was stopped out during an unusual surge in Aussie whispaws. A new round of Premium Trades are to be issued early Wednesday morning.

Short-squeezes are difficult to predict but US dollar longs have been a crowded trade for weeks and a sharp reversal finally hit. It wasn't just the dollar as oil shorts, gold longs and bond bulls were also squeezed.

The momentum started in EUR/USD as it broke a minor double-top at 1.1363 and subsequently broke a number of other levels until it finally stalled just ahead of the pre-ECB low of 1.1539. Cable and the Canadian dollar were also at the forefront of the move.

Crude was the driver for the loonie and prices rose as much as 24.5% from Thursday's low. In USD/CAD the pair touched the 61.8% retracement of the post-BOC move at 1.2350. Oil hit $54.27 but is already showing signs of staggering as API inventories rose another 6.1m barrels. That sparked some late selling back to $51.57.

Keep in mind that the BOC assumed price of WTI is $60, so anything lower keeps rate cuts on the table.

In AUD/USD was where the enormity of the USD squeeze was clearest, after falling nearly 200 pips to 0.7625 after the RBA, the pair climbed all the way back and more, hitting 0.7851 in rapid move. The kiwi rallied alongside it, especially after a strong milk auction.

Late in the day, NZ traders were also caught in a whipsaw on the jobs data. The first number to cross was a jump in the unemployment rate to 5.7% from 5.3% but it was entirely due to a rise in the participation rate to 69.7% from 69.1% and the underlying jobs data was very strong.

The market remains tentative on the kiwi with a speech from Wheeler due at 0000 GMT. It's virtually assured that he will attempt to jawbone NZD lower. Another event to watch at 0130 GMT when Japan releases Dec labor cash earnings. An improvement would keep the BOJ in the background

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Mester speech | |||

| Feb 04 17:45 | |||

| RBNZ Governor Wheeler Speech | |||

| Feb 04 0:00 | |||

| Labor Cash Earnings (DEC) (y/y) | |||

| -1.5% | Feb 04 1:30 | ||

| Employment Change (Q4) | |||

| 1.2% | 0.8% | 0.8% | Feb 03 21:45 |

| Unemployment Rate (Q4) | |||

| 5.7% | 5.3% | 5.4% | Feb 03 21:45 |

Fierce oil bounce slams USD

The surprise RBA cut was news until the 8% rebound in oil led the way for four straight daily gains, something not seen since June. The oil rally initially triggered broad gains in the energy currencies of Canada, Norway, Sweden and Mexico, with USDCAD plummeting 250 pips or 2.4%, and even the Aussie, which collapsed by nearly 200-pips or 3% against the USD following the RBA rate cut has recovered all of its post-RBA decline. Full chart & analysis here.

5 Things Ahead of the RBA

Markets were choppy to start the week with the US dollar generally softer in New York trading after a soft ISM manufacturing report. The Canadian dollar was the top performer while sterling lagged. We take a closer look at a tough-to-handicap RBA statement due at 0330 GMT.

Central bank decisions don't get much closer than the RBA. Here are five things to keep in mind ahead of the decision.

1. The rate futures market slots the likelihood of a cut at 56%

2. Signals about the March meeting are almost equally as important with a 40% chance of a second cut priced in but a 12% chance of no cuts at all.

3. The remainder of the year is also critical with markets pricing in about 58 basis points of cuts. That would rise significantly in the event of a cut and a dovish RBA.

4. Only 7 of 29 economists surveyed by Bloomberg expect a rate cut.

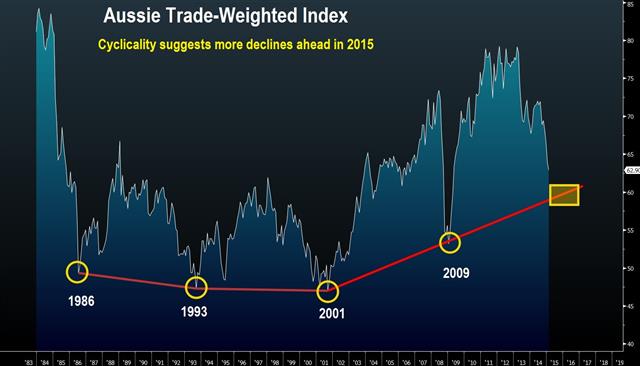

5. AUD/USD fell to the lowest since 2009 on Thursday

Technically, AUD/USD is flirting with the 200-month moving average at 0.7788. There's also the July 2009 low of 0.7708; those are the key technical metrics to watch.

