Intraday Market Thoughts Archives

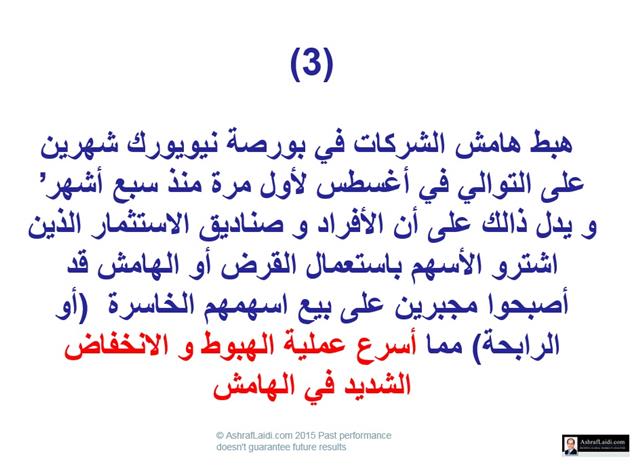

Displaying results for week of Oct 11, 2015مقاطع مختارة من محاضرتي في الخبر

بعض المقاطع مختارة من محاضرتي في معرض الخبر

Inflation Fuels USD Bounce

The US dollar rebounded on Thursday after higher inflation numbers and the best initial jobless claims report since 1973. The commodity currencies were the best performers while the euro lagged. The Asia-Pacific calendar featured a higher than expected New Zealand CPI and a speech from Kuroda is due later.

Yesterday we warned of the potential for USD/JPY declines on a break below the September lows. The gave way early in the day and the pair continued to 118.05 as it looked to be breaking out of a seven-week consolidation pattern.

But the US dollar came back to life like a horror-movie villain and the pair recovered to unchanged on the day at 118.85. It was aided by the CPI report and initial jobless claims. Core inflation rose 1.9% y/y compared to 1.8% with similar-sized beats in other metrics. Claims fell to 255K compared to 270K expected, a more than 40 year low. They were balanced somewhat by a soft Empire Fed but the flip was clearly switched on the US dollar as it climbed across the board.

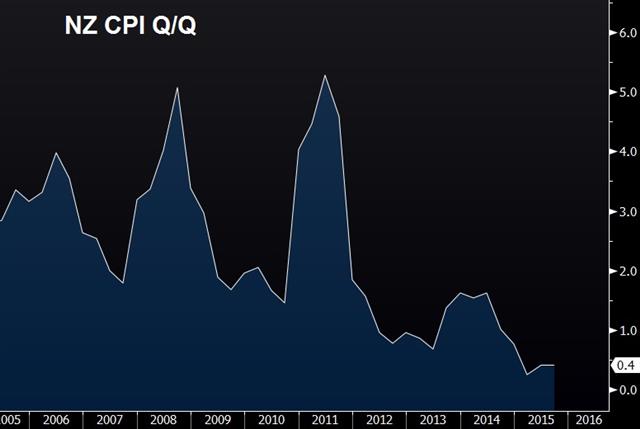

New Zealand Q3 CPI came out at 0.3% q/q vs exp 0.2% q/q and 0.4% y/y vs exp 0.3% y/y, while the prior 0.3% was revised to 0.4%. Inflation data is only released every three months so it's an especially impactful report. The kiwi has been on a tear over the past two weeks. The consensus was for just a 0.3% y/y rise in prices so today's figure hits at Wheeler's rate cut hints earlier this week. It's a tough report for economists to estimate because three competing factors have had a big impact on the CPI compared to this time last year. Oil/commodities have dropped, the kiwi is much softer and house prices have jumped.

