Intraday Market Thoughts Archives

Displaying results for week of Jun 12, 2016Brexit Trading Playbook

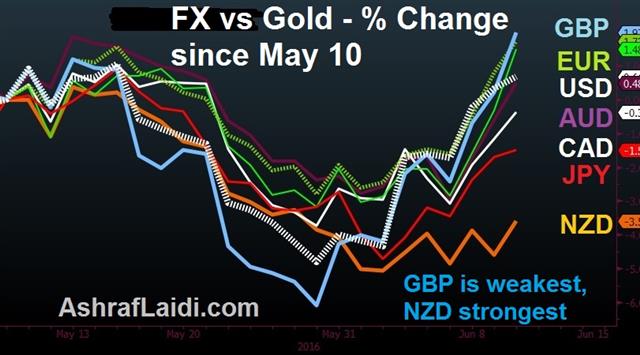

Thursday's volatility is an important lesson in the week ahead. The massive reversal in sterling left the yen as the top performer and AUD the laggard. Traders will get a chance to catch their breath in Asia-Pacific trading after a hectic 24 hours. After 2 Premium trades were opened yesterday, there are 6 existing trades currently open.

The tragic killing of UK MP Jo Cox makes a Brexit slightly less likely and that's what prompted a 240 pip reversal in cable Thursday. We don't want to dwell on the morbidity of trading around a tragedy. The lesson is that swings in markets are likely to extraordinary in the week ahead.

The market is signaling that the Brexit vote is close and liquidity is drying up. Few want to fight swings in either direction in the pound or risk appetite. It's not only the Brexit vote either; the market has come around to the idea that the Fed might not hike at all and is worried about global growth. The weak yuan is creeping into the discussion as well

Retail forex brokers are cutting margins and bank desks are cutting risks. There is a profound sense of the unknown, and not only of the results of the referendum. Hidden Brexit headlines and risks are everywhere and liable to start the kinds of stampedes we saw today.

Ultimately, even though the 'risk-on' side won the battle today, volatility is the enemy of positive sentiment. The VIX briefly jumped to the highest since February on Thursday.

Technical levels will play a critical role. The rebound in cable keyed off the April low of 1.4006 and USD/JPY folded after breaking the April low of 105.55, something we warned about if the BOJ delivered a wait-and-see statement.

Oil has also broken the uptrend that began in February and, notably, it didn't show any signs of recovery as sentiment reversed Thursday; nor did it hold gains Wednesday after a bullish inventory report.

The underlying trading theme for the week ahead will be to go with the momentum, avoid fighting the tape and managing risks. Far more fortunes are lost in volatile trading than won.

The Asia-Pacific session on Friday is a chance for markets to gain some perspective and consolidate. The lone notable release is the 0100 GMT New Zealand consumer confidence report. The prior reading was 116.2.

No Fed Hike Signals, BoJ Next

The FOMC was in no mood to send hawkish signals after building up rate hikes hopes only to see them dashed by the non-farm payrolls report. The US dollar initially sold off on the FOMC statement but later battled back. The BOJ decision and Australian jobs report are due later. Due Thursday are UK retail sales and the BoE decision/MPC minutes. Ashraf's Premium Insights issued 2 trades today, one before the Fed and one after, both of which have been filled and in progress.

The FOMC statement downgraded the labor market assessment and fretted about soft business investment but retained some optimism. It was largely the same as the April text, reverting to a wait-and-see stance.

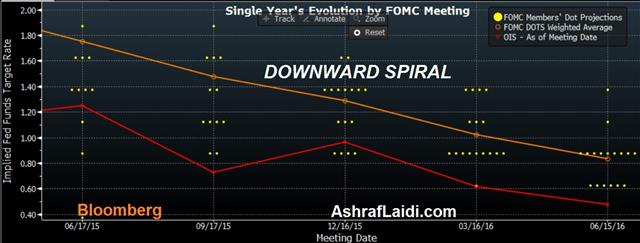

The dot plot showed a downshift in hike expectations and George dropped her dissent but the media still shows two hikes this year. GDP forecasts were lowered slightly this year and next, both to 2.0%.

The was some speculation the Fed may want to keep a July hike on the table but they let it go rather easily and the dollar initially dropped. On inflation, the Fed wasn't overly concerned about falling inflation expectations but Yellen said it may be 2-3 years before core inflation returns to 2%.

The dollar rebounded during Yellen's press conference but it's difficult to tie it to anything she said. She was clear that the Brexit vote was a concern but equally clear that it wasn't the only one.

Looking ahead, “once bitten, twice shy” is an apt expression. It's clear the coordinated effort to signal a rate hike 'in the coming months' has been abandoned and the cautious tone from Yellen suggests she doesn't want to make the same mistake again. The Fed will now wait for abundantly clear economic signs before making a move. Given the sluggish economic news, that probably means no hikes at all in 2016.

