Oil Roars again

There are only two types of oil news lately – bullish and hyper-bullish. Oil hit a six-month high Monday, pushing the Canadian dollar to the top of the FX leaderboard while the yen lagged. The RBA minutes from the meeting where they cut rates are due next. There are 3 Premium trades currently in the Canadian dollar.

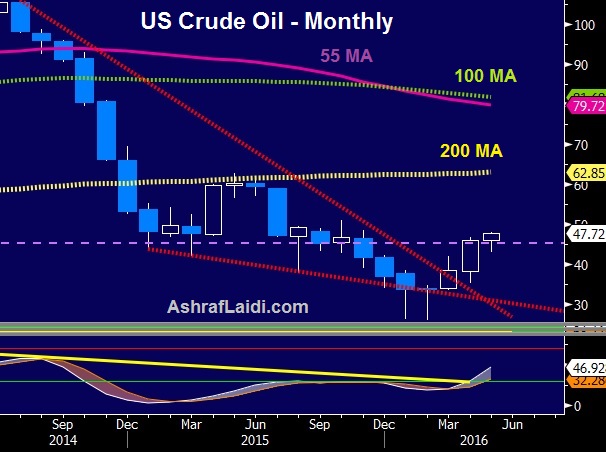

WTI crude gained $1.65 to $47.86 on Monday after supply disruptions hit Nigeria and a Goldman Sachs note captured the market's imagination.

Oil gains in the past month have been a triumph of technicals over fundamentals. The lone hard news on Monday was a Genscape report showing another 694K barrels of crude going into storage in Cushing, OK. The Goldman Sachs note raised near-term price forecasts for oil because of supply disruptions.

In a sign of how skewed the market is, crude took off to the upside and finished at the highs. The Goldman note also tempered the medium and long-term oil outlooks because higher prices will bring back shale drillers. For Q1 2017, they now see $45/barrel compared to $55 previously.

The bottom line is that there is no sign of weakness in the oil market just yet.

Another area we are watching is Chinese futures trading. A story that's flown below the radar is the massive jump in volumes of futures trading in things like iron ore, rebar, cotton and oil. Retail traders fell in love with those markets as they gathered momentum earlier this year.

Officials took steps to raise margins in late April and that coincided with the cooling in iron ore and some other commodities but speculation remains rampant. On Monday the Hong Kong Hang Seng China Enterprises Index fell 2.5% in two minutes as futures were dumped.

It may have been an old-fashioned fat finger but given the immaturity of these markets, we fear that some kind of deeper flash crash is a matter of 'if' not 'when'.

Looking ahead towards Asia-Pacific trading, the focus shifts to the Australian dollar. The commodity bloc struggled to make gains Monday despite the rip higher in oil prices. At 0130 GMT the minutes of the RBA rate-cut meeting are out. The market is priced for a 25% chance of a cut at the June 7 meeting, rising to 73% by year-end.

It will be interesting to see how policymakers responded to the sudden drop in inflation. Serious alarm bells could lead to a quick pricing of more-aggressive rate cuts.

The other report to watch is at 0300 GMT when New Zealand delivers Q2 inflation expectations over the next two years. There is consensus estimate but the prior was 1.63%. A similarly low reading or a decline would certainly get the RBNZ's attention.

Latest IMTs

-

Oil Metrics & Gold Risks

by Ashraf Laidi | Mar 6, 2026 20:39

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35

-

Gold and Silver Repeat June 13 Playbook

by Ashraf Laidi | Mar 3, 2026 13:35

-

How I Grew the Account 5x

by Ashraf Laidi | Mar 2, 2026 11:54