Intraday Market Thoughts Archives

Displaying results for week of May 15, 2016Dollar Stumbles Despite Dudley’s Help

Hawkish hints from the Fed's Dudley failed to boost the US dollar Thursday in what's a mild setback for the USD bulls. The yen was the top performer on the day while the Canadian dollar lagged. The Asia-Pacific schedule is light but the G7 finance minister meetings are underway in Japan. USDCAD was stopped out, while one CAD trade remains open ahead of Friday's double Canadian release of retail sales and CPI.

Dudley is generally a more-dovish FOMC member but he endorsed market pricing of a June hike at 30% and July at almost 50% in a press briefing. He said a hike will depend on data and emphasized that growth will need to pick up but overall he confirmed the hawkish message from the FOMC Minutes.

That should have given another lift to the US dollar but it didn't. Instead the dollar gave back about 50 pips of gains across the board as the day wore on. Economic data was a small factor as the Philly Fed business outlook, Chicago Fed national activity index and initial jobless claims all missed estimates, albeit only slightly.

The Fed's Fischer also spoke but avoided monetary policy while Lacker was hawkish as usual but also said the Brexit vote could keep the FOMC on the sidelines in June.

Still, that lack of dollar momentum into the end of the day was a disappointment. After the FOMC Minutes, dollar bulls had a strong reason to buy and Dudley confirmed it. Breakouts in EUR/USD, USD/JPY, USD/CAD and AUD/USD looked to be under way. But instead of picking up momentum on the breaks, the dollar stumbled and retraced.

For now, it's only a minor setback for the US dollar but it's a concern and something we'll be watching on Friday and into next week.

For the G7, note that this weekend is for central bankers and finance ministers while next weekend is the leader's summit so there will be no statement. Media reports say Japan and Canada are pushing their counterparts for more fiscal spending but Germany is resisting and the US is focused on FX.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Philadelphia Fed (MAY) | |||

| -1.8 | 2.7 | -1.6 | May 19 12:30 |

| Continuing Jobless Claims (JUN 07) | |||

| 2152K | 2165K | May 19 12:30 | |

| Initial Jobless Claims (JUN 14) | |||

| 278K | 278K | 294K | May 19 12:30 |

Dollar Days Are Back

The FOMC Minutes shook up sleepy June hike expectations and set the stage for a far-more-interesting month ahead. The US dollar jumped on the headlines but GBP was still the top performer on the day. Japanese machine orders and the Australian employment report are due later. Both Premium trades in GBPCAD and GBPJPY were stopped out. A new Premium trade was added ahead of the FOMC minutes.

The FOMC Minutes are often the most over-hyped release on the calendar but once in a while they rock markets and that was the case Wednesday. The dollar had been under steady pressure and was at session lows moments before the release but it rocketed higher afterwards. The minutes said most Fed members want to hike if growth, inflation and jobs all make progress before the June 15 meeting. In the Fed funds futures market, that sent the implied probability of a hike up to 32% from 14% (and from 4% at the start of the week). The US dollar gained 70-130 pips across the board in the aftermath of the release.

Speeches on Thursday from key FOMC members Dudley and Fischer are now top-tier events and economic data between now and the dollar will be sensitive to every data release.

One line of thinking is that the Fed can't hike ahead of the Brexit vote but the risks there appear to be diminishing. The latest polls show the 'remain' side further ahead than ever and bookies have lengthened the odds of Britain leaving to 4-to-1.

In other central bank news, the chance of an RBA cut in June has fallen to 16% from 25% a week ago. That's after the RBA minutes showed a close call in April. The thinking is that Stevens will wait-and-see rather than moving again but that could quickly change with the release of the April jobs report at 0130 GMT. The consensus is for 12K new jobs and the unemployment rate ticking to 5.8% from 5.7%. As always, watch the full/part-time breakdown.

Technically, the drop in AUD/USD Wednesday led to the first close below the 200-day moving average since March 2. The 61.8% retracement of the Jan-April rally is just below at 0.7213.

The other event on the calendar is the 2350 GMT release of Japanese machine order for March. The strong GDP report yesterday pushes back the BOJ timeline for more stimulus. A press report also said that Abe won't consider delaying the consumption tax increase until after July Upper House elections.

Death Cross not seen since 2001 & 2008

The S&P500 is currently showing a pattern seen in June 2008 and March 2001, both cases in which the index lost more than 30%. Full charts & analysis here.

Ashraf on Bloomberg TV Part 2

The 2nd part of my Bloomberg interview on the "12-month anniversary", the Bank of Japan, the yen and Yellen's choice. Watch.

Ashraf on Bloomberg TV Part 1

My interview earlier today on the US Treasury's publication of Saudi Arabia's treasury holdings. The 2nd part of the interview regarding the yen, yields and stock indices will be posted later today. Full interview.