Other central banks with biases towards waiting and seeing are the BOJ and RBA but the pictures from both will grow clearer in the coming hours.

The Australian jobs report is due at 0130 GMT and expected to show 15.0K new jobs compared to 10.8K the prior month. The Aussie jobs numbers have been nearly impossible to bet against. The economy has done an admirable job adjusting to the commodity collapse, at least so far. Even a weak number likely wouldn't jar the RBA.

The BoJ, due to announce around 2-3 am GMT, hasn't sent any easing signals and we haven't picked up on secondary signs in the local press. However, we take nothing for granted from Kuroda, who loves to surprise. The timing would be advantageous to the government with Upper House elections coming and would help to underscore a floor near 105.55 in USD/JPY. That was the May low and although it was momentarily broken after the Fed, it's the critical level in the day ahead. If the BOJ delivers another wait-and-see statement, expect it to break.

Brexit Feared for the Wrong Reason

UK trade and the direct knock-on effects are the reasons widely touted as the reasons to fear a Brexit but something else is also afoot. The yen was the top performer on Tuesday while pound continued to plunge. The Asia-Pacific calendar is light, but the UK claimant count is due later ahead of the FOMC decision. A new set of Premium trades will be issued on Wednesday ahead of the Fed. Ashraf posted the chart below on Friday, warning on how the upward divergence in the S&P500 would eventually catch "down" with falling yields and USDJPY. The ensuing 4 days did just that.

Shifting winds

The Brexit vote will probably fail but it's no longer a sure thing.Like the old economic models, the models of voter behaviour are breaking down. The dominant trend of the past 30 years has been towards open borders and open trade. That it will continue has been taken for granted.A Brexit would undoubtedly create hardships for UK trade that may or may not be resolved with quickly-signed trade deals but the trend is clear -- the public is losing faith in economic orthodoxy.

The promise of globalization and free trade has been wealth creation, which largely occurred but distributing that wealth has failed. Voters feel cheated new and want to try something new, maybe something radical.

Perhaps we should have paid more attention to Greece when voters rejected the bailout deal. It was easy to ignore because Tsipras cast aside the result, accepted EU terms and was re-elected.

Like the Brexit vote, Trump may also lose but by winning the Republican nomination he's tapped into the same anger that's fuelling a Brexit.

The UK economic effects of a Brexit are assuredly overstated by the 'remain' side but the effects of a reversal of globalization will be far more dangerous and tumultuous. If it doesn't happen because of a Brexit or Trump, it will likely be a result of what seems like the inevitable failure of the Trans Pacific Partnership.

Tuesday, in a sign of desperation, Osborne said he will raise taxes if the 'leave' side wins. The pound has been the victim so far but fears are beginning to spread

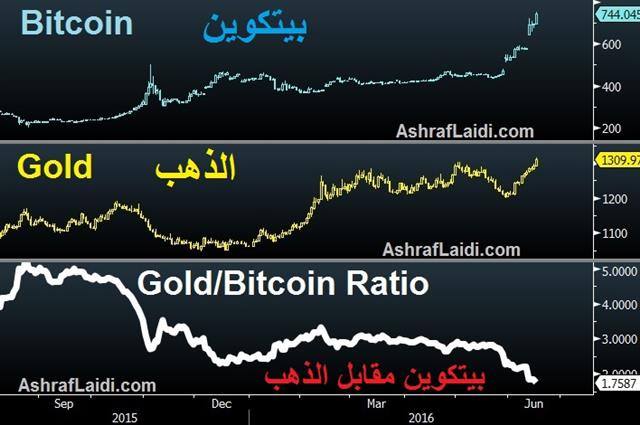

The short-term trade will certainly be centred around the referendum but no matter the result, the bigger picture trade may be a reversal of the open trade and open borders trend. Gold anyone?

Ashraf at XTB this afternoon

This afternoon, Ashraf will hold an interactive presentation at XTB's Trading Club at XTB's London Headquarters in Canary Wharf from 4 to 5:30pm, covering his latest trades ahead and insights ahead of tomorrow's Fed decision. DIRECTIONS.

وبينار اليوم - 6 توقيت لندن، 8 توقيت مكة

"ما هي التوقعات قرار الاحتياطي الفدرالي ليوم الأربعاء؟" هل سيرفع الاحتياطي الفدرالي سعر الفائدة أم سينتظر ازالة المخاطر بعد الاستفتاء البريطاني عن اوروبا؟ كيف سيتم تأثير التوقعات الفردية في لجنة الاحتياطي الفدرالي على العملات و مدى تقارب/تباعد تنبؤاتهم بالنسبة لتوقعات السوق؟ اتخاذ الحذر من تصريحات جانيت يلن الغير متوقعة أثناء مؤتمرها الصحفي، ومما يجب الانتباه؟

Brexit Polls Lottery

Brexit polls will continue to dominate the landscape even with US retail sales and the Fed due in the next two days. The yen was the top performer Monday while the pound lagged. Australian business confidence is due later.

