Intraday Market Thoughts Archives

Displaying results for week of Sep 15, 2019More Injections & Brexit Chatter

The Fed injected another liquidity operation, in what still known as a "temporary" measure aimed normalizing liqudity shortage in the short-term funding market. Upbeat comments from the EU's Juncker sent the pound to 6-week highs on Thursday. The Swiss franc remains the top performer Comments from the Fed's Williams and Rosengren are due up next.

تحديث فني و استراتيجي لصفقاتنا (فيديو للمشتركين)

EU Commission leader Juncker said he sent documents to Boris Johnson outlining draft ideas for a new Brexit deal. The Irish border backstop remains the main hurdle and European leaders are waiting on the UK Prime Minister for fresh ideas.

Along with that, Jucker expressed openness about making a deal and warned about the consequences of a no-deal Brexit. The uncertainty alone has been enough to encourage the crowded short-GBP trade to cover. That continued on Thursday as cable rallied to 1.2580 – the highest since July 14. Ashraf made the following observation fegarding GBP and RSI analog between today and exactly 365 days ago.

Equally important to note is how the pound has been able to hold its ground on occasional negative Brexit headlines over the past week. It's an impressive turn in sentiment and a complete reversal from the sour tone of June and July.

Elsewhere, US housing may be demonstrating the power of lower rates. August existing home sales rose 1.3% in the month compared to a 0.7% decline expected. It was the largest one-month gain in two years and follows a trend set by other recent housing indicators. Another month of strong data may give the Fed pause about cutting rates.

With regards to the Fed's latest liquidity injections, it seems inevitable that more injections are due next week when the US Treasury issues a fresh $45 bn in funding. This would prove to be an extra drain of liquidity, which will trigger fresh palpitations in the system, especially as we near quarter-end. Ashraf tells me the Fed has little choice but to formalize a process of systematic balance sheet accumulation.

In other economic news, the Philly Fed was slightly stronger at +12.0 vs +10.5 expected and Canadian ADP employment rose 49.3K (no estimate).

There were signs that China-US trade is creating fresh jitters. A hawkish interview from a White House China advisor in the South China Morning Post erased an early positive tone in US equity markets. With Chinese officials in Washington at the moment, risks are high now and into the weekend.

Economic data and news will be another important spot to watch. The Fed's Rosengren is expected to speak after his dissent and Williams has a speech scheduled as well. We would be reluctant to read anything into comments that weren't from Powell or a core governor but the market is jittery and may think otherwise.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (m/m) | |||

| -0.1% | 0.2% | 0.9% | Sep 20 12:30 |

| FOMC's Rosengren Speaks | |||

| Sep 20 15:20 | |||

Powell Put, or Powell Pause

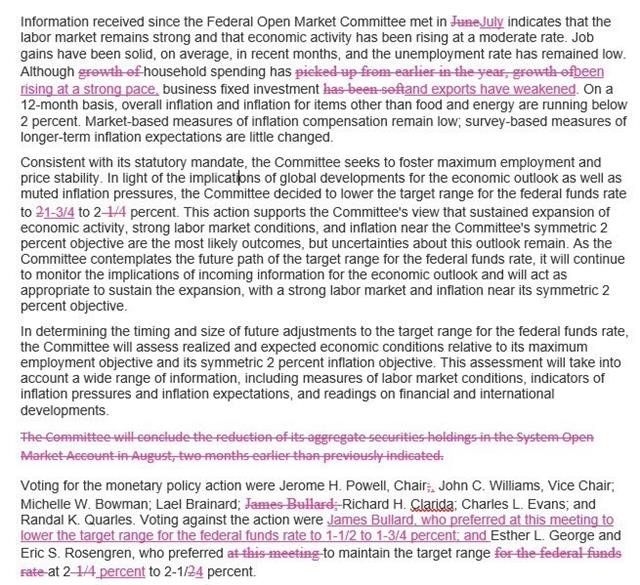

The Fed lowered interest rates as expected but didn't offer a clear sign on what's coming next and that helped to boost the dollar but other markets took a different signal. The pound was the top performer while the New Zealand dollar lagged. The BOE decision is next. A new Premium trade was issued just ahead of the Fed decision, bringing the number of open trades to three. GBP holds firm despite an unexpected decline in UK retail sales. An unremarkable BoE decision is due up next, followed by US jobless claims and Philly Fed survey. The latter, will highlight the divide between the contracting US manufacturing and booming services sectors. Below is the redline comparison of the last two Fed decisions.

A rate cut from the Fed came as no surprise and the statement was virtually unchanged except for a slight upgrade to household spending and a downgrade to exports but it was the dot plot that first caught the attention of the market.

The forecasts showed a clear divide with 10 showing no more cuts this year and 7 forecasting one more move. Similarly, 9 saw the unchanged stance continuing through 2020 while 9 saw a move. The initial reaction was dollar strength and a slump in bonds, stocks and gold.

