Intraday Market Thoughts Archives

Displaying results for week of Dec 15, 2019استغلال ظاهرة الين الياباني المتكررة

يظهر على الين الياباني ظاهرة معينة تتكرر في بداية كل عام، فما هي هذه الظاهرة وما هي العوامل المؤدية إليها؟ وكيف يمكن الاستفادة منها في تداولاتكم؟ التفاصيل مع خبير الأسواق العالمية أشرف العايدي في الفيديو التالي

Manufacturing and Negative Rate Blues

The US dollar struggled on Thursday after a poor factory reading while Sweden's Riksbank cast a vote against negative rates. On Thursday, the Australian dollar led the way while the pound lagged as it has all week. US PCE data and Canadian retail sales are up next. Ashraf noticed peculiar developments in markets yesterday, as tweeted below.

The weak Philly Fed on Thursday gives us another chance to highlight the risks around pricing in a turn higher in economic activity in 2020. The Philly Fed was at +0.3 versus +8.0 expected .The miss kicked off a slump in the US dollar against the yen and re-emphasizes that there are few signs of a pickup in global factory activity despite lower interest rates.

In Sweden, the Riksbank move to raise its benchmark rate to zero from -0.25% is more-notable for the 'why' than the 'what'. Inflation is Sweden is under 2% and projected to stay this way and growth is forecast at just 1.2% next year. Those aren't the conditions for hiking rates anywhere but the move wasn't about the economy, it was about side effects. In raising rates the central bank warned if negative rates continued for too long “the behaviour of economic agents may change and negative effects may arise”.

ECB voices are growing louder to re-think negative rates. It was also notable that the currency reaction to the move was modest and that's something that could ease ECB worries.

Looking ahead, today is the final fully-staffed trading day of the year on most desks. Flows should lighten substantially from here but not until a pair of key economic reports. The November US PCE report may disappoint on the spending side if the retail sales data is any indication. The consensus is +0.4% but last week's retail report was +0.2% compared to +0.5% expected and many of the estimates haven't been updated since.

We also get a look at Canadian consumers but note that this is data for October. With this week's slump in the pound, the loonie is now the year-to-date winner in developed-market FX. With oil strong it's not likely to give up the title at this point but a strong reading could set it up for a year-end flourish.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (m/m) | |||

| 0.2% | 0.2% | Dec 20 13:30 | |

Six Early Themes for 2020

It's time to start looking towards 2020. Even with that in mind, we emphasize that the important themes now will undoubtedly change. At the start of 2019 the Fed was in a hiking cycle, but by year-end the entire world was easing (except for Sweden). The Brexit drama took an uncountable number of turns and the US President has just been impeached. Ashraf reminded us here, 2019 may be like 1998 when the Fed did 3 mid cycle rate cuts and a US president was impeached in December of that year.

تحديث فني مهم على الإسترليني (فيديو المشتركين)

1) Circle November 3

One thing that's certain is that US politics will resonate into the year ahead. A conviction in the Senate is a remote possibility, but an election on November 3, 2020 is a certainty. The question for the first half of the year will be who will lead the Democratic party into the election. Biden currently leads in betting markets at about 31%, followed by Sanders at 21%, Warren at 15%, Buttigieg at 14% and a rematch with Clinton at 10%.The only prediction we're comfortable making at this point is that this will be the dirtiest, most bitterly-contested Presidential election of our lifetimes. Undoubtedly, America will be left more divided and that leaves the dollar more vulnerable in the long term.

2) Oil Risks are Underappreciated

A second theme is turmoil in the oil market. We've highlighted the narrow range in crude this year and how narrow ranges often precede breakouts. The supply side is where the intrigue lies. The downside risk is that production in Saudi Arabia, Iran and/or Venezuela return to the market. The upside is more intriguing because there's a growing risk that US shale production will disappoint. There is $71 billion in US oil production debt coming due in the next 7 years and it'll be a nightmare to refinance with much of the shale industry still failing to generate profit. The industry raised money on the promise of profitability at $20/barrel but it's increasingly clear there are still no profits at $55/barrel. Rather than 5 more years of production growth, US crude volumes could peak in 2020 and leave the market undersupplied and trigger a run on energy bonds that could spread from there. Democratic candidates are threatening to ban fracking in another potential risk but at the very least there will be a debate about egregious flaring practices and that will drive up industry costs.3) Negative Thoughts on Negative Rates

In Europe and Japan a debate is brewing about the wisdom of negative rates. The simplified version is 1) they haven't worked out how to boost inflation and, 2) the costs to banks may outweigh the benefits. It would take a crafty climb-down from central banks to reverse the policy but the debate is going to gather steam.4) Spend the Free Bond Market Money

The other debate that isn't going to go away is on the need for fiscal stimulus. Japan rolled out yet-another package in December that Abe says will boost growth by 0.5 pp to 1.4% in 2020. Economists see just 0.3% GDP growth next year.In the eurozone the outcome is even tougher to handicap. The consensus for growth is just 1.0% and Merkel and her austere grand coalition is losing its grip on power. With rates so low it will be tough for European nations – including the UK – to resist loosening fiscal policy. The question is: How much pain will there have to be first?

