Intraday Market Thoughts Archives

Displaying results for week of Jul 12, 2015Beware of Stocks vs Oil

How high can stocks go following the dissipation of Grexit, reiterated ECB calls to stick with its asset purchases and the stabilisation in Chinese stocks? Can equity bulls ignore the relationship between oil and stocks?

The 22% decline in oil from the May high raises the old question from early Q1: Will cutbacks from oil companies weigh on overall spending? Remember how in January, economists raised the red flag over oil prices' tumble below $50s, owing to the implications of severe cuts in capital expenditure by big oil/gas companies could, falling by as 20%, as low revenues no longer justify project finance.

Considering that energy sector capex accounts for almost 40% of total capex in S&P500 companies and non-energy capex has remained below 2008 highs as companies are busy investing in their shareholders by buying back stocks and paying dividends, what would become of the corporate spending boost to the economy?

With the economic foundation of energy companies already under assault in Q1, how will they fare today after the latest 20% tumble in prices? And what becomes of those energy-sector bonds when the Fed growing hawkishness boosts bond yields?

Energy-driven underperformance

90% of today's biggest losing shares in the S&P500 and FTSE-100 are in energy/commodity sectors. The charts below illustrate the positive correlation between the FTSE-100 and brent oil, which is comparable to that of SP500 and crude oil. Taking the FTSE100/Brent relationship, the ratio is reaching a key resistance as is the case of the SPX/Brent.Could the Fed continue to flex its rate liftoff muscle when inflation risks succumbing back to zero%.

Calendar Clarity on Carney

Carney gave clues on exactly when the BOE might begin hiking rates on Thursday. The US dollar remained firm but the Australian dollar was the top performer while the kiwi lagged on the day. The Asia-Pacific schedule to end the week is light.

After Carney hinted at sooner rate hikes earlier this week, the obvious question was, when? The market had been dabbling with the idea of a May hike but then priced in an increase by March. Today, Carney indicated that the BOE is on hold for at least a few months.

Some (like the FT) interpreted his comments to mean a hike could come in December or January but a closer look points to later. “In my view, the decision as to when to start such a process of adjustment will likely come into sharper relief around the turn of this year,” he said. That means – barring a shock – the BOE won't even seriously begin to debate about hiking until year end. In that sense, the market may have gotten ahead of itself by fully pricing in a March hike. That said, the pound continues to benefit from EUR/GBP flows. That pair fell for the sixth consecutive day on Thursday and touched a six-year low. The pair has fallen in 13 of the past 16 weeks.

The other continuing story is commodity FX weakness. AUD scored a minor bounce but the NZD and CAD were laggards once again despite sizeable declines Wednesday. That's good evidence that few buyers are waiting in the weeds.

Looking ahead, the Asia-Pacific calendar winds down with only the lowly Australian leading indicators report. Instead, look to commodities and Chinese stocks to drive sentiment.

DAX Rally Hit Back at Euro, Carney Next

It's another case of USD rallying on non-US events before pausing on reality at home. Two days ago, the USD rallied on Greece uncertainty ahead of the Greek parliament vote only to find an unexpected 0.3% contraction in US retail. Today's greenback rally re-emerged on the prospects of renewed run-up in Eurozone equities (especially Germany), which would require fresh hedging of euro exposure at the expense of the single currency. But the USD was checked by an unexpected decline in the July Philly Fed survey, hitting a 4-month low of 5.7, with a contraction in the employment index.

On the euro front, ECB president Draghi announced a EUR 900 mln increase in the ELA for Greek banks for 1-week after a EUR 7 bln bridge loan for Greece was confirmed. The loan will enable Greece to meet its EUR 3.49 bn payment to the ECB on July 20.