The moves, however, stalled quickly and equities reversed higher. That may have been the usual buy-the-dips mentality but Powell also hinted the Fed could do more. He emphasized the same hollow data-dependent stance but he indicated that he was worried about low inflation expectations, pleased about workers being pulled off the sidelines and committed to extending the expansion.

That left the market with the sense that a Powell put remains intact. Another clue was that he did not push back against pricing for an October/December cut.

It leaves us unsure about the state of the threshold for economic weakness, which would trigger another insurance move for next month -- but watching data and signals from core FOMC members will be key. If they're not planning on cutting, at some point they need to push back on what's priced in.

Looking ahead, expect the BOE to avoid making waves on Thursday with political stakes around Brexit and an election extremely high. We will also get a look at how markets react to the data dependence pledge with US initial jobless claims, existing home sales and the Philly Fed.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| -0.2% | -0.2% | 0.4% | Sep 19 8:30 |

Fed Injects Liquidity for 1st time since 2008

No, the title is not related to today's Fed decision. It is something related to corporate liquidity. Strains in the short-term funding market added an unexpected twist ahead of Wednesday's FOMC decision, and one that could have important implications. More on this below. The euro was the top performer Tuesday while the Swiss franc lagged. The Fed decision is at 2 pm EST, 7 pm London. A new Premium Insights' trade has been issued yesterday. Another Premium trade will be issued shortly before the Fed decision.

Some final economic data points ahead of the Fed were positive on Tuesday as industrial production cooled worries about manufacturing. The NAHB home builder survey also beat expectations in a sign that lower rates are enticing home buyers.

Those numbers were ignored by markets as the focus turned to a jump in repo lending rates. Short-term funding costs rose as high as 10% and forced the Fed to hastily arrange a $75 billion repo operation. In an embarrassing moment, the first try failed before the Fed got at $53B take-up in the second effort. Another operation is scheduled for Wednesday.

Short-term dollar-funding strains have hit markets before but came at quarter-end and year-end. This mid-month problem was likely caused by a confluence of factors including corporate bond issuance, tax payments and Treasury auction settlement – all of which drain reserves. So why were firms not ready for it?

What has the market worries is that it might not be those factors alone. The Fed's balance sheet runoff was always more art than science and policymakers believed that keeping it near $3.5 trillion preserved ample liquidity in the system. That may not be the case.

If so, the Fed could be forced to announce fresh measures in what would be interpreted as QE-lite. That speculation is likely what drove the dollar lower Wednesday. Other fresh factors to watch now include lowering IOER by 5 bps and a standing repo facility.

In terms of the bigger market move, a 25 basis point cut is priced in and signals about October will be key. The Fed likely still likely to describe it as a mid-cycle adjustment (and that language is key, and would be dollar positive) so the plan is probably to cut once more, then wait-and-see and expect guidance to be vague once again. Also watch out for the FOMC dissenters, possibly 3-way dissent, with Rosengren & George voting to hold rates unchanged, Bullard asking for a 50-bp cut and the rest for 25-bps. A more likely scenario & a bad one for markets is for Bullard to vote along for 25-bps but 3rd dissenter joins Rosengren & George in voting for no cut.

Oil Tests Trump & Powell Resolve

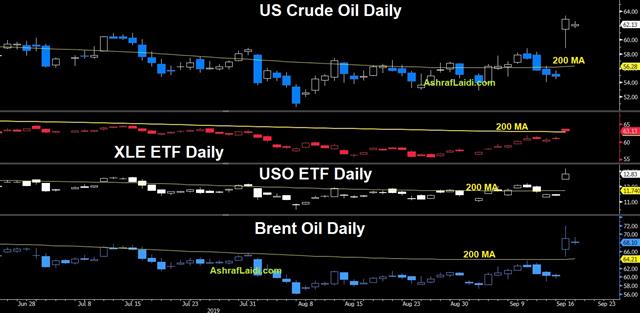

The latest rise in oil prices may jeopardize the already complicated balancing act at the Fed (between containing manufacturing deterioration from the trade war) and Trump's managing of Saudi and Iran without provoking further price ascent. Yet, the US administration continues to send signals about reprisals against Iran and that helped crude to its 4th best day on record Monday. US crude oil is currently trading at $62 (from an earlier $63.38), while Brent is at $68.10 (from $71.95 earlier). CAD loses half of its gains as US equity futures head into the red. EUR is the strongest of the day after better than expected ZEW sentiment survey. Data points on Tuesday include US industrial production and homebuilder sentiment. The Premium JPY trade was stopped out, leaving only 1 trade in progress. A new trade shall be issued ahead of the US opening bell.