5) The Place to Be for Global Growth

The beaten-up antipodeans are the best gauge of global growth for 2020 with both at compelling levels. AUD/USD continues to flirt with the 200-day moving average and industrial metals/materials prices are rising from depressed levels. If the truce in the trade war holds, there's further value here.6) Brexit Blues

Must we mention Brexit? The painfully short honeymoon after Boris Johnson's election win is puzzling. We would have expected some instinct towards policies to stimulate growth, or at least some reform, but instead Johnson has reverted to Brexit brinksmanship. It's dispiriting to think that UK politicians have become so adept at playing Brexit games that they've forgotten about the job of governing. Do Fitch and S&P know something that we don't, when they stated Boris Johnson will in fact extend the transition period?Election Pop Burst

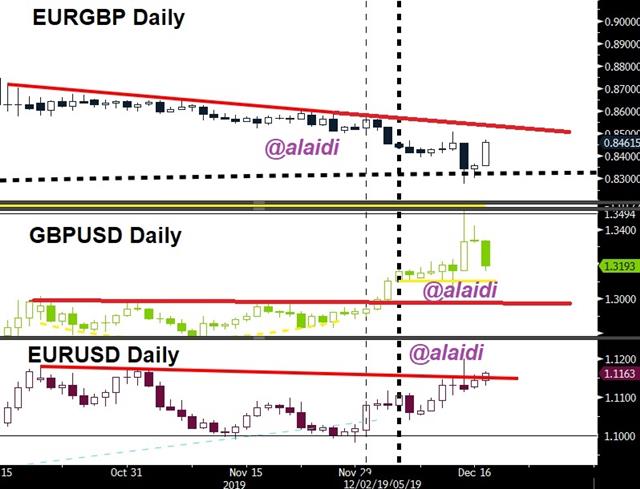

The pound has given back all of its election night gains in a sharp fall Tuesday after Boris Johnson pledged that he wouldn't extend the transition period. GBP is trading below 1.31 after UK Oct CPI remained unchanged at 1.5% y/y and core at 1.7% y/y. Eurozone Oct CPI stood unchanged at 1.3%. Canadian CPI is due up next. Below is the Premium subscribers' video, focusing on updating crucial technicals on GBPUSD following the loss of all post-election gains.

The market honeymoon for Conservatives abruptly ended Tuesday after the party said it would add a new clause to the Brexit bill that would rule out any extension to the transition period beyond December 31 2020.

That will leave the EU and UK just 11 months to negotiate a new trading relationship. Johnson insists that the existing relationship makes that a realistic deadline but EU officials point to the seven years it took to negotiate the Canada-EU pact as evidence it will take longer. Barnier was recorded telling MEPs earlier this month that at best the timeline would mean a bare-bones agreement.

Cable fell more than 200 pips on the news and is now at 1.3090s, almost precisely where it was before the election exit poll was published.

There was a slice of good news on the GBP front early in Asia as both S&P and Fitch upgraded their UK outlook to stable from negative on falling hard Brexit risks. Interestingly, S&P saw "receding" risk of no deal, expecting an "extension to transition period beyond December 2020".both agencies stated that Johnson would eventually extend the transition period. Eyes turn towards Thursday's BoE's take on the post-elections climate and Friday's discussion of the Brexit transition period in Parliament.

Aside from the pound, economic news was light but generally positive. US industrial production, housing starts and JOLTS all beat estimates. In markets, oil continued to make fresh post-Saudi attack highs. Another profit warning from FedEx will be seen how it impacts Dow Transports.

Looking ahead, the economic calendar is important for the Canadian dollar including CPI, house price data and weekly oil inventories. Canada is one of the few countries with above-target inflation and might be the canary in the global coalmine if prices start to run. The consensus for Wednesday's report is +2.2% on the core and +1.9%-+2.2% on the three core measures. So far, inflation hasn't captured the market's attention but a further rise might change that.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (m/m) | |||

| -0.1% | 0.3% | Dec 18 13:30 | |

| CPI (y/y) | |||

| 1.5% | 1.4% | 1.5% | Dec 18 9:30 |

| FOMC's Evans Speaks | |||

| Dec 18 17:40 | |||

| JOLTS Job Openings | |||

| 7.27M | 7.01M | 7.03M | Dec 17 15:00 |

EUR GBP USD Triangularity

Pound loses all of its post-elections rally after PM Johnson said he would not extend the transition period allowed for reaching a trade deal with the EU beyond Dec 2020 (more below). US economic data on Monday was mixed as the market eases back towards evaluating the growth outlook. The euro is again the top performer on Tuesday, with EURUSD rising for the 3rd straight week, something it has done ONLY TWIC over the last 18 months. UK employment data was mixed, showing fresh declines in unemployment but weakening wage growth. Ashraf summarizes the EUR-GBP-USD situation in his tweet below. US Industrial production and housing starts/permits are next.