DAX Rally Hit Back at Euro

As the DAX breaks above its 100-DMA, EURUSD deepens its breakdown below its 100-DMA hitting a 7-week low. The 3rd element of this relationship are bund yields, which broke a 3-day losing streak, cheered on by Draghi's comments that recent events in Greece had not changed the ECB outlook for further recovery in Eurozone inflation. And so the question becomes to what extent bund yields and the DAX-continue rallying, while the euro ignores yields and remains pressured.Sterling bulls were dealt a scare to see cable drop below 1.5570 before stabilising above its 55-DMA. GBP traders await BoE governor Carney's comments due at 19:00 BST. A new Premium note on our EURUSD will be issued later today.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Philadelphia Fed Manufacturing Survey (JUL) | |||

| 5.7 | 12.0 | 15.2 | Jul 16 14:00 |

How Commodity FX is Crumbling

The BOC cut, drop in metals prices and crash in the New Zealand dairy market may usher in a dark period for commodity currencies. The trio fell badly Wednesday while the US dollar led the way on another Yellen reminder that rates are going up. New Zealand CPI is up later. A new CAD Premium trade has been issued, while our EURCAD longs and CADJPY shorts remain intact.

BOC Governor Steven Poloz has repeatedly shown that he's an optimistic leader but he's not stubborn. He admitted the economy has fallen far short of where the BOC expected and responded with a rate cut. The market was split 50/50 but he said it was a relatively easy decision because growth had fallen so far short of estimates.

The BOC said GDP was about 1% below where they expected through Q2 and lowered the full-year forecast to 1.1% from 1.9%, and the 2016 forecast to 2.3% from 2.5%.

The lone solace for CAD bulls was him saying the BOC doesn't believe another move is necessary unless the data or oil prices deteriorate. USD/CAD immediately rose to 1.2930 from 1.2780 on the decision and eventually hit a 6-year high of 1.2958. The crisis high was 1.3063 and is the next (last?) line of resistance. As real money exits CAD, it's likely to be put under heavy pressure in the days ahead.

But CAD only begins to tell the story of an intense news day on Wednesday. Gold fell to the lowest since March and the New Zealand dollar was smashed by a 10.7% in dairy prices at the latest Fonterra auction. NZD/USD hit a 5-year low after the news.

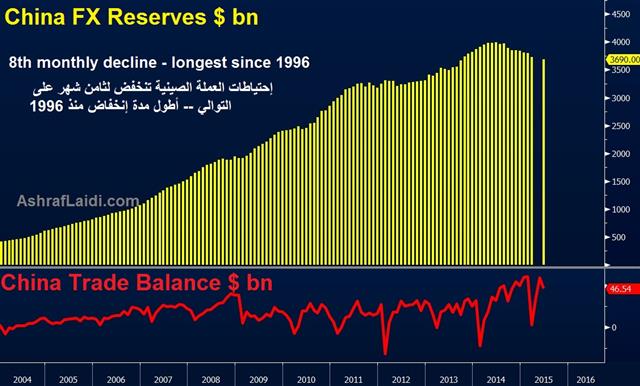

Despite China GDP once again hitting the 7% target, demand for commodity imports is conspicuously absent. In part it shows a shift to domestic consumption but if China isn't supporting demand at this pace of growth, the commodity currencies are extremely vulnerable when the inevitable Chinese slowdown arrives.

In the nearer term, the divergence between Yellen talking about hikes on the same day the BOC cut couldn't be any more stark. The focus is now on the RBNZ, which meets next week.

A major consideration for them will be the 2245 GMT CPI report for Q2. It's expected to show inflation up 0.5% q/q. Also watch as Greek parliament battles to meet the bailout deadline by approving austerity measures.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Price Index (Q2) (q/q) | |||

