Intraday Market Thoughts Archives

Displaying results for week of Feb 15, 2015Greece and Germany Square Off

The hours are winding down on the latest supposed deadline in Greek negotiations, we break down what to watch for. On Thursday, the US dollar recovered from the post-FOMC minutes drop and was the top performer while the Swiss franc continued to lag. The Asia-Pacific calendar is quiet as Lunar New Year holidays continue. Our Premium trades include GBPUSD, GBPCHF (currently netting 180 pips), GBPUSD( +50 pips), USDCAD, NZDCAD and AUDNZD.

The Greek austerity fight has morphed into a five-year battle with the generals in Athens and Berlin. At other times, the market would have jumped or plunged on Thursday's headlines and rumors of a deal extension or not but the market was generally tuned out.

But there could be a knockout blow (or at least a knockdown) on Friday. MNI sources reported that many Eurozone members feel a deal is close enough for compromise but Germany is driving a hard line. A letter from Berlin said the Greek bailout extension request should be three sentences not thirty pages and boil down to 'we will honor current agreements.'

EUR/USD also reflects an unease, uncertainty and perhaps a disinterest until there is some clarity. It has settled back into the middle of the recent range close to 1.1365 after a failed attempt at 1.1450 on Wednesday.

A question that troubles us is, what is the real deadline? The posturing of the deal suggests it's Friday but unless that is the true last minute (it's probably not) then one party or another will grandstand. At least that has been the pattern for the past 5 years. Deals in Europe just don't get done until the last minute, that leaves considerable headline risk on Friday as Germany tries to score some political points before the true deadline.

A New Challenge to the Currency Crown

The US dollar fell after the FOMC minutes but market participants are left with a familiar feeling of 'what else is there?' But this time there could be a new challenger as cable rallied again to lead the way. The loonie and Swiss franc lagged. Japanese trade data is due next. In today's Premium insights, we issued a new GBP trade in addition to the GBPCHF (currently netting 220 pips), GBPUSD( +90 pips), USDCAD (+110 pips), while other trades include NZDCAD and AUDNZD. Today's trade is accompanied by 3 charts, a technical and fundamental explanation.

The FOMC minutes were the highlight of the day as the FX market got a momentary reprieve from following Greek headlines. The Fed statement after the Jan 28 meeting left a distinct hawkish impression and helped the US dollar but the Minutes were much more cautious, with many participants saying they were inclined to stay at zero for longer.

But keep in mind that the Minutes are a snapshot of how the Fed saw the world three weeks ago. Oil is 15% higher since then, stocks are at a fresh record, yields are higher and non-farm payrolls were extremely strong. The Fed will probably want to have a June hike as an option and the only way to do that is by removing 'patient' from the statement.

The rates market is a solid reflection of the change after the minutes with the probability of a June hike falling to 54% from 64%.

Even if the Fed stays on the sidelines, traders will struggle to hold other currencies. Kuroda gave a fresh green light to more yen weakness after the BOJ and Sankei reports today that the BOJ could delay the timing of hitting its 2% inflation target, something that would diminish pressure to do more QE.

The commodity bloc remains tied to commodities, including a steep fall in crude prices late in US trading after a massive build in API inventories. And the Eurozone is still in a Greek existential crisis.

The other bright spot might be cable. After a sharp fall to start the year, it's been climbing steadily. The BOE sees inflation rising 'fairly sharply' next year and the urgency to hike could come sooner after wages rose 2.1% in Q4 compared to 1.7% expected.

In the near term, the focus in on Japan with January trade data due. The yen is helping with exports expected up 13.5% y/y but a 1.6T yen deficit is still a headwind to growth.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Exports (JAN) (y/y) | |||

| 11.9% | 12.9% | Feb 18 23:50 | |

| Exports (JAN) (m/m) | |||

| 15,776M | Feb 19 7:00 | ||

GBP resumes rally on stellar UK jobs report

The positives of the UK jobs figures are broad-based as the unemployment rate –measured by the ILO– dropped for the 3rd straight month to reaching 5.7%–its lowest since August 2008. Earnings rose by 2.1% y/y in the 3 months ending in December, reaching their highest level since Q2 2013, while earnings excluding bonuses slipped to 1.7% from 1.9%, meaning that pay growth after inflation grew at the highest level in nearly 6 years. jobless count fell by 38,600, well above expectations of a 25,000 decline. More on the charts and BoE minutes.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Jobless Claims Change (JAN) | |||

| -38.6K | -25.0K | -35.8K | Feb 18 9:30 |

Safe Havens Slump, BoJ Next

Gold and bonds fell on Tuesday, we look at why safe assets are less in demand. The kiwi was the top performer on better milk prices while the yen lagged. JPY will remain in focus with the BOJ next but an early taste of the BOJ decision came from the Japanese press. CAD was the 2nd performing currency and our Premium short in USDCAD at 1.2575 is +190 pips in the money. GBPUSD and 4 other Premium trades are in progress in our latest Premium Insights.

Gold fell more than $20 while US 10-year yields moved up 14 bps to 2.14% in the most-notable moves on the day. Higher yields helped USD/JPY climb as high as 119.40, up more than a cent from early in the week.

Signs of a thaw in Greek negotiations are evident with newswire reports about a Greek request for an extension to come on Wednesday. The semantics of the deal have quickly grown esoteric so we caution trading headlines until there is some genuine clarity.

Deposit outflows remain acute and that is the major risk to the slides in gold and bonds. Otherwise, US stocks touched a fresh record high Tuesday and the overall risk profile sanguine; at least in the near term.

Up later it's the BOJ decision. To start the week USD/JPY fell on reports from sources that the BOJ no longer wants to see additional yen weakness. The latest leak was from Nikkei and said the BOJ is considering raising its assessment on output. It comes after a soft Q4 GDP report but that could mean better growth in the months ahead.

