Intraday Market Thoughts Archives

Displaying results for week of Apr 10, 2016New Trade Pre G20, Doha

We're issuing a new trade ahead of this weekend's oil summit in Doha and the final communique on FX from the G20. Possible statements from the latter may include the usual laissez-faire remark on FX (discouraging intervention), renewed reminder from IMF for Fed to leave rates alone, broadening realisation by FX mainstream universe that Japanese foreign-bound flows are increasingly hedged to reap the benefits of yield AND FX and on the other hand of the yen ledger will be Tokyo likely indicating that its policies to combat deflation have not been exhausted. As risky as the decision to trade before a weekend appear, the idea is to enter an already technically established set-up with the help of a fundamental trigger. Access to the Premium trade.

Fed Flustered, China in the Crosshairs

Another disappointing US inflation report undermined Fed expectations to hike rates twice this year. The Australian dollar was the top performer while the kiwi lagged on divergences after the Aussie employment data. A big major of Chinese economic data is due next, including GDP. A new Premium trade in the Aussie was added 10 mins after those Aussie jobs figures. Below is the latest Premium Video on equity indices - is the 2008Parallel still valid?

The Fed model says rising employment will add to disposable income, drive up prices and push wages higher on competition for workers. It's classic economics but it hasn't unfolded. US CPI rose just 0.9% y/y compared to 1.1% expected in March.

A more convincing model is that real wages haven't risen in a generation and are capped by offshoring and automation. The rise in consumer spending was fueled by credit, not a rising economy where the gains were unevenly distributed.

At some point the Fed will need to reconsider the model but in 7 years we haven't seen any evidence of it. Instead, the Fed complains about disappointing consumer spending and inflation then pushes out the recovery and rates hikes another month.

The market struggled to grasp a theme on the day. The US dollar fell 20-50 pips across the board on the CPI headlines but in another sign of USD resilience, it recovered all the losses in the following hours in a rebound underscores the lack of real alternatives in a world where no one is hiking.

Gold would normally rally on anything bad for the dollar or central banks but it sank $17 on Thursday. All the dovish talk and USD weakness over the past two months was some of the best possible news for gold but it hasn't been able to take advantage. That's worrisome and a head and shoulders top is beginning to unfold on the chart.

The wildcard in the global economy remains China. The PBOC's Yi was on the wires and said he was 'pretty confident' in 6.5-6.7% growth, citing robust data and electricity consumption. Other officials dismissed worries about the SME debt load.

The China bears were put at bay by this week's export data and the slow recovery in Shanghai stocks has largely gone unnoticed. The focus in the hours ahead will be data with the first look at China Q1 GDP due at 0200 GMT. The consensus is 6.7% y/y and YTD growth. A stumble – even a tick or two – could lead to a wobbly in risk assets in the day ahead.

Keep a close eye on the accompanying data as well. Retail sales are expected up 10.4% y/y in March. Industrial production is forecast to rise 5.9% y/y.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (MAR) (y/y) | |||

| 10.40% | 10.12% | Apr 15 2:00 | |

| Industrial Production (MAR) (m/m) | |||

| 0.1% | -0.5% | Apr 15 13:15 | |

| Industrial Production (FEB) (y/y) | |||

| 5.9% | 5.4% | Apr 15 2:00 | |

USD Bulls Awake, Aussie Jobs next

The US dollar was hit with another wave of weak news and data on Wednesday and yet it was the top performing currency. The Swiss franc and euro were laggards and Canadian dollar reversed after the BOC. The Australian jobs report is due next. In the Premium Insights, the trades in the Dow & FTSE were bpth stopped out. The latest Premium video on FX, gold, oil and indices trades is included blow.

Trades aren't made in the rearview mirror. Economic data looks backwards in time and there was more evidence Wednesday that the first three months of the year were weak in the United States. Retail sales fell 0.3% in March compared to +0.1% expected. The control group was at +0.1% versus the +0.4% consensus.

The Fed expects the better jobs picture to filter through to more spending but the evidence is lacking. The Beige Book talked about better manufacturing, spending and overall activity. Yet the data has shown the first quarter was flat despite the warmest winter in a generation. Inventories are the highest they've been since crisis. The manufacturing sector has bled jobs the past two months.

It's tough to find a reason to buy the US dollar in those headlines but it shrugged off the concerns in the second day of broad gains. Perhaps it's a bounce but you can make an argument that this is about as bad as it will get. Jobs numbers have been healthy and sentiment is improving so some growth is coming. The Fed may also try to reclaim some forecast credibility by forcing another rate hike.