The other event to watch is a speech from BOJ leader Kuroda at 0635 GMT. This is likely to be his last appearance before the Oct 30 central bank decision. If anything, he will use it to stifle talk of more QE and that may further weigh on USD/JPY.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Price Index (Q3) (q/q) | |||

| 0.3% | 0.2% | 0.4% | Oct 15 21:45 |

| Consumer Price Index (Q3) (y/y) | |||

| 0.4% | 0.3% | 0.3% | Oct 15 21:45 |

| Eurozone CPI (SEP) (m/m) | |||

| 0.2% | 0.0% | Oct 16 9:00 | |

| Eurozone CPI (SEP) (y/y) | |||

| -0.1% | -0.1% | Oct 16 9:00 | |

| Eurozone CPI - Core (SEP) (y/y) | |||

| 0.9% | 0.9% | Oct 16 9:00 | |

| Continuing Jobless Claims (OCT 2) | |||

| 2.158M | 2.195M | 2.208M | Oct 15 12:30 |

| Initial Jobless Claims (OCT 9) | |||

| 255K | 270K | 262K | Oct 15 12:30 |

Dollar Bulls Feel the Pain

Weak retail sales and a dovish Beige Book sent the US dollar reeling Wednesday in one of the first genuine signs that the crowded USD trade is beginning to clear out. USD lagged all its counterparts badly on the day while the kiwi gained a whopping 2.2% in a reversal from Asia-Pacific trading. The Australian jobs report is up next.

Retail sales rose 0.1% in September compared to 0.2% expected but the details of the report were more downtrodden. Market participants focus on sales excluding autos, gas and building materials – also known as the control group – it fell 0.1% compared to +0.3% expected and the prior was revised to +0.2% from +0.4%.

Soft US economic data has reached the point where it's no longer a one-off. A series of releases have missed expectations and that will drive home the risk for the Fed and US dollar bulls. Many analysts long underestimated the headwinds from a strong US dollar, global slowdown and tighter financial conditions because of hawkish Fed rhetoric. In Ashraf's latest Premium trades, after EURUSD long was closed on Tuesday for 180-pip gain, the position was reopened at 1.1410. Shorts in USDJPY and both DAX positions are well in the green, while GBPCAD and GBPJPY are at a loss and EURCAD is just below B.E. point.

The US economy is still plodding along but it's looking like another year of growth around 2%, rather than the 3% the Fed expected to see. The US dollar was down at least 0.8% against every G10 currency Wednesday and selling accelerated after the Beige Book which cited modest growth, subdued wages and headwinds from the dollar. The implied Fed hike odds for December are now down to 27.1%.

The news was less important than the market moves as the US dollar was belted especially badly against GBP and NZD. Another one to watch is USD/JPY as it touched 118.59, which was below the post-NFP spike but just above the Sept low of 118.54 and support that extends to 118.44. The pair has been in a relatively narrow range for the past seven weeks and a breakout could be long lasting.

But the immediate focus is on the Australian dollar as it turned higher and has now gained in 11 of 12 sessions. Talk of RBA rate cuts circulated yesterday after Westpac rose its mortgage rates. That talk will gain traction if the employment report at 0030 GMT is weak. The consensus is for 9.6K new jobs and unemployment flat at 6.2%. Watch the full/part-time breakdown.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (SEP) | |||

| 0.1% | 0.2% | 0.0% | Oct 14 12:30 |

| Retail Sales (ex. Autos) (SEP) | |||

| -0.3% | -0.1% | -0.1% | Oct 14 12:30 |

| Core Retail Sales (m/m) | |||

| -0.3% | -0.1% | -0.1% | Oct 14 12:30 |

| Employment Change s.a. (SEP) | |||

| 5.0K | 17.4K | Oct 15 0:30 | |

| Fulltime employment (SEP) | |||

| 11.5K | Oct 15 0:30 | ||

| Part-time employment (SEP) | |||

| 5.9K | Oct 15 0:30 | ||

| Unemployment Rate s.a. (SEP) | |||

| 6.3% | 6.2% | Oct 15 0:30 | |

Ashraf's Interview on BNN

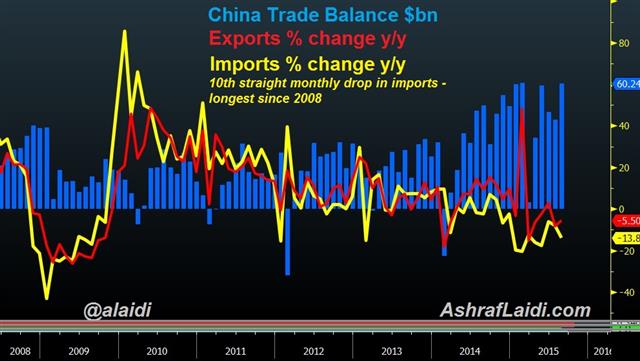

Ashraf's interview with BNN earlier today on China's imports, CNY, commodities, Fed expectations and indices. Full interview