| 0.4% | 0.6% | -0.3% | Jul 15 22:45 |

| Consumer Price Index (Q2) (y/y) | |||

| 0.3% | 0.4% | 0.1% | Jul 15 22:45 |

| Gross Domestic Product (2Q) (y/y) | |||

| 7% | 6.8% | 7.0% | Jul 15 2:00 |

| Gross Domestic Product (2Q) (y/y) | |||

| 7.0% | 6.9% | 7.0% | Jul 15 2:00 |

| Gross Domestic Product (2Q) (q/q) | |||

| 1.7% | 1.6% | 1.4% | Jul 15 2:00 |

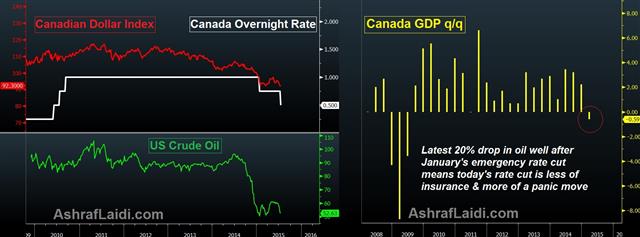

BoC Rate Cut on Recession Watch

The Bank of Canada cut its overnight rate by 25-bps to 0.50%--the lowest in five years. The rate cut was all about fears of a full blown recession as the BoC expects a contraction in H1 2015 with -0.5% GDP growth in Q2 (revised from +1.8%) following -0.6% in Q1. +1.5% seen in Q3 (revised from +2.8%). Overall 2015 GDP revised to +1.1% from +1.9%. The BoC expressed risks to the downside in inflation and growing financial vulnerabilities stemming from rising household debt. Judged rate cut was needed to return the economy to full capacity, aimed for 1H 2017 from H2 2016.

Since BoC described January's rate cut as an “emergency”, what would it call today's cut? Despite the loonie's 8% depreciation of the past 9 weeks, the central bank is on a mission to avert a deepening recession. Previous reluctance from the BoC to cut was attributed to risking further swelling in household debt, but the priority of avoiding a deepening growth slump led the central bank to take action. The 18% drop in oil five months after January's emergency rate cut implies further shakedown Canada's economic foundation to the extent that the central bank sees no pickup from its Southern neighbour.

Our Premium Insights subscribers received the initial warning of a BoC rate cut on July 6th (well before those disappointing CAD jobs figures). Our decision to stick with CADJPY shorts and EURCAD is now paying off.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| BoC Interest Rate Decision | |||

| 0.50% | 0.75% | 0.75% | Jul 15 14:00 |

Mansion House Redux, BoJ, China GDP Next

The Mansion House speech tarnished Carney's reputation as a slick central banker. His hint at rate hikes coming “sooner than markets were expecting” was wrong. Inflation has proved stubbornly low and that was underscored by a flat y/y CPI reading on Tuesday.

That data pinned cable to 1.5450 but a few hours later Carney said the time to hike rates is “moving closer” in testimony to parliament. Sterling shot to 1.5600. It was given another lift by a disappointing US retail sales report then BOE dove Miles said “the time to start normalization is soon” in his final MPC speech and cable hit 1.5635.

The market hadn't been anticipating a BOE hike until May 2016 but the MPC is sounding increasingly like they want to stay ahead of the curve. Yet the BOE and Carney were wrong before. Until wages, productivity and inflation show true evidence of picking up, Carney is working more on hope than hard data.

What's different about this speech and the Mansion House episode is that cable longs aren't nearly as crowded. That speech came at the tail end of a 14-month GBP/USD rally to 1.71 from 1.50. This time, the pair is just starting to turn upwards on a series of higher lows and highs since April.

In the short term, look to Chinese economic data at 0200 GMT to steer markets. Chinese retail sales are expected up 10.2% y/y, industrial production forecast to rise 6.0% and Q2 GDP estimated up 1.6% q/q. All three are important data points but GDP is critical. A soft reading would immediately spark talk of more simulative measures from the PBOC.