Cliff-edge Headlines are Back?

Johnson's insistence to complete a trade deal by Dec 2020 is viewed by the media as "taking Brexit through Cliffedge", because it implies forcing a Brexit trade deal on WTO terms even if no trade deal is reached within 12 months. This has led to GBP selloff, especially as EU negotiators said it's highly unlikely a Canada-style trade deal could be completed within 12 months. Whether Johnson is using the threat of a hard Brexit as a means to rush through negotiations with the EU remains to be seen.Global PMIs

The next leg in broad markets will depend on the strength of global growth indications in 2020. It will be weeks before we have a better idea of how strong the economy is but the market is already pricing in at uptick in growth. It's clear now that most data points have stabilize since September but few have turned aggressively upward.On Monday, the Markit US services PMI was at 52.2 compared to 52.0 expected. That's an improvement from the 50.7 low in October but still well-below 56.0 in February. On the manufacturing side, the index was at 52.6 compared to 52.6 expected. That's flat from the prior month and there was no improvement in new orders.

Along the same lines, the Empire Fed manufacturing index was at +3.5 in November compared to +4.0 expected. It remains squarely in the doldrums.

One spot that's inarguably turning higher is housing. The sensitivity to interest rates in the past two years has been remarkable. The home builders sentiment survey rose to a 20-year high on Monday at +76 vs +70 expected. In a global sense, US house prices are still relatively low so that sector could be a sustained source of growth, especially with the Fed firmly on the sidelines.

Globally, the picture is also mixed. Markit's eurozone manufacturing PMI deteriorated to 45.9 in December compared to 47.3 expected. That was just a shade above the September low. In contrast, weekend industrial production data from China was a bit stronger than anticipated.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Flash Manufacturing PMI | |||

| 52.5 | 52.6 | 52.6 | Dec 16 14:45 |

Calendar Considerations

The stripped-down Phase One deal failed to match early reports and that sparked some risk aversion, but the week ahead is more likely to be about flows and calendar effects than news. Today's US econ data include the Empire Fed (exp 4.0 from 2.9) and Dec Markit PMIs. All major currencies are up vs USD today after the pound was the top performer last week as the yen lagged. The video below shows how GBP has achieved a feat not seen since 1996 and what the JPY has done in 12 out of the last 25 years. CFTC positioning data continued to show reduced net short in sterling, but last week's positioning commitments (due Friday) will be closely watched to see how they unfolded on Elections Thursday.

Last week cleared up most of the outstanding fundamentals issues for the year and now market participants will get to the messy business of closing up their books for year-end. The structure of the calendar this year leaves this week as the de facto final week of the year. This time of year makes it tougher to explain day-to-day moves. It is said that seasonal surge in USD demand leads to some short-bouts of USD gains, but none has been seen so far.

Early trading Monday has included some pound strength that's likely residual and real-money buying post-election. GBP jumped to as high as 1.3422 in the early hours of EU trade before dropping a full cent ahead of what proved to be a disappointing set of UK PMIs (composite slipped to 48.5 from 49.3 vs exo 49.5).

In the bigger picture, there is a tight focus on liquidity into year-end. The Fed ramped up repos purchases, but that might not be enough. Expect a quick reaction from the Fed if there are any problems. At this point, we tend to believe that any 'black swan' that has been well-covered and publicized that it can't possibly come to fruition but we may be overestimating the Fed.

This is also the week when the traditional Santa Claus rally gets underway. Tax-loss selling is usually over after the 15th of the month so the coast is clear. At the same time, no one has forgotten the massacre in stocks that started at this time last year.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -68K vs -69K prior GBP -23K vs -30K prior JPY -44K vs -48K prior CHF -21K vs -22K prior CAD +21K vs +21K prior AUD -37K vs -36K prior NZD -25K vs -21K prior

The pound net short is about 25% of the extreme levels in August but it's still sizeable undoubtedly some of that cleared out on election night and in the aftermath. The question now is: Can UK Conservatives convince market participants to build a net long position in the pound? A quick Brexit backed up with some growth-friendly initiatives would go a long way.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Flash Manufacturing PMI | |||

| 52.6 | 52.6 | Dec 16 14:45 | |

| Flash PMI Manufacturing | |||

| 47.4 | 49.1 | 48.9 | Dec 16 9:30 |

ندوة أشرف العايدي مع أوربكس مساء الثلاثاء

ما هي أخطاء التداول التي ارتكبناها في عام 2019؟ انضموا إلى ندوتي المجانية يوم الثلاثاء الساعة 10 مساءً بتوقيت مكة المكرمة للتعلّم من أخطائنا وضمان عدم تكرارها. للتسجيل من السعودية فقط الرجاء النقر هنا و للتسجيل من باقي دول العام الرجاء الدخول هنا