China Trifles, Wheeler Talks Cuts

China and a rarely-heard-from Fed Governor were in the spotlight on Tuesday. The Swiss franc was the top performer on mild risk aversion while the Australian dollar lagged. Up next are the Japanese PPI and Chinese CPI reports. Ashraf's Premium trades closed the GBPNZD short for a 290-pip gain as well as closing the EURUSD long for a 180-pip gain. Premium subscribers will be alerted as soon as these trades are re-opened.

Chinese imports is a metric we've long focused on and it gripped markets on Tuesday because of the eleventh consecutive decline. China imports a great deal of raw materials for its 1.3 billion people but it's also the intermediary stage in the global manufacturing cycle. Raw materials are imported, built into an array of products and then shipped around the globe.

The undeniable softness in imports can't be explained by a slowdown in domestic consumption. After all, the Chinese economy is still growing. It can better be explained by slower infrastructure spending in China and (mostly) a weak global economy.

US economic data was light but comments from a Fed Governor were notable. Tarullo generally focuses on regulation but he spoke to CNBC and said right now it's not appropriate to raise rates. He said we're in a global disinflationary environment and the Fed should be looking for tangible evidence of higher wages. Brainard was similarly cautions and together it suggests the core of the Fed – Yellen, Dudley and the Governors – are more cautious than some of the outspoken regional Presidents.

The news late in the day was from the RBNZ's Wheeler who said that “further easing seems likely” and that sent NZD quickly 50 pips lower. House prices in New Zealand are red-hot but it appears as though policymakers want to use macroprudential tools rather than rates too cool it.

The main event in Asia-Pacific trading is Chinese inflation at 0130 GMT. The consensus for CPI is a 1.8% y/y rise but a 5.9% y/y decline in PPI. Officials are less concerned about inflation and more worried about lending excesses but low readings would give them a green light to lower rates once again.

The other event to watch is Japanese PPI at 2350 GMT. Talk of another round of Japanese QE is probably overdone but a reading below the -0.4% m/m consensus would restoke the fires.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Prce Index (SEP) (m/m) | |||

| 0.5% | Oct 14 1:30 | ||

| Consumer Prce Index (SEP) (y/y) | |||

| 2% | Oct 14 1:30 | ||

Brainard Deals a Blow to Fed Consensus

The growing inverse correlation between the frequency of Fed speeches and uniformity of the message on monetary policy action cannot be ignored. The newest member of the Federal Reserve Board of Governors hasn't made too many speeches, but her message has been on point since her first speech in June.

In her speech yesterday, Lael Brainard, Federal Reserve Governor since June of this year, dealt a prominent blow to the hawks at the Fed, by contradicting three major premises upon which calls for a 2015 rate hike are built. Having served as Undersecretary of the Treasury for International Affairs for over three years, she knows a few things about international developments. Here are some of the central points of her speech:

Market & FX tightening is equivalent to two rate hikes

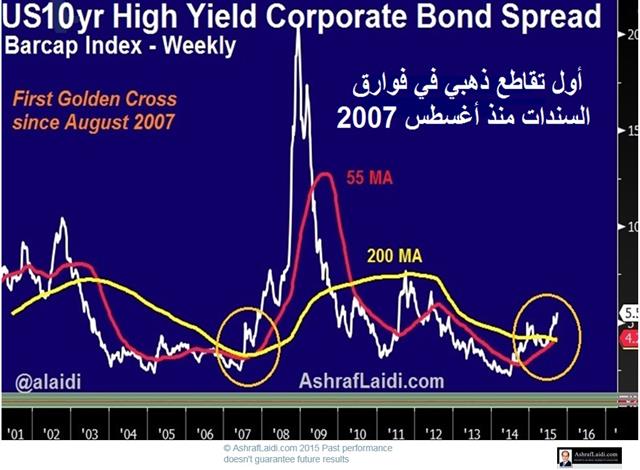

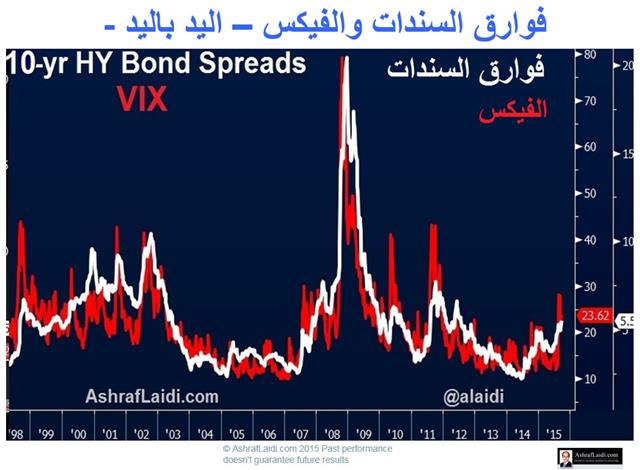

"Over the past year, a feedback loop has transmitted market expectations of policy divergence between the United States and our major trade partners into financial tightening in the U.S. through exchange rate and financial market channels. Thus, even as lift-off is coming into clearer view ahead, by some estimates, the substantial financial tightening that has already taken place has been comparable in its effect to the equivalent of a couple of rate increases."This is not a foreign idea. Former Treasury Secretary Lawrence Summers made the same point last month about the recent back-up in bond yields and decline in equities. Not to mention the rise in high yield bond spreads hitting three-year highs and long-standing effects of the strong US dollar, we mentioned here.

Economic risks titled to downside

"There is a risk that the intensification of international cross currents could weigh more heavily on U.S. demand directly, or that the anticipation of a sharper divergence in U.S. policy could impose restraint through additional tightening of financial conditions. For these reasons, I view the risks to the economic outlook as tilted to the downside. The downside risks make a strong case for continuing to carefully nurture the U.S. recovery--and argue against prematurely taking away the support that has been so critical to its vitality."Brainard's “tilted to the downside” qualifier contrasts with the Fed central view, which “continues to see the risks to the outlook for economic activity and the labor market as nearly balanced”. Brainard's international focus and experience has led her to integrate the international factors into her assessment for the US, instead of keeping it apart.

Jobs data not enough to judge inflation

"In contrast to the considerable progress in the labor market, progress on the second leg of our dual mandate has been elusive. To be clear, I do not view the improvement in the labor market as a sufficient statistic for judging the outlook for inflation. A variety of econometric estimates would suggest that the classic Phillips curve influence of resource utilization on inflation is, at best, very weak at the moment. The fact that wages have not accelerated is significant, but more so as an indicator that labor market slack is still present and that workers' bargaining power likely remains weak."The statement that tightening labour markets remain insufficient to normalize inflationary considerations has already been made by Fed Chair Yellen and Vice Chairman Fischer recently. But their insistence on communicating a rate hike this year is not shared by Brainard, who advises for “watching and waiting”.

The growing inverse correlation between the frequency of Fed speeches and uniformity of the message is simply a reflection of heightened uncertainty with their economic models. Our expectations that the Fed will not raise rates in 2015 were established since January , confirmed in April and reconfirmed in July, while our calls for the peak in the USD began here. Beware of the extended focus on international affairs at the expense of overlooking a US slowdown, which risks turning into something more. Just as we repetitively warned of the dangers of falling capex, exceeding the advantages of cheaper oil, we warn about the possibility of an “earnings recession” likely to emerge in Q2. A full blown US economic recession is more probable in Q3 2016.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's Bullard speech | |||

| Oct 13 12:00 | |||

Back to China Trade Figures and Oil

Trading was light on Monday with parts of US markets closed but the Australian dollar managed to close higher for the ninth consecutive day. The kiwi was the top performer while the Canadian dollar lagged. It was a quiet market so all moves should be viewed with skepticism but oil and Chinese stocks were especially notable. Wednesday's Premium trade on GBPNZD deepened gains into +250 pips, while EURUSD long entry at 1.1210 is netting over 150 pips. GBPJPY is in the black, GBPCAD and USDJPY are flat and EURCAD and DAX are in the red. China's trade figures will be the highlight of the Asia/Pacific session.

WTI crude fell $2.19 to $47.44 and back near the midpoint of the six-week range. It was the largest decline since Sept 1. Crude had looked like it was breaking out on Friday but reversed late in the day to finish lower and that continued on Monday. The catalyst was OPEC, which revealed it raised production to 31.57 mbpd in September – the highest since 2012. There are signs that US producers are beginning to blink as drilling rigs decline, but it will take months before that translates into lower production. Meanwhile, Iran will continue to ramp up production and exports as sanctions are lifted.

Possibly helping oil is better sentiment and/or more stimulus from China. The Shanghai Composite rose 3.3% on Monday to the highest since late August in what could be the start of a retracement. That would also bode well for the surging Australian dollar.

China's trade figures are due at 02:00 GMT/03:00 BST. In terms of AUD, the focus will be on the RBA at 2140 GMT when Deputy Governor Lowe speaks. The Aussie rose last week in part because the RBA statement was less dovish than anticipated. He may wish to reel it in via some jawboning or highlight the possibility of a future cut. The other release to watch in Asia-Pacific trading comes at 0600 GMT when the preliminary September Japanese machine tool orders report is due. In August, orders were down 16.5% y/y.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Exports (SEP) (y/y) | |||

| -5.5% | Oct 13 2:00 | ||

| Fed's Bullard speech | |||

| Oct 13 12:00 | |||

| Machine Tool Orders (SEP) (y/y) [P] | |||

| -16.5% | Oct 13 6:00 | ||

AUD on Fire, Fed Flailing

The Australian dollar is on an impressive run but has stumbled so far in Asia-Pacific trading while EUR leads the way. We look at the Fed's communication conundrum and the news from the IMF meeting. Weekly CFTC positioning data showed commodity currency shorts edging towards the sidelines.

Markets opened without a sharp moves but the Australian dollar is moderately lower and the euro mildly higher to start Asian trading.

AUD/USD is on a spectacular run with gains in 8 consecutive days. Amazingly, it's the second eight-day rally since the start of September. The cumulative gain then was 282 pips compared to 351 now. There hasn't been a longer winning streak since March 2009 when AUD/USD climbed for 10 straight days after the S&P 500 hit the crisis low.

Central bankers and politicians were in the spotlight on the weekend due to the IMF meeting in Peru. The Fed's Fischer noted the soft jobs and export reports but said recent events probably won't have a significant effect on policy. He said he continues to expect a rate hike this year.

This has become a familiar refrain from the Fed but Dec hike pricing remains at 39%. If and when the Fed decides it wants to hike; they will have a communication problem because markets just don't believe hawkish rhetoric at the moment.

BOC Governor Poloz offered conflicting comments. He said there was evidence that businesses are becoming more confident and ready to invest but he also said the BOC won't hike rates to cool housing and could commit to keeping rates lower for longer.

On the topic of hot housing markets, one metric that's eye-popping is New Zealand REINZ September home sales report. Sales volumes rose 38.3% y/y and Auckland prices were up 25.4% y/y. With rates lower, there is likely more to come but that is a frantic market. Otherwise the economic data calendar is light.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -89K vs -88K prior JPY -18K vs -22K prior GBP -4K vs -2K prior AUD -41K vs -49K prior CAD -35K vs -42K prior CHF -4K vs -3K prior

Listening to chatter in the market, the enthusiasm for US dollar longs has definitely sagged but futures positioning still shows heavy bets. That leaves USD vulnerable to a larger squeeze. AUD was the second-largest net short position but the recent rally will have eaten into that further.