The FOMC two-day meeting begins on Tuesday but Brexit is the topic dominating markets. Polls are anticipated more than economic data points.

Today's 3 Polls

The Guardian hyped a poll for hours ahead of the release and when it was finally released it showed 'leave' ahead by 53% to 47% but newswires first reported it backwards before making a quick correction. Cable jumped a full cent and then crashed back down.Late in the day another set of polls hit. Data from ORB showed 49% to remain and 44% to leave but the leave side had a slim lead among voters certain to vote.

Finally, a poll from YouGov put the leave side ahead 46% to 38% with the remainder undecided.

The vote is suddenly much closer and it's spilled over into a broad risk trade. Stocks fell hard for a second day but the fear is most visible in the VIX as portfolio managers rush into options trades to hedge. The VIX has risen to 21 from 15 in the past two trading days and is at the highest since March 1.

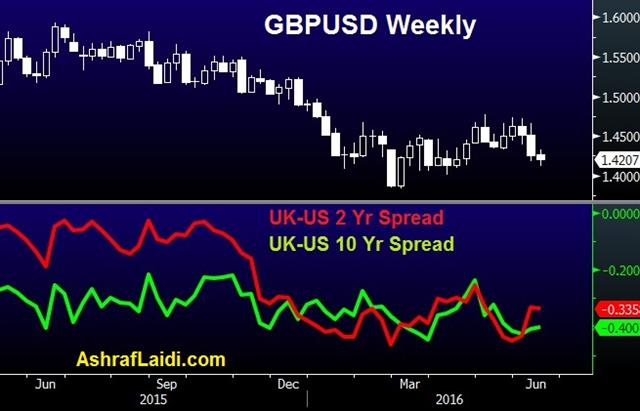

In FX, two things stand out. The first is that the pound has shown more resilience to signs of Brexit, which means a close vote may be priced in or that real money selling is ahead of the vote is largely done. Secondly, yen buying isn't as dramatic as stocks and the VIX might indicate. That may be due to technical support in USD/JPY as it approaches the May low or apprehension ahead of the Fed but it bears watching closely.

On the day, economic data was light but it will pick up on Tuesday with US retail sales followed by the Fed Wednesday. Those releases may be swamped in the near-term by the fear trade but, in turn, that could lead to a more dovish Fed and a bigger bounce if/when Britons vote to remain.

In the immediate future, the calendar is light for Asia-Pacific traders. The lone indicator that might move the market is NAB Business Confidence for Australia. The prior readings were +5 for confidence and +9 for conditions.

Japanese final April industrial production is also on the schedule at 0430 GMT but it is less likely to move the market.

أشرف العايدي على قناة سي إن بي سي العربية

Brexit Worries in a Big Week

The Fed, SNB and BOJ are on the calendar this week but the big story remains the Brexit vote. The pound was hammered Friday and was the laggard on the week as polls showed momentum for the 'leave' side; the kiwi led the way. Weekly CFTC positioning data showed a flight to the yen. On Friday, the Premium GBPUSD short was stopped out, while GBPJPY short was closed for a 350-pip gain and this evening, the DAX30 short was shut at 9740 (instead of the stated 9310) from the 10150 entry, for 410-pt gain.

Looking back at the 2014 Scottish referendum, the peak of GBP selling was 8-10 days before the vote. The Brexit vote is in 11 days on June 23.

A poll on Friday showed the leave side at 53% to 47% among decided voters with 15% still unsure. Oddsmakers have shortened odds on a Brexit but still see it as only a 30% chance.

What happened in Scotland was that voters dabbled with the idea of independence about two weeks before the vote but by the time it came to vote, they had second thoughts. At the same time, the undecided voters swung towards familiarity.

It's a similar story in most elections, where incumbents tend to outperform polls.

In the market, it's around two weeks that jittery real-money worries peak but it's not until a week before the vote that speculators attempt to buy the dip.

In the Scotland referendum, the pound rallied into the vote and peaked a few hours after the result was clear.

The vote comes after a week of major central bank decisions. The Fed will be sidelined but the statement will be critical. There is speculation about a BOJ move and Kuroda loves to surprise but so expect yen traders to be on edge.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -67K vs -38K prior JPY +43K vs +15K prior

GBP -66K vs -33K prior

CHF -10K vs +0K prior AUD -16K vs -5K prior CAD +22K vs +26K prior NZD +9.0K vs +5.5K priorThese are some of the biggest-single week swings in more than a year. It's the first reflection of the post-NFP trade as the market rushes into the yen. Brexit worries are also hammering sterling while the spec flows shows the market was caught offside into the RBA decision.