Back to China Trade Figures and Oil

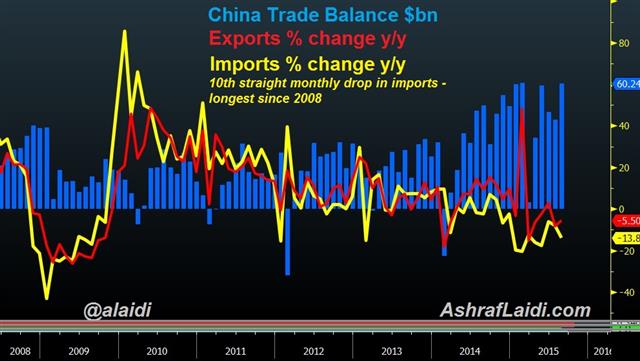

Trading was light on Monday with parts of US markets closed but the Australian dollar managed to close higher for the ninth consecutive day. The kiwi was the top performer while the Canadian dollar lagged. It was a quiet market so all moves should be viewed with skepticism but oil and Chinese stocks were especially notable. Wednesday's Premium trade on GBPNZD deepened gains into +250 pips, while EURUSD long entry at 1.1210 is netting over 150 pips. GBPJPY is in the black, GBPCAD and USDJPY are flat and EURCAD and DAX are in the red. China's trade figures will be the highlight of the Asia/Pacific session.

WTI crude fell $2.19 to $47.44 and back near the midpoint of the six-week range. It was the largest decline since Sept 1. Crude had looked like it was breaking out on Friday but reversed late in the day to finish lower and that continued on Monday. The catalyst was OPEC, which revealed it raised production to 31.57 mbpd in September – the highest since 2012. There are signs that US producers are beginning to blink as drilling rigs decline, but it will take months before that translates into lower production. Meanwhile, Iran will continue to ramp up production and exports as sanctions are lifted.

Possibly helping oil is better sentiment and/or more stimulus from China. The Shanghai Composite rose 3.3% on Monday to the highest since late August in what could be the start of a retracement. That would also bode well for the surging Australian dollar.

China's trade figures are due at 02:00 GMT/03:00 BST. In terms of AUD, the focus will be on the RBA at 2140 GMT when Deputy Governor Lowe speaks. The Aussie rose last week in part because the RBA statement was less dovish than anticipated. He may wish to reel it in via some jawboning or highlight the possibility of a future cut. The other release to watch in Asia-Pacific trading comes at 0600 GMT when the preliminary September Japanese machine tool orders report is due. In August, orders were down 16.5% y/y.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Exports (SEP) (y/y) | |||

| -5.5% | Oct 13 2:00 | ||

| Fed's Bullard speech | |||

| Oct 13 12:00 | |||

| Machine Tool Orders (SEP) (y/y) [P] | |||

| -16.5% | Oct 13 6:00 | ||

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40