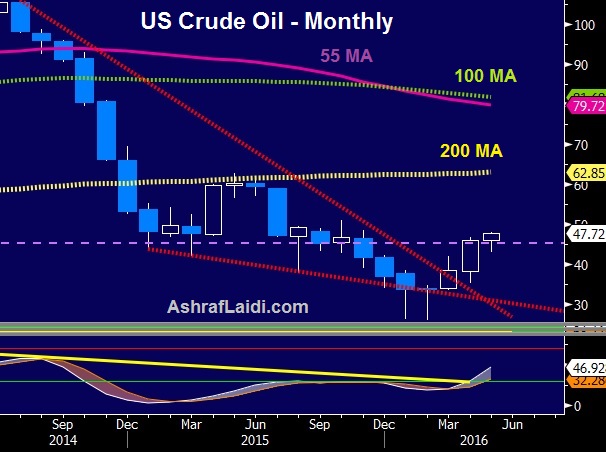

Oil Roars again

There are only two types of oil news lately – bullish and hyper-bullish. Oil hit a six-month high Monday, pushing the Canadian dollar to the top of the FX leaderboard while the yen lagged. The RBA minutes from the meeting where they cut rates are due next. There are 3 Premium trades currently in the Canadian dollar.

WTI crude gained $1.65 to $47.86 on Monday after supply disruptions hit Nigeria and a Goldman Sachs note captured the market's imagination.

Oil gains in the past month have been a triumph of technicals over fundamentals. The lone hard news on Monday was a Genscape report showing another 694K barrels of crude going into storage in Cushing, OK. The Goldman Sachs note raised near-term price forecasts for oil because of supply disruptions.

In a sign of how skewed the market is, crude took off to the upside and finished at the highs. The Goldman note also tempered the medium and long-term oil outlooks because higher prices will bring back shale drillers. For Q1 2017, they now see $45/barrel compared to $55 previously.

The bottom line is that there is no sign of weakness in the oil market just yet.

Another area we are watching is Chinese futures trading. A story that's flown below the radar is the massive jump in volumes of futures trading in things like iron ore, rebar, cotton and oil. Retail traders fell in love with those markets as they gathered momentum earlier this year.

Officials took steps to raise margins in late April and that coincided with the cooling in iron ore and some other commodities but speculation remains rampant. On Monday the Hong Kong Hang Seng China Enterprises Index fell 2.5% in two minutes as futures were dumped.

It may have been an old-fashioned fat finger but given the immaturity of these markets, we fear that some kind of deeper flash crash is a matter of 'if' not 'when'.

Looking ahead towards Asia-Pacific trading, the focus shifts to the Australian dollar. The commodity bloc struggled to make gains Monday despite the rip higher in oil prices. At 0130 GMT the minutes of the RBA rate-cut meeting are out. The market is priced for a 25% chance of a cut at the June 7 meeting, rising to 73% by year-end.

It will be interesting to see how policymakers responded to the sudden drop in inflation. Serious alarm bells could lead to a quick pricing of more-aggressive rate cuts.

The other report to watch is at 0300 GMT when New Zealand delivers Q2 inflation expectations over the next two years. There is consensus estimate but the prior was 1.63%. A similarly low reading or a decline would certainly get the RBNZ's attention.

China Retail Sales Miss, Dollar Sluggish

A slate of weekend Chinese economic data missed the mark. The US dollar was the top performer last week but the weak finish raises questions. CFTC positioning data showed a falling AUD longs and less GBP pessimism. There are 10 Premium trades currently open: 6 in currencies, 2 in commodities and 2 in equity indices.

The outlook for China remains murky and mixed. The attempted transition to a consumer economy is working but not at the pace officials hoped for. April retail sales rose 10.1% y/y, which is a good pace almost anywhere but fell short of the 10.5% expected.

Other parts of the economy are also underperforming with industrial production up 6.0% y/y compared to 6.5% expected and fixed investment up 10.5% y/y compared to the +10.9% consensus. Overall, the numbers aren't enough to raise fresh worried but they won't spark enthusiasm either.

That kind of takeaway is indicative of broader markets. The US dollar had some traction last week and that momentum might have accelerated after strong retail sales and consumer sentiment data on Friday. But after a quick round of gains on the headlines, the dollar flattened out. Against the yen, it fully retraced to finish at the lows of the day.

As exciting as it was for dollar bulls to see the currency edge up despite soft non-farm payrolls; the inability to climb on good data is equally concerning.

In early trading the dollar is largely unchanged. It will need to establish some momentum early answer the doubters.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -22K vs -23K prior JPY +59K vs +61K prior GBP -35K vs -40K prior CHF +7K vs +7K prior AUD +38K vs +52K prior CAD +26K vs +19K prior NZD +9K vs +9K prior

The cut in AUD longs is the notable move. It's the first look at specs since the soft CPI report and RBA cut. Given the continued Australian dollar declines, expect longs to continue to exit.