Another thing to keep in mind is the New Zealand dollar. It will track the AUD move following the RBA but the risks switch 18 hours later when the Q4 New Zealand employment report is due. That's followed a few hours later by a speech from Wheeler and he's sure to salt it with some anti-NZD jawboning.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ISM Prices Paid (JAN) | |||

| 35.0 | 40.0 | 38.5 | Feb 02 15:00 |

| Fed's Bullard speech | |||

| Feb 03 3:00 | |||

| Fed Minneapolis's Narayana Kocherlakota speech | |||

| Feb 03 16:45 | |||

| RBNZ Governor Wheeler Speech | |||

| Feb 03 23:00 | |||

| Employment Change (Q4) | |||

| 0.8% | 0.8% | Feb 03 21:45 | |

| Unemployment Rate (Q4) | |||

| 5.3% | 5.4% | Feb 03 21:45 | |

ISM punished by USD, CNY weakens further

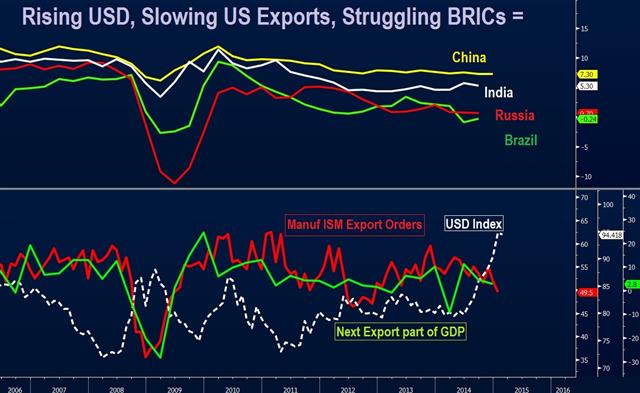

Broadening decline across all components of the January manufacturing ISM survey highlights the early signs of punishment from the rising USD on US factories, orders, jobs and prices. Aside from the prices paid index resuming its downward spiral to reach fresh six-year lows, the exports orders component fell into contraction zone (below 50) for the first time since November 2012. Meanwhile in China, this happened

SNB Chatter Continues, USD/JPY Stumbles

The Swiss press highlighted a report on the SNB aiming for a soft 1.05-1.10 band for EUR/CHF and that boosted the pair early in the week. Last week the yen was the top performer while the Canadian dollar lagged. CFTC data showed fewer yen shorts. China's manuf PMI hut 2 1/2 year low. Although Thursday's Premium short in USDJPY with entry at 118.50-118.80 missed the 118.50 fill by 1 point, sveeral clients opted for the manual fill and opened the trade themselves. The trade is now 1150 pips in the money. NZDCAD remains in progress.

The Swiss Tages Anzeiger referred to “a well-informed source” on the SNB willing to lose 10 billion francs to maintain a 1.05-1.10 corridor. The report isn't definitive and is equal parts speculation and sources but it lifted EUR/CHF nearly a full point higher to 1.0500 before it trimmed a quarter-cent.

The other big move to start the week was in USD/JPY as it fell by as much as 70 pips to 116.66; that's the lowest in two weeks and broke the deadlock around 118.00. Traders will be watching to see if the move is maintained once liquidity improves. So far the loss has been pared to 117.20.

The fundamental weekend news focused on China where official PMI's for January were soft. The manufacturing reading fell to 49.8 compared to 50.2 expected. The non-manufacturing data was at 53.7 vs 54.1 prior. The manufacturing number is the key reading and it's the first time below 50 since Sept 2012. The market may be hesitant to react until the HSBC final reading is delivered at 0145 GMT. The preliminary reading was 49.8.

The Australian dollar may be unlikely to react either way with the RBA decision on Tuesday. A final driver could be the inflation report from TD Securities at 2330 GMT. The prior reading was 1.5% y/y.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -185K vs -181K prior JPY -64K vs -78K prior GBP -45K vs -46K prior AUD -49K vs -47K prior CAD -24K vs -29K prior CHF -24K vs -29K prior

The larger move was in USD/JPY and that leaves more dry fuel if the pair embarks on a break higher above the recent range. But what really stands out is the lack of enthusiasm in CAD shorts. Specs missed the boat but could be looking for a bounce to buy.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBC PMI Manufacturing (JAN) | |||

| 53.9 | Feb 02 12:20 | ||

| SVME - PMI (JAN) | |||

| 54 | Feb 02 8:30 | ||

| PMI (JAN) | |||

| 49.8 | 50.1 | Feb 01 1:00 | |

| PMI (JAN) | |||

| 53.7 | 54.1 | Feb 01 1:05 | |

| PMI (JAN) | |||

| 49.6 | Feb 02 1:45 | ||