Intraday Market Thoughts Archives

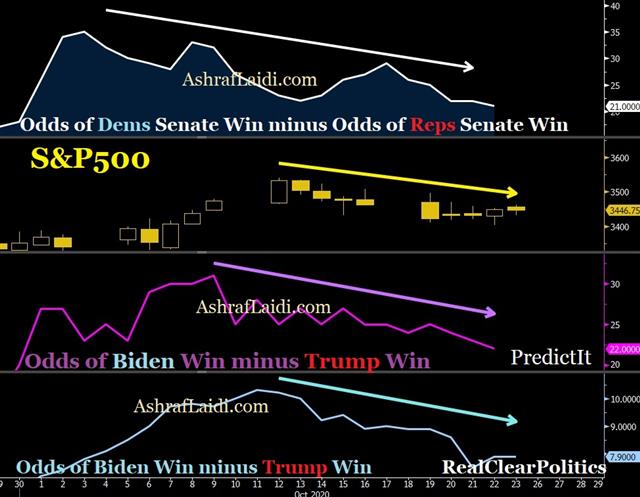

Displaying results for week of Oct 18, 2020After the Blue Wave

1) Lame duck stimulus

The market continues to get bounced around by stimulus headlines but this is clearly a game where neither side wants to appear to be walking away. Pelosi highlighted progress on Thursday but was asked at the end of her press conference if there had been progress on state & local funding or liability, she said 'no'. Those are the two areas that have held up negotiations for months and doom hopes for a real deal.So the question after the election is whether a deal is possible in the lame duck session in November, before the new congress is sworn in. Assuming a blue wave, it appears highly unlikely unless it's something small and targeted towards hard hit businesses like airlines. For the broader economy, it's going to have to wait. That's likely to trigger severe market disruptions even with a huge package on the way in January/February. Can the market look through it? Probably but it will be a tough test.

2) COVID resurgence

France and Holland reported record case numbers on Thursday and the US is clearly seeing an uptick in cases again. US cases regained the 70K mark, while Italy, France and Luxembourg will announce curfews. Another wave is here and the speed of the rise in cases – particularly in France and a few US states – is troublesome. Flu season doesn't peak until February and expectations for growth around 4% annualized in Q4 and Q1 are too optimistic. Again the question will be whether the market can look through it and based on the past six months the answer is that it probably can, but the wall of worry is building.3) Negative rates

Central banks in a number of countries are flirting with negative rates and given the expected virus resurgence and concurrent slowdown, the odds that they're used is rising. The hollowing out of eurozone banks might be a coincidence but the financial sector is one of the big laggards coming out of the pandemic and negative rates are one of the main reasons why. If there's some success in Australia or the UK, could the Fed have another look?Other themes to watch will be: digital currency adoption, rising home prices, inflationary pressures, a green energy boom, OPEC's December meeting, Biden's promise to hike taxes 'on day 1'.

Join Ashraf for his webinar on the latest lntermarket fractals applications next Tuesday (Oct 27) at 17:10 Eastern (21:10 London/GMT) (time difference will be 4 hrs not 5 hrs during that week).

Intraday Trades around Deadlines

With every bluff and missed deadline in Brexit negotiations the market looks more like Charlie Brown repeatedly having the football pulled away at the last moment. We highlighted earlier in the week that a deal was still an 80% likelihood but you can never be sure with politicians.

The EU and UK put the latest spat aside and now will try to hammer out a deal before year end. The same problems on fisheries, a level playing field and dispute resolution remain and there's no way of knowing how far European leaders will go to get their way. For Johnson's part, he issued another threat, saying the UK was prepared to exit on Australia terms.

Sterling certainly bough the headfake as it climbed to 1.3150 from 1.2950 in a break to the highest since September 7. Take it as a sign of a reactive market rather than one sniffing out political outcomes. There's a lesson there for the weeks ahead.

In a larger breakout, Bitcoin soared through the August high and is nearing the target from Ashraf's trade from the March lows. It was a textbook break as it came on the big news that PayPal will let users hold and spend BTC along with three other cryptocurrencies. We await the details -- and fear a prohibitive fee structure – but it's undoubtedly good news as it opens up a market of 26 million merchants and gives crypto a major stamp of approval.