Around 0300 GMT, the BOJ decision will be released. The monetary base is widely (but not universally) expected to remain at 80 trillion yen. The focus is instead on the latest growth and inflation forecasts. Nikkei reported last week that the central bank is considering cutting 2015 FY GDP forecasts closer to the consensus at 1% from the current 2.0% estimate. The larger focus is inflation and a downgrade to the 0.8% FY 2015 forecast would hint at yet another round of QE.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's George Speech | |||

| Jul 15 0:15 | |||

| Fed's Yellen Speech | |||

| Jul 15 14:00 | |||

| FOMC's Mester speech | |||

| Jul 15 16:25 | |||

| FOMC's Williams speech | |||

| Jul 15 19:00 | |||

| CPI (y/y) | |||

| 0.0% | 0.0% | 0.1% | Jul 14 8:30 |

| Advance Retail Sales (JUN) | |||

| -0.3% | 0.3% | 1.0% | Jul 14 12:30 |

| Retail Sales (ex. Autos) (JUN) | |||

| -0.1% | 0.5% | 0.8% | Jul 14 12:30 |

| Retail Sales Ex Auto and Gas (JUN) | |||

| -0.2% | 0.4% | 0.5% | Jul 14 12:30 |

| Retail Sales Control Group (JUN) | |||

| -0.1% | 0.3% | 0.7% | Jul 14 12:30 |

| BRC Retail Sales Monitor - All (JUN) (y/y) | |||

| 1.8% | 0.0% | Jul 13 23:01 | |

| Retail Sales (JUN) (y/y) | |||

| 10.2% | 10.1% | Jul 15 5:30 | |

| Industrial Production (JUN) (m/m) | |||

| 0.2% | -0.2% | Jul 15 13:15 | |

| Industrial Production (JUN) (y/y) | |||

| 6.0% | 6.1% | Jul 15 5:30 | |

USD Returns from Greece Rally to Retail Sales at Home

Just at a time when the US dollar was soaring on the rationale that a Greece deal will open the path for the Fed to tighten as early as September and on falling oil prices from a nuclear deal with Iran, the greenback half of its gains from Sunday evening's open on a 0.3% decline in US June retail sales, disappointing expectations of a 0.3% rise and a downward revision of the prior reading to 1.0% from 1.2%. It was the biggest monthly decline since February's supposedly weather-driven 0.5% decline. Earlier, the US NFIB Small Business Optimism Survey Index plunged to its lowest level since March 2014. The latest US data disappointment sends the ball back to Fed Chair Yellen as she testifies to Congress tomorrow about the US economy and will likely begin to turn the September/December rate hike debate into a December/2016 debate.

DAX30 gives up at the 100-DMA, while the S&P500 pauses at 2100, just below its 55-DMA.

A new Premium trade will be issued later today.

Carney Lifts Sterling – from CPI to Earnings

GBP adds to its gains, outperforming all major currencies after Bank of England governor Carney said the time for a BoE rate hike is moving closer, lifting GBPUSD by 105 pips to 1.5603. The statement was made 90 minutes after the latest UK CPI data showed inflation slipping back to 0% in June following 0.1% in May. Carney's remarks maintained GBP strength as he went on to acknowledge the recovery in earnings growth and the reduction in household debt (seen as a barrier to higher rates).

Wednesday's release of UK June jobs & May earnings could be instrumental in further boosting GBP if earnings growth rises by the expected 3.0% from the prior 2.7%, in which case would be the highest increase since January 2009. Even a disappointing reading in jobs is likely to be shadowed by positive earnings growth figure, thus, favouring the currency. GBPUSD is showing a doji candle on the weekly, coinciding with the April trendline support and will have to close above 1.5580 to break above the June trendline resistance.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Advance Retail Sales (JUN) | |||