It's early days but those are these we will be looking for in the days ahead.

In the meantime, we're looking forward to Australian jobs data at 0130 GMT. The Australian dollar retraced Wednesday to 0.7660 but is up 1.4% this week on better commodity prices. The 18% y/y rise in Chinese exports allayed some foreign fears and another strong jobs report could sooth some domestic jitters. The consensus is for 17K new jobs and a rise in unemployment to 5.9% from 5.8%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Employment Change s.a. (MAR) | |||

| 20.0K | 0.3K | Apr 14 1:30 | |

| Fulltime employment (MAR) | |||

| 15.9K | Apr 14 1:30 | ||

| Part-time employment (MAR) | |||

| -15.6K | Apr 14 1:30 | ||

| Unemployment Rate s.a. (MAR) | |||

| 5.9% | 5.8% | Apr 14 1:30 | |

Oil and CAD Breakout

Signs of an oil output freeze pushed oil and the Canadian dollar to multi-month highs on Tuesday. The Australian dollar was the top performer while the yen lagged. Japanese PPI is due up next. In the Premium Insights, the GBPCAD short was closed at 1.8215 from the 1.8480 entry for 265-pip gain. GBPCAD's selloff has been partly triggered by oil-led ascent in CAD but late session losses in GBP have also helped. Ashraf has issued more details on future plans for this pair in the Premium trades.

Two separate stories were unfolding on Monday. The main one was a rally in oil to the best levels since December. The gains came after an Interfax report suggested Russia and Saudi Arabia had bridged differences in oil output freeze talks. Official Russian comments later confirmed they had reached a consensus.

WTI crude broke above the 200-day moving average and the March highs to $42.25 per barrel. It later slumped 75 cents when API inventory data showed a 6 million weekly build in US supplies but that didn't stall the rally in CAD.

USD/CAD started North American trading at 1.2900 then plunged down to 1.2750. Of the reasons that so few market participants were willing to catch the falling pair is that the BoC meeting is tomorrow. Poloz will undoubtedly hike growth forecasts and is likely to say the output gap will close in mid-2017 rather than the end of 2017.

The other story was a recovery in the US dollar. The streak of seven consecutive declines in USD/JPY was finally halted in a modest 70 pip bounce.

The tougher dollar trade was EUR/USD. It appeared to be breaking out of the recent range as it touched 1.1465 – the highest since October. But a short time afterward it reversed and tumbled more than a full cent to 1.1345. The false breakout is a warning that dollar selling may have gone too far, too fast.

The calendar in Asia-Pacific trading slows. The only notable release is the March Japanese PPI report at 2350 GMT. The consensus is for a 3.5% price decline but the market will likely overlook the release given the recent moves in USD/JPY.

BoC Bottleneck

USD/CAD closed at the lowest level since October and is threatening a 9 month low ahead of a BOC decision that will have a bigger impact than it seems. On Monday, the pound was the top performer while the Swiss franc lagged. BOJ commentary and Australian business conditions are due later. A new trade in commodities was added to the Premium Insights, bringing the number of open positions to 6 trades.

The Canadian dollar made a strong move for the second day as WTI oil prices ignored record Iraqi production and continued above $40 per barrel in a 2% rally. It was part of a broader commodities rally that included a $15 rise in gold.

Newsflow was generally light but the Fed's Kaplan spoke. He ruled out supporting an April hike but said he was open minded about June. The market is pricing just a 15.7% chance of a June hike in a sign that hawkish talk isn't flying with dollar bulls any longer.

At least it isn't flying with US dollar bulls. It might be a different story on Wednesday when the BoC meets. There is virtually zero chance of a move on rates but Poloz is likely to be upbeat. Recent economic data has been surprisingly strong and the government's latest budget will add to GDP in 2016 and 2017. In addition, oil prices have rebounded strongly from the Feb lows.

Despite all that, the market still doesn't anticipate a BoC hike for more than a year. In January, the BoC said its output gap would close 'around' the end of 2017, which would imply a hike in mid-2017 but the waves of good news then will have likely pushed that forward.

That's only partly reflected in the price of USD/CAD, even after a 15 cent drop. Poloz tends to be an optimist at the worst of times and he would like nothing better than to warn over-indebted Canadians that rate hikes may come sooner than they think.

Shifting to another commodity currency, the focus will be on the Australian jobs report later in the week but for today it's the NAB business confidence survey at 0130 GMT. Prior conditions were +8 and confidence +3. Another event to watch at the same time is a speech from the BOJ's Harada; look out for commentary on JPY.