Note that Lunar New Year holidays are now underway and will continue to ramp up for the remainder of the week and into next. That may add volatility to Asia-Pacific trading.

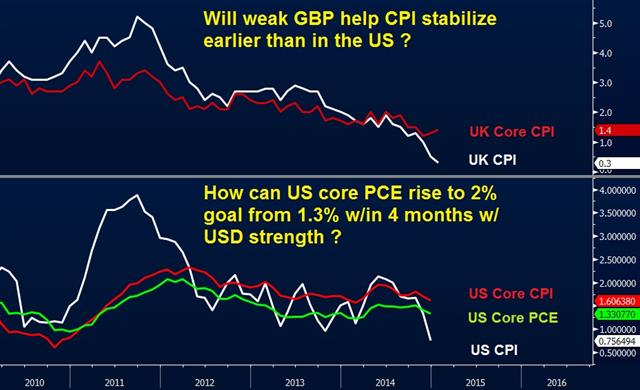

Beyond UK CPI & onto BoE, Fed Minutes

UK CPI fell to 0.3% -- the lowest since 1960, but both the pound and gilt yields held up as the CPI figures were in line with the figures anticipated by the BoE's quarterly inflation report. Here is why the report remains a short-term positive for the British pound. Full analysis here.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Bank of England Minutes | |||

| Feb 18 9:30 | |||

Greek Deal or No Deal, RBA Next

Tough talk from Greek meetings led to a swift drop in the euro but a deal might be right around the corner. The kiwi was the top performer while the euro lagged. Existing Premium trades include USDCAD, AUDNZD, and NZDCAD, with AUDNZD totalling more than 200 pips in the green. The RBA minutes are due next.

The US and Canada were on holiday to start the week so that sapped liquidity and might have led to an exaggerated move in the euro. The general theme was USD strength but we're skeptical until New York returns.

All eyes were on Brussels where talks between EU ministers and Greece took place. Early in the day, there was talk of a deal on an extension and that kept the euro pinned to 1.1410. But it unraveled as both sides appeared inflexible and the euro skidded to 1.1320.

The eurogroup is essentially insisting that the broad strokes of previously-agreed deals remains in place while Greece wants more concessions. “Any new program for Greece would not look much different than the current one,” Dijsselbloem said.

He indicated that Greece must accept that demand before Friday. The past 5 years of Greek negotiations have been no stranger to brinksmanship and this one won't be any different. On the positive side, Greece's finance minister brushed off worries and said he expects a deal within 48 hours.

There is always the risk of a blowup but the slump Monday in the euro might be overdone. Officials are discussion a 4-month extension and that's hardly the hill either side wants to die on.

Otherwise, cable was a laggard in a full cent fall after an early rally. USD/JPY stabilized near 118.45 after an opening fall. A puzzling move was USD/CAD as it climbed a quarter cent despite a small rally in oil. That may unwind as liquidity returns to the pair.

In the near-term the focus is on the Australian dollar with the Feb RBA minutes due at 0030 GMT. The decision to cut rates was a close one. Stevens said last week that “the economy could use some help, so we eased,” last week, but there hasn't been much guidance about what will happen next.

At the moment, the national pride in Australia took a hit as AUD/NZD touched an all-time low on Monday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA Meeting's Minutes | |||

| Feb 17 0:30 | |||

| Philadelphia Fed's Plosser speech | |||

| Feb 17 17:45 | |||

USD Lower to Start Week, Yen Shorts Thin

The US dollar continued lower as markets re-opened for the week. The New Zealand and Australian dollars are the best peformers but Chinese money supply data may be a warning sign. Up later it's Chinese GDP. USDCAD, AUDNZD, NZDCAD are among the Premium trades, currently in progress in the Premium Insights.

The US dollar starts this week in much the way it ended the last one – on its back foot. The moves are relatively minor except for a 15-20 pips in cable and AUD/USD along with a 42 pip rally in the kiwi on a 1.7% q/q rise in retail sales compared to 1.3% expected. Weekend news was generally benign as a skeptical ceasefire gets underway in the Ukraine.

M2 money supply data is difficult to interpret but early-week Chinese data showing the slowest pace of growth since records began in 1998 grabbed some headlines. The good news was on the lending side with new loans at a 5-year high at 1.47T yuan compared to 1.35T expected. The money supply could represent capital outflows but it could also spark easing from the PBOC.

Looking ahead, preliminary Q4 GDP data from Japan is due at 2350 GMT and expected to show the economy exiting recession with 0.9% growth and a solid 3.7% growth pace. A key focus will be on exports and consumption as consumers finally adjust to the sales tax hike from April.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -195K vs -196K prior JPY -55K vs -60K prior GBP -38K vs -42K prior AUD -53K vs -56K prior CAD -33K vs -27K prior CHF -5K vs -5K prior

Most pairs didn't move significantly in the past week and that was reflected in a market that lacked any strong directional bias. What's notable is the continued fall in bets against the yen. It's the least-bearish net position since July 22, 2014. USD/JPY looked like it might break out last week but was quickly reeled in. It starts the week at 118.65.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Annualized (Q4) [P] | |||

| -1.9% | Feb 15 23:50 | ||

| GDP (Q4) (q/q) [P] | |||

| 0.9% | -0.5% | Feb 15 23:50 | |

| GDP Deflator (Q4) (y/y) [P] | |||

| 2.1% | Feb 15 23:50 | ||

| Retail Sales (q/q) | |||

| 1.7% | 1.3% | 1.6% | Feb 15 21:45 |

| M2 Money Supply (JAN) (y/y) | |||

| 10.8% | 12.1% | 12.2% | Feb 16 2:00 |