| -0.3% | 0.3% | 1.0% | Jul 14 12:30 |

| Retail Sales (ex. Autos) (JUN) | |||

| -0.1% | 0.5% | 0.8% | Jul 14 12:30 |

| Retail Sales Ex Auto and Gas (JUN) | |||

| -0.2% | 0.4% | 0.5% | Jul 14 12:30 |

| Retail Sales Control Group (JUN) | |||

| -0.1% | 0.3% | 0.7% | Jul 14 12:30 |

| BRC Retail Sales Monitor - All (JUN) (y/y) | |||

| 1.8% | 0.0% | Jul 13 23:01 | |

| Fed's George Speech | |||

| Jul 15 0:15 | |||

| CPI (y/y) | |||

| 0.0% | 0.0% | 0.1% | Jul 14 8:30 |

Oil Won’t Stay Overshadowed

In less-hectic times, the 13% drop in WTI crude oil prices since the start of the month would be the focus in markets but it's fallen to the wayside. That doesn't mean it's not an excellent opportunity.

WTI has been ranging from $51-$54 for the past week after a sharp drop to begin the month. Iran negotiations have massive implications for crude. The latest self-imposed deadline for a deal is midnight ET today but that could be extended. There are signs that an agreement is close; there was even a rumor of a planned photo op at 0000 GMT but it will probably only be a press conference.

Unlike Greece, the negotiations have taken place behind closed doors and with relatively few self-serving leaks. The stakes are enormous and in oil markets it could mean a doubling of Iranian production and a wave of stored crude hitting the market.

Crude has found some support above $50 but there is very little technically from preventing a return to the March low at $42.10.

The implications are especially high for the Bank of Canada as they weigh the impact of falling oil on the economy. Crude is well below their assumed $60 price and Canadian oil is selling at a $12 discount, compared to $8 in June.

The BOC decision is on Wednesday and the OIS market is pricing in a 40% chance of rate cut. Poloz hasn't hinted about a rate move but after his January surprise, the market is unsure. He's likely to stay on the sidelines but a strong hint at a cut would do just as much damage to CAD as a cut with a neutral bias.

In the immediate term, the Asia-Pacific calendar is light with only June NAB business confidence for Australia on the docket at 0130 GMT. Watch for headlines from Greece and Vienna, where the nuclear talks are taking place.| Act | Exp | Prev | GMT |

|---|---|---|---|

| NAB's Business Confidence (JUN) | |||

| 7 | Jul 14 1:30 | ||

Euro Down on Deal Doubt

The Eurogroup gave Greece two options 1) take a five-year 'time-out' from the Eurozone 2) Enact legislation by July 15 to unlock emergency funds and begin negotiations on a third bailout.

Passing the legislation would be a capitulation for Tsipras and Syriza. There are six demands including a VAT hike and pensions cuts, which are two of Syriza's 'red lines'. From there it gets worse as officials from Greece's creditors want full access to government ministries and a veto over relevant legislation. They also want workers laid off and 50 billion euros of state assets transferred to a fund in Luxembourg; a clause that may be the most problematic.

Greek banks will almost certainly remain closed next week as there are no provisional lifelines. The ultimatum isn't yet final and it could be watered down but the focus is now on the reaction from Athens. Syriza lawmakers are calling it a 'humiliation' and even if they wanted to, it may be technically impossible to pass the legislation before July 15.

The euro fell to 1.1089 in early trading but has rebounded to 1.1116 from 1.1175 at the close on Friday. The early market reaction may understate the grave situation. If Syriza balks today, a Grexit is virtually assured.

The other main weekend negotiation was in Vienna where Iran and nuclear powers met. Talks have been tense but are reportedly making progress ahead of tomorrow's deadline. The result will be critical in oil markets in the days ahead.

A few items on the calendar include Chinese money supply, foreign reserves, Australian credit card purchases and a third reading on Japanese industrial production but none is likely to move markets.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -99K vs -99K prior

JPY -64K vs -79K prior

GBP -23K vs -13K prior

AUD -22K vs -12K prior

CAD -32K vs -23K prior

CHF +6K vs +7K prior| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (MAY) (m/m) | |||

| -2.1% | -2.2% | Jul 13 4:30 | |

| Industrial Production (MAY) (y/y) | |||

| -4% | Jul 13 4:30 | ||