At 0600 GMT, the preliminary March Japanese machine tool orders report is due. In Feb, orders fell 22.5%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Williams speech | |||

| Apr 12 19:00 | |||

| Machine Tool Orders (MAR) (y/y) [P] | |||

| -22.6% | Apr 12 5:00 | ||

| NAB's Business Conditions (MAR) | |||

| 8 | Apr 12 1:30 | ||

| NAB's Business Confidence (MAR) | |||

| 3 | Apr 12 1:30 | ||

Japan Jawbone Put to the Test

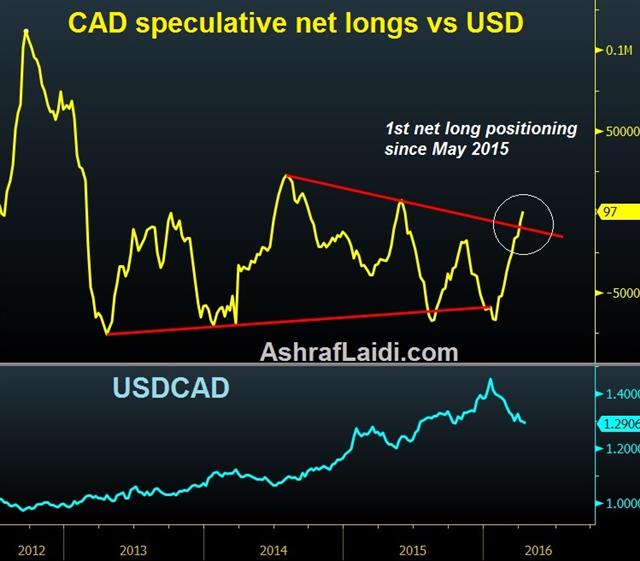

Japan continued to touch on the intervention code on the weekend but yen strength late on Friday and growing yen speculative longs show a market without fear. Moves at the market open have been minimal. CFTC positioning data showed CAD positioning entering flat from negative.

Japanese government spokesman Suga spoke with Reuters on the weekend and said pledges to avoid competitive devaluations don't mean Japan can't intervene. He called the moves one-sided and said Abe's comment last week that countries should avoid 'arbitrary intervention' was misunderstood.

USD/JPY opened the week unchanged at 108.02. What's concerning is that a rally in the pair in Friday's Tokyo session was wiped out late in New York in a 60 pip fall in the final five hours of trading. That marked six consecutive days of declines.

The market wants to test the MOF and find out where the true line in the sand is located. Ashraf wrote about the correlations in USD/JPY, bonds and equities on Friday.

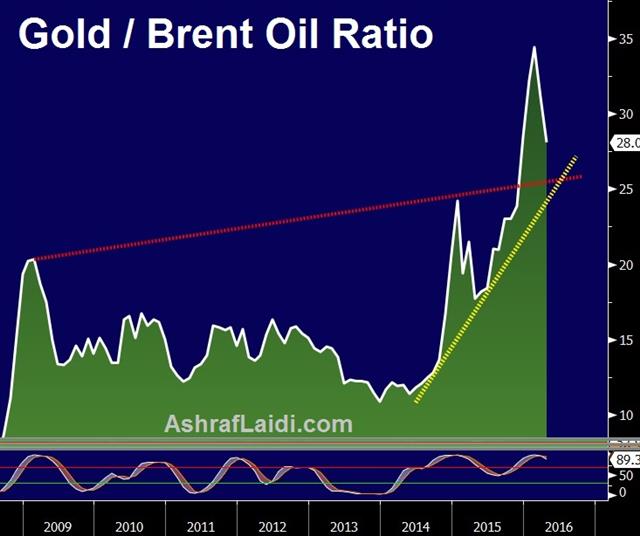

Another focus this week is oil. WTI crude jumped $2.50 to $29.37 on Friday. The production freeze meeting is scheduled for Sunday in Doha but we expect leaks on what will happen before the weekend. The first headline to consider is a rise in official Iraq production to 4.55 mbpd from 4.46 mbpd in March along with a nearly 600k bpd rise in exports. That's a hefty supply dump and could cap WTI ahead of $40.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -53K vs -64K prior JPY +60K vs +54K prior GBP -47K vs -40K prior CHF +6K vs +5K prior AUD +27K vs +23K prior CAD +0.1K vs -6K prior NZD +3K vs +2K prior