The day ahead features the final Trump-Biden debate. It's the final opportunity for Trump to swing a vote that appears to be getting away from him. We take the latest rise in Treasury yields as a sign the market is betting on more reflationary stimulus – the kind that's only possible in a blue wave.Central Bank Shifts Obscured by ‘Deadlines’

Perhaps we were naïve to think Pelosi's stimulus negation deadline was as advertised. She held another round of talks with Mnuchin on Tuesday as her 48-hour self-declared deadline ticked down. Afterwards, she said negotiations would continue for another day, leaving no sense of when the real deadline is.

We've seen so many Brexit and political deadlines ignored in the past few years that we should have known better. That said, we're now 13 days to the US election and that is a genuine deadline. Next Monday the US Senate will also take up the confirmation of Amy Comey Barratt for the Supreme Court, eating up much of the remaining time. So maybe we weren't naïve to see the deadline as a bluff, but naïve not to see that the real deadline has already passed.

For his part, Senate Republican leader Mitch McConnell said he will have a vote on any stimulus package that passes the House and is endorsed by the White House; but importantly he said the vote would come 'at some point' suggesting it might not be until after the election.

In the world of central banking, the RBA underscored two ongoing shifts in the latest minutes. The first is more open-mindedness towards negative rates, or getting closer to the lower bound. AUD was rattled Tuesday by that talk and the BOC earlier this month also left the door open for negative rates while the BOE continues its long flirtation with the idea.

The second is the abandonment of forward-looking inflation targeting in favor of regimes of waiting for actual inflation to materialize. The idea has taken central banks by storm as a way to strongly reinforce forward guidance.

The market is still skeptical that central banks will hold rates near zero when inflation rises above 2% but if so, the result could be inflationary and a big boost to asset prices or yet-another hit to central bank credibility.Deal Dance & Hand-Holding

The game of deal-or-no-deal on both sides of the Atlantic was in high gear to start the week. In Europe, a call between Frost and Barnier appeared to thaw negotiations but the UK side sent mixed messages that initially led to GBP strength, only for it to fade later.

A reminder of the stakes came after the close on Friday when Moody's lowered the UK's sovereign rating to Aa3 from Aa2. The cited a soft economy and an erosion in fiscal strength but also added that “the quality of the UKʼs legislative and executive institutions has diminished in recent years.”

In the US, talked between Mnuchin and Pelosi continued ahead of the Tuesday deadline but messages were mixed. Reports that Pelosi highlighted fundamental differences in values to Democratic colleagues weighed heavily on equities as they fell the most in almost a month. That spilled over to commodity currencies as they gave back early gains.

There are two options now: Bet on an outcome or wait for clear news. There have been so many fakeouts in both these negotiations that it's tough to plant a flag on either side. In all likelihood, markets are still placing a high probability on some kind of Brexit deal and a low probability on stimulus. Perhaps that sits at 80/20 in both instances, if not lower for stimulus.

Of course, neither of those are occurring in a vacuum. Ireland closed non-essential retail for six weeks on Monday with European cases continuing to rise, albeit at a slower pace. Q4 GDP throughout the continent is deteriorating along with optimism about Q1.

In the US, voting and election campaigning continue, while there has been a noticeable uptick in Trump's betting odds. That likely reflects an over-reliance on history repeating itself but financial markets certainly aren't immune to the same thinking. The failure of a short-term stimulus deal followed by a divided Congress would be the worst-case scenario for US short-term growth and associated trades.

Many of the trades in the coming days will be taken as developments happen but one macro trend is showing strength almost everywhere: Housing. The power of low rates was on full display with the US home builder sentiment survey hitting a record high on Monday. Tuesday is housing starts, which are forecast to rise 2.8% with associated permits up 2.0%. Some time in 2021 or beyond, the rises in home equity will be a large tailwind for growth.

CFTC Commitments of Traders Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR +168K vs +174K prior GBP -10K vs -11K prior JPY +20K vs +21K prior CHF +12K vs +13K prior CAD -14K vs -18K prior AUD +4K vs +11K prior NZD +6K vs +5K prior

The euro net continues to drift lower after hitting a record in July but rising virus cases, lockdowns and economic risks combined with sinking eurozone yields argue for more short covering to come.Ashraf on MoneyShow Oct 27

Join me for my webinar on the latest lntermarket fractals applications next Tuesday (Oct 27) at 17:10 Eastern (21:10 London/GMT) (time difference will be 4 hrs not 5 hrs during that week). Book your spot here.