Oil finished Monday with an astounding $8 rally in the largest percentage climb since 2009 and fourth-highest on record. The attack on Iran sets in motion a wild amount of possibilities, including war between Iran and Saudi Arabia.

Trump's response has pointed the finger at Iran but stopped short of anything definitive. So far in his Presidency, he has largely ignored the drums of war and his firing of John Bolton underscored that just a week ago. Not to mention the fact, Congress is will unlikely authorise a strike on Iran.

Feel free to participate in this open discussion about oil, Trump, Fed & USD.

This time, he's hinting that action may be in order but his tepid response so far suggests it may be limited. That may mean a further escalation down the line but if so, the market will revert to a focus on fundamentals and the ability of Aramco to bring production back online. On that front, reports vary widely with some suggesting nearly all of it could be restored in two weeks while others say it could be months.

Oil Complicates Fed Odds

Expect oil headlines to be a major factor in the days ahead but the Fed remains a key input. The odds of a cut fell to 95% from 100% a week ago. The oil jump complicates the decision because it creates a series of pros and cons. Higher gasoline prices for consumers and geopolitical uncertainty are negatives, but higher inflation and more investment/profits from US oil firms are positives. Ultimately, it's more of a reason to cut 25 bps as anticipated while sticking with a wait-and-see statement and message. Also, pay attention to the dissent and whether St Louis Fed president Bullard shall stick to his position of demanding a 50-bp rate cut after the oil spike.Saudi Strike Upends More Than Oil

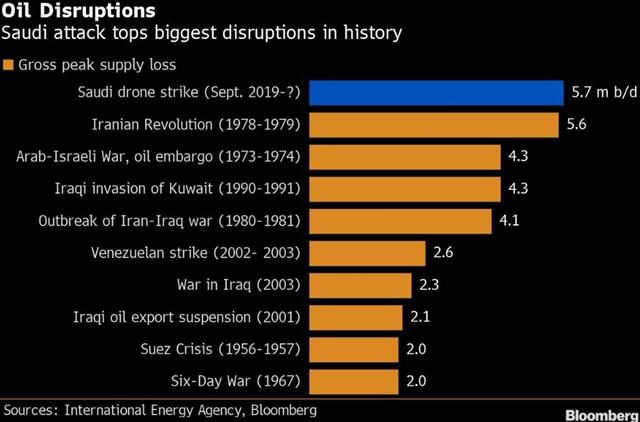

Oil prices are up 8%, paring earlier gains of nearly 20% seen at the Asia open following the wide-ranging attack on Saudi oil infrastructure. The price spike signalled geopolitical worries rather than a loss of production. The chart below shows the attack caused the biggest supply disruption in history, exceeding supply shocks caused by the Iran revolution and the Arab oil embargo. JPY and CAD are today's FX winners, but gold and silver are up against all currencies, recovering from last week's metals slump. The Empire Fed (ISM from NY Fed) is due later, but world markets remain fixated on the US and Saudi response. Do not forget Tuesday's UK Supreme Court ruling on whether PM Johnson's prorogation of Parliament was legal. Then, all eyes shift to Wednesday's Fed decision and Trump's reactions. The Premium oil short was stopped out, leaving two existing trades in progress. New tactical Premium trades will be issued over the next two days.

Japanese markets were closed to start the week but that did nothing to stop a wild open. Brent rose as much as $11.70 to hit $71.95 – the highest since late-May. WTI hit $63.54. Dow and S&P futures were down by as much as 200 and 25 pts respectively before stabilizing.

The attacks cut Saudi production roughly in half, taking 5.7 million barrels per day out of service. Videos of the facilities showed massive fires and report said it will take “weeks not days” to fully restore operations. At the same time, some (if not most) of the production could be restored within a week.

Given ample supplies and reserves globally – including large amounts of oil in storage in Saudi Arabia – the moves in oil cannot be justified by fundamentals. Instead, it's the geopolitical risk that goes along with the attacks, as signified by the $20 jump in gold prices in early trading.

Houthi rebels in Yemen claimed responsibility for the attack, and if that's the case, it marks a leap forward in their offensive capabilities, proving a continuous threat to Saudi oil. The US, however, insisted on blaming Iran, which could lead to US and Saudi strikes in retaliation – something that risks sparking open war. US Secretary of State Pompeo openly pointed the finger at Tehran, but so far the President Trump has refrained from doing the same. If he does, it may signify an imminent reprisal. So far he has said the US is 'locked and loaded' for a response but wants to hear from Saudi Arabia first.

In FX, the Canadian dollar is the early leader with the yen and Swiss franc both attracting bids. The US dollar is generally stable elsewhere. It also adds a wrinkle to Fed thinking. Higher gasoline prices are undoubtedly inflationary but the attacks add a further geopolitical risk.

There are still some final data points for the FOMC to consider as well, including Monday's Empire Fed. The consensus is for a